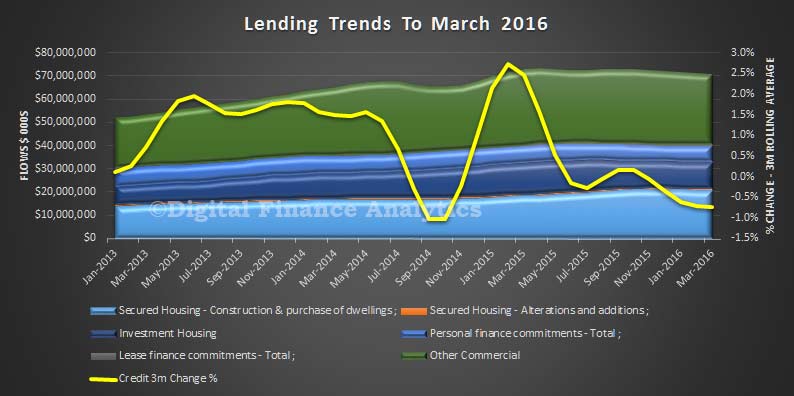

The final data from the ABS for March lending finance includes data on all the flows, including commercial. Trend finance for owner occupied housing flows fell 0.7% to $20.9 billion in the month, personal finance rose 0.5% to $6.9 billion and commercial finance fell 1% to $41.9 billion (which includes investment housing lending of $11.7 billion).

Looking at the overall lending trends, we see on a 3 month rolling average, credit flows fell by 0.73% and have been falling since October 2015.

Looking at the overall lending trends, we see on a 3 month rolling average, credit flows fell by 0.73% and have been falling since October 2015.

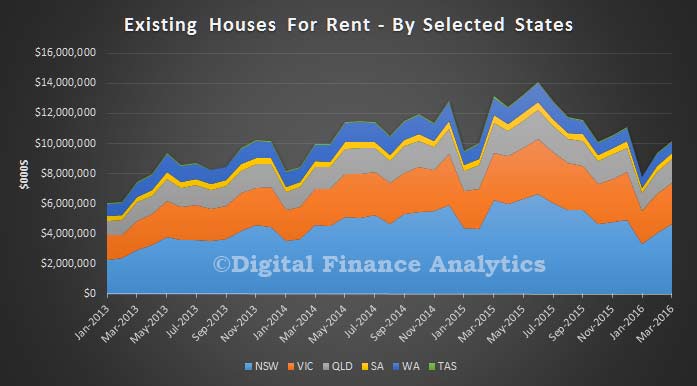

Data on commercial lending for the purchase of existing investment properties shows an uptick, based on the original data by selected states. After the slowing around the summer, it is now trending higher, especially in NSW (before the cash rate cut).

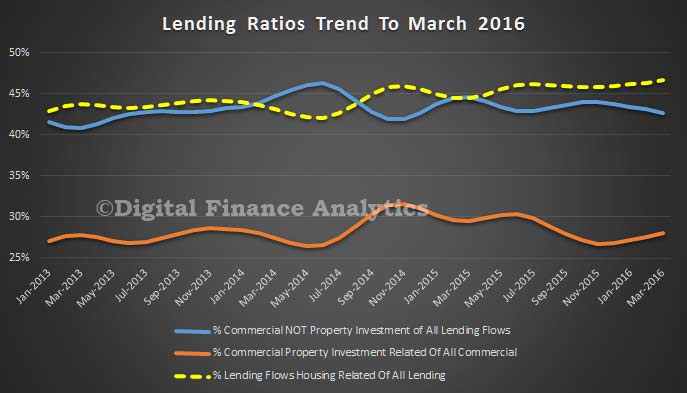

We can also look at some of the other ratios which are important. First, total housing lending – including owner occupation and investment made up 46.7% of all lending flows. This is a record, and shows that the banks are reliant on housing lending to keep their ships afloat. The proportion of commercial lending not investment property related to all lending was 42.7%, and has been falling since October 2015. The proportion of commercial lending which was for investment property related, to all commercial lending rose to 28.1%, the highest it has been for six months.

So do not be fooled by talk of the home lending market stalling, it is not so. Even before the RBA’s cash rate cut at the start of May, housing lending of all flavours was significant, and demand will likely rise as lower rates flow through, especially as the stock markets look shaky in May (sell in May and go away…?) and deposit interest rates are being killed.

So do not be fooled by talk of the home lending market stalling, it is not so. Even before the RBA’s cash rate cut at the start of May, housing lending of all flavours was significant, and demand will likely rise as lower rates flow through, especially as the stock markets look shaky in May (sell in May and go away…?) and deposit interest rates are being killed.

Economically though, more home lending does not solve our economic growth problem.