Jerome Powell has been nominated to be the next chair of the Federal Reserve Board. Historically, what has happened to economic growth following a transition?

Average Growth Sometimes Slows in the Short Term

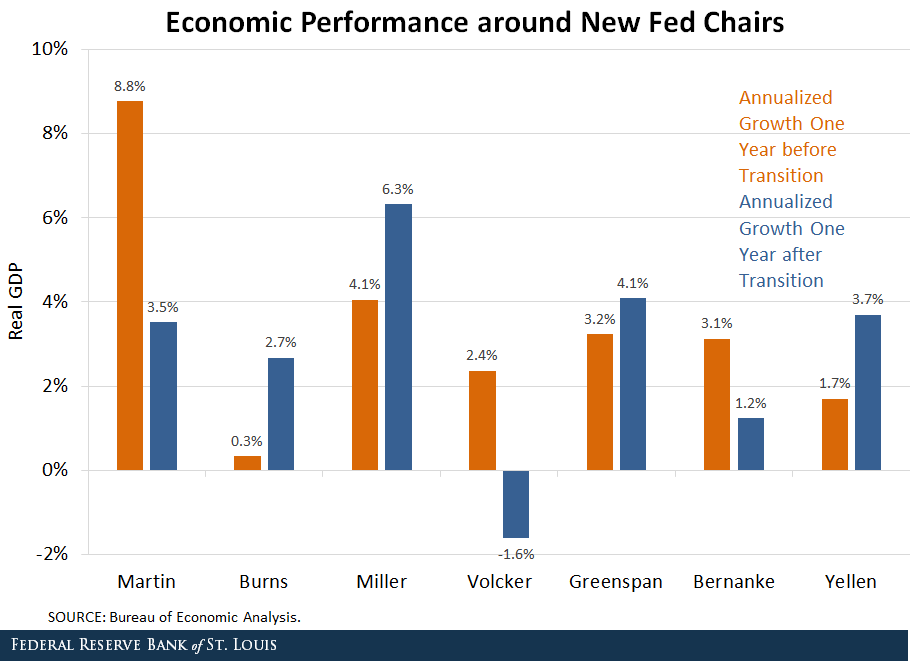

Whether a transition to a new Fed chair affects economic growth in the short term is not apparent at first glance, as can be seen in the figure below.

Notable growth slowdowns occurred immediately after Chairs William McChesney Martin, Paul Volcker and Ben Bernanke took office. However, growth was stronger in the year after the terms began of Chairs Arthur Burns, G. William Miller, Alan Greenspan and Janet Yellen.

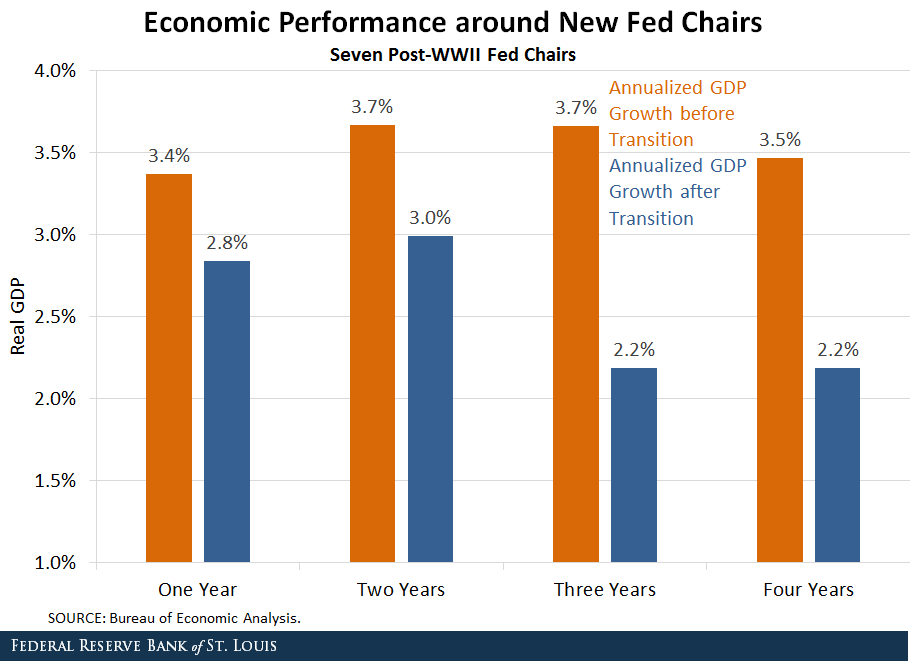

Taking the average of all seven Fed transitions since World War II, the economy grew about 0.6 percentage points more slowly in the year after a new Fed chair took office than during the year preceding the transition, as seen below.

Clearly, this is due to the very large slowdowns that occurred after Martin, Volcker and Bernanke took office. It was more common for growth to increase in the year after a transition than to decrease, but the magnitudes were smaller.

Average Growth More Often Slows over the Medium Term

In the two years following a Fed chair transition, average growth was about 0.7 percentage points less than during the two years prior to the transition, as seen in the figure above. Growth slowdowns in three-year and four-year before-and-after comparisons were somewhat larger, at 1.5 and 1.3 percentage points, respectively.

While only three of the seven transitions resulted in growth slowdowns at the two-year horizon, five of the seven transitions resulted in slower growth in both the three-year and four-year periods. In addition to transitions to Martin, Volcker and Bernanke, who experienced growth slowdowns at every horizon considered here, transitions to Miller and Greenspan also were followed with slower three- and four-year growth than had occurred prior to their terms.

Growth Slowdowns Are a Feature of the Recent Period, Too

It’s possible that early post-WWII Fed chairs faced unusual circumstances that aren’t relevant anymore:

- Martin helped establish Fed independence from the Treasury after WWII and faced the disruption of the Korean War.

- Burns served during the Vietnam War and, according to some observers, faced unusual political pressures.

- Miller served the briefest term of all post-WWII chairs.

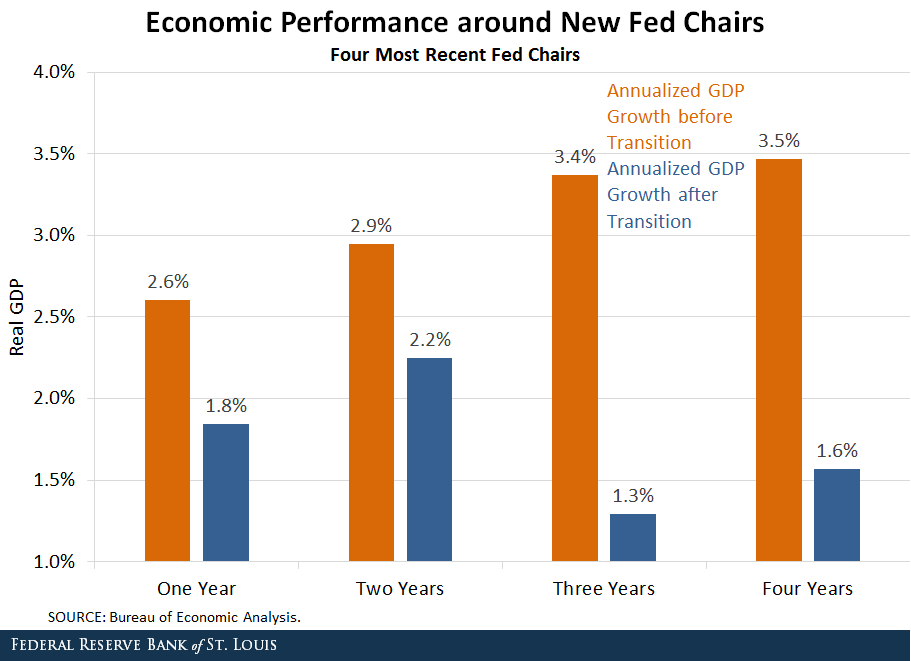

It turns out that the average growth slowdown around a Fed chair transition has been larger in recent decades (beginning in 1979) than it was before at each of the horizons considered here. The figure below shows the before-and-after growth averages for one-, two-, three- and four-year horizons for only the four most recent Fed chairs.1

Remarkably, the average growth slowdown is nearly two full percentage points at both the three- and four-year horizons. As before, the large declines experienced after the Volcker and Bernanke transitions play the largest roles, but average growth also slowed in the three- and four-year periods after Greenspan took office.

Why Would a Transition Lead to Slower Growth?

The historical pattern shown here might be merely a coincidence. Another possibility is that it might reflect heightened uncertainty in financial markets and the economy as Fed leadership changes. It also might be the result of incoming Fed chairs pursuing monetary policy somewhat differently than their immediate predecessors.

Would a New Fed Chair Face a Growth Slowdown?

The number of Fed chair transitions since WWII is small, so it’s difficult to generalize about what might happen next. Nonetheless, the pattern of slower growth on average after a new Fed chair takes office is striking—especially at the three- and four-year horizons.

Notes and References

1 Janet Yellen has not been the Fed chair long enough for four full years of data, so her four-year data covers 3.5 years.

Skip to content

Digital Finance Analytics (DFA) Blog

"Intelligent Insight"