We showed recently that households with specific post codes may have significantly higher mortgage rates than their neighbours. As a result, significant savings may be made by seeking out a mortgage with a better rate.

Of course households need to be careful, as they may incur transaction costs, and even break costs if the loan is fixed.

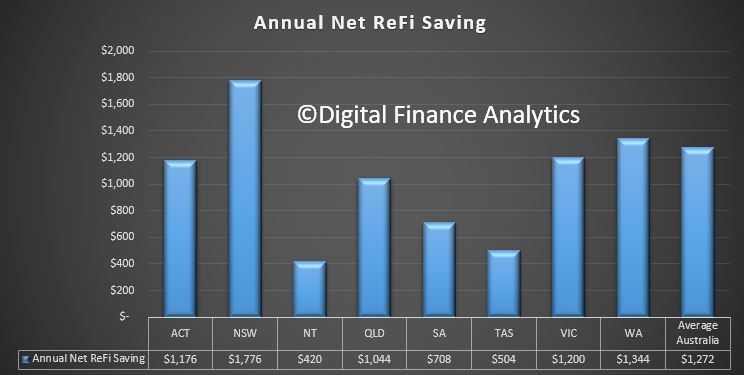

But we went though our Core Market Model looking at those who refinanced in the past year. We then calculated the annual savings they had, on average achieved. Here are the results:

The larger the loan, the bigger the potential saving, which is why there are state variations. There were quite big differences between the old rate and new rates, and we incorporated break costs where appropriate.

The larger the loan, the bigger the potential saving, which is why there are state variations. There were quite big differences between the old rate and new rates, and we incorporated break costs where appropriate.

This again highlights that households should be checking their rates and seeking out better, lower rates. Substantial savings are available, and when we consider the average loan life is more than 5 years, the potential savings are significant.