The Economist says it was telling that Germany, a country with a phobia of rising prices, in the first week of 2017 reported a jump in inflation. Its headline rate rose from 0.8% to 1.7% in December.

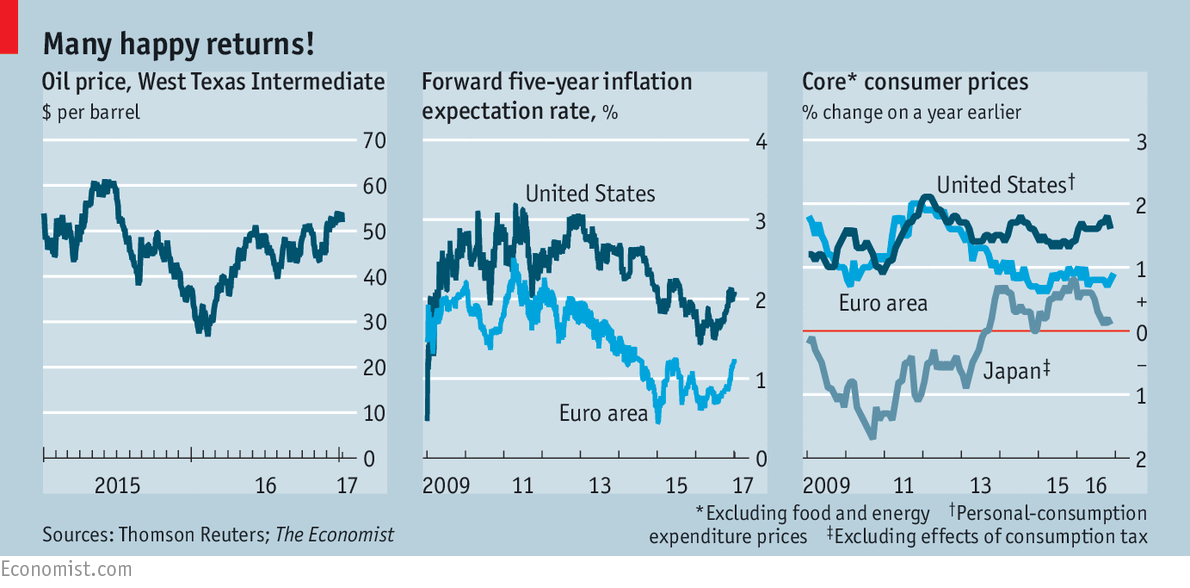

After two years of unusually low price pressures, inflation across the rich world is set to revive this year. Much of this is because of the oil price, which fell below $30 a barrel in the early months of 2016 but has recently risen above $50 (see chart). Underlying inflation, too, seems poised to drift up. That is good news. The story for 2017 is not of inflation running too hot but rather of a welcome easing of fears of deflation.

To understand why, consider the three big drivers of inflation in the rich world: the price of imports, capacity pressures in the domestic economy and the public’s expectations. Start with imported inflation. A year ago, global goods prices were falling because of a slide in aggregate demand and a seemingly endless glut of basic commodities and manufactures. China’s economy wobbled. Emerging markets in general were in a funk; two of the largest, Brazil and Russia, were deep in recession.

Things look perkier now. Emerging markets still have plenty of trouble spots, but the bigger economies are stabilising. After falling for 54 months, producer prices in China are climbing at last. Prices at the factory gate rose by 5.5% in the year to December. China’s supply glut, though still vast, is shrinking. An improving demand climate is reflected in upbeat surveys of manufacturing purchasing managers across Asia and in the rich world. It is also visible in a revival in commodity prices.

So rich countries are importing a bit more globally made inflation. How big an impact that has depends on the exchange rate. And in much of the rich world, currency markets are proving helpful. In America, where underlying inflation is close to 2%, the Federal Reserve’s goal, the dollar has risen. In Japan and the euro area, where underlying inflation is lower (see chart), the yen and euro have weakened.

The second big influence on inflation is the amount of slack (or spare capacity) in the domestic economy. The unemployment rate, measuring labour-market slack, is often a convenient gauge. On that basis, America’s economy, with unemployment at 4.7%, is close to full capacity. Average wages rose by 2.9% in the year to December, the highest rate since 2009. Assuming that trend productivity growth is around 1%, then wage growth of around 3% is consistent with a 2% rise in unit-wage costs, in line with the Fed’s inflation target.

The picture is cloudier in other parts of the rich world. Euro-area jobs markets are more rigid and run into bottlenecks more readily than America’s. Even so, the euro-area economy has far greater slack. The unemployment rate is 9.8%. The big southern euro-zone economies, such as Italy and Spain, have ample spare capacity. So if inflation is to get back to the European Central Bank’s target of close to 2%, it will require other economies, notably Germany, to generate inflation rates well above 2%.

That is not as implausible as the form book suggests. Germany has a tight labour market. The unemployment rate is just 4.1% and the workforce has shrunk as the population ages. And after a decade or more of restraint, wages have picked up a bit. Compensation per employee has risen at an average annual rate of 2.5% since 2010, according to the OECD, a rich-country think-tank. That is faster than in any other G7 country, but still not enough to drive German inflation up to the sorts of levels needed to push euro-zone inflation close to 2%. Faster wage growth has not fed through to higher consumer-price inflation, notes Ralf Preusser of Bank of America Merrill Lynch. Average core inflation has been around 1.1% since 2010. German firms have absorbed rising wage costs without increasing prices. In Japan, where the jobs market is even tighter, wage growth has struggled to reach even 1%.

That wages have not risen faster owes much to the third big determinant of inflation—expectations. Firms will feel freer to push up prices, and employees to bargain for bigger wage rises, if they expect higher inflation. In theory expectations are in the gift of central banks. If they can convince the public that they have the tools to regulate aggregate demand, and thus the level of slack, expectations should converge on the central bank’s inflation target, usually 2% in rich countries. But expectations are also influenced by what inflation has been recently. In rich countries, it has fallen short. Inflation expectations in financial markets have recently perked up, but in the euro area are still well shy of the target (see chart). In Japan, two decades of deflation have taught firms and wage-earners to expect a lot less than 2%.

Put the pieces of the jigsaw together and the following picture emerges. Headline inflation in the rich world is likely to rise quickly in early 2017, thanks largely to rising oil prices and a generally firmer global backdrop. Underlying inflation will grind up more slowly as above-trend growth eats away at available slack. A burst of stronger headline inflation this year might drive up inflation expectations and set the stage for bolder wage claims in northern Europe and Japan in 2018.

Analysts at JPMorgan Chase expect higher inflation to add one percentage point to global nominal GDP in 2017, spurring a revival in profits and setting the scene for a recovery in capital spending (even without tax cuts in America). Forecasters often now look for extreme outcomes, but rich-world inflation this year may turn out to be a tale of moderation: enough to grease the wheels, but not enough to upset the cart.

The WHO* warns of outbreak of virulent new ‘Economic Reality’ virus

https://www.elgaronline.com/view/journals/roke/5-1/roke.2017.01.08.xml?rskey=EcXQgX&result=1