Another bank has decided to increase its mortgage interest rates, the third rate change it has made in the last seven months, via Australian Broker.

ING has announced that from 7 February variable rates for all customers will increase by 0.15%.

The hike comes after ING previously lifted variable rates by 0.10% in July last year and by 0.15% for investors in September.

This means ING owner occupier customers on a variable rate are facing a total increase of 0.25% on their home loan rate since July.

Research director at RateCity.com.au, Sally Tindall, said it is disappointing to see ING hiking rates again.

She added, “Today’s announcement will come as a surprise to some ING customers who weren’t expecting a second out-of-cycle rate hike.

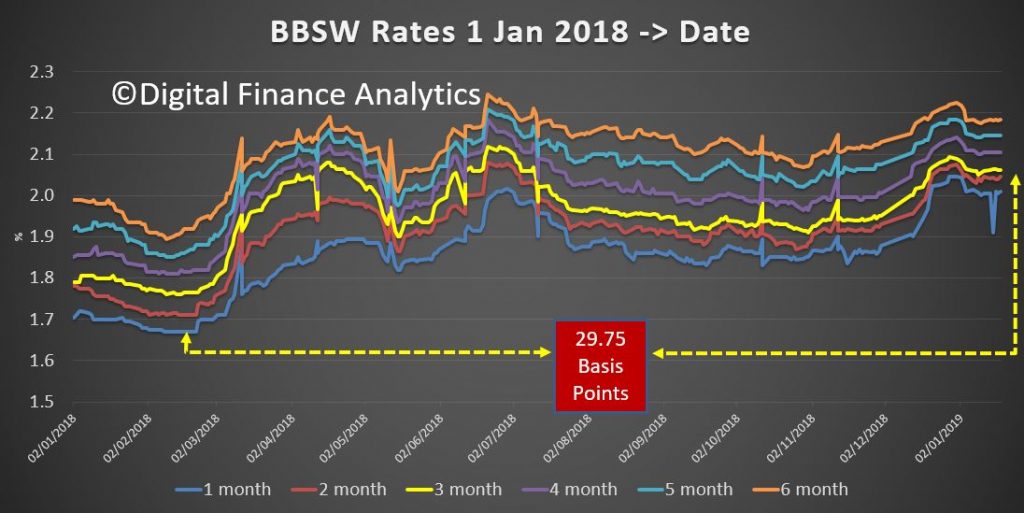

“The cost of funding pressures are real and here to stay, and we expect more lenders to follow in a second round of hikes.”

While ING is not the only bank to have increased rates in the first month of 2019, other lenders have managed to cut rates [for new business – DFA].

Fixed investment rates at the Teachers Mutual Bank, Firefighters Mutual Bank and UniBank have decreased for new customers.