APRA has released their monthly banking stats to the end of July 2018 today. As expected from our survey data, gross investment mortgage lending balances fell last month. Expect more ahead.

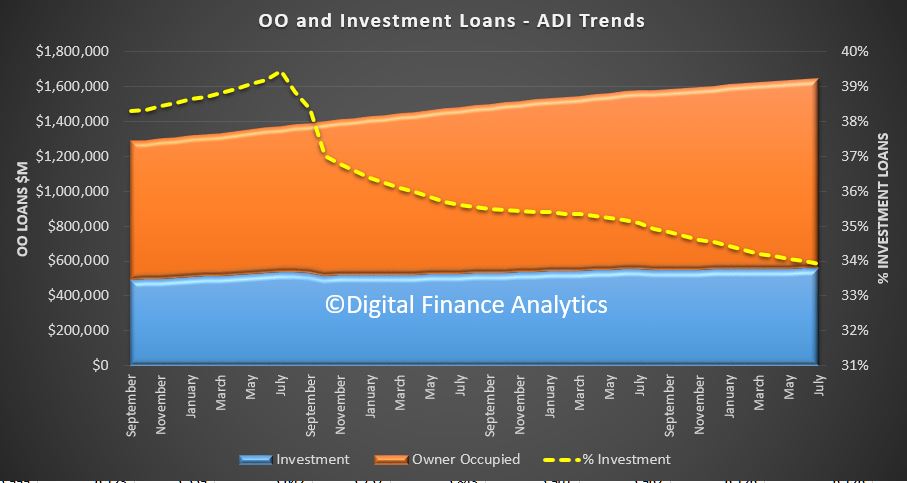

Total loans outstanding for all residential property – owner occupied and investment rose by 0.24% to $1.64 trillion, which would be an annual rate of 2.9%. Within that lending for owner occupation rose by 0.38% to $1.09 trillion while lending for investment loans fell 0.25% to $557.4 billion. As a result the proportion of loans for investment purposes fell to 33.9%, the lowest for years.

The monthly movements underscore the changes, (and remember the August 2017 drop was a blip created by loan reclassification at CBA from their residential books).

The monthly movements underscore the changes, (and remember the August 2017 drop was a blip created by loan reclassification at CBA from their residential books).

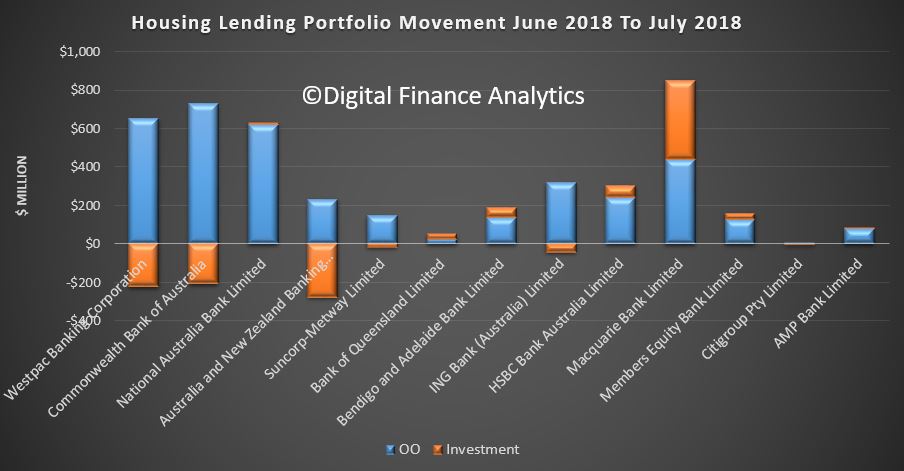

![]() The monthly portfolio movements by lender really tell the story, with investor loan balances at Westpac, CBA and ANZ all falling, while NAB grew just a tad. Macquarie, HSBC. Bendigo Bank and Bank of Queensland grew their books, highlighting a shift towards some of the smaller lenders. Suncorp balances fell a little too.

The monthly portfolio movements by lender really tell the story, with investor loan balances at Westpac, CBA and ANZ all falling, while NAB grew just a tad. Macquarie, HSBC. Bendigo Bank and Bank of Queensland grew their books, highlighting a shift towards some of the smaller lenders. Suncorp balances fell a little too.

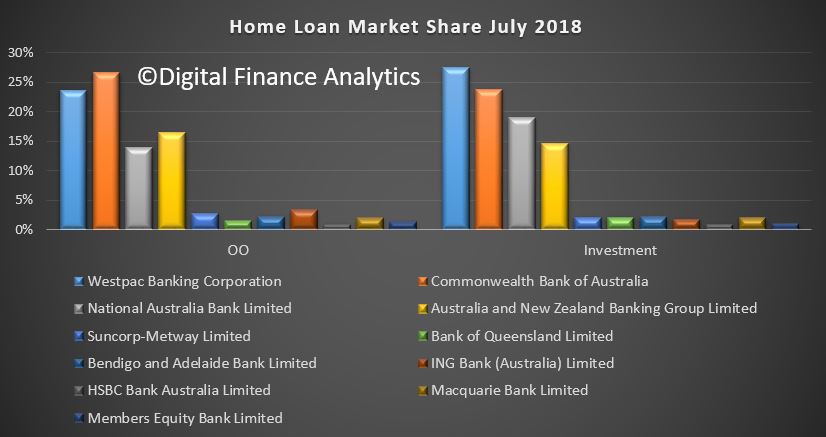

The overall portfolios by lender continue to show CBA the largest owner occupied lender, and Westpac the largest investor lender.

The overall portfolios by lender continue to show CBA the largest owner occupied lender, and Westpac the largest investor lender.

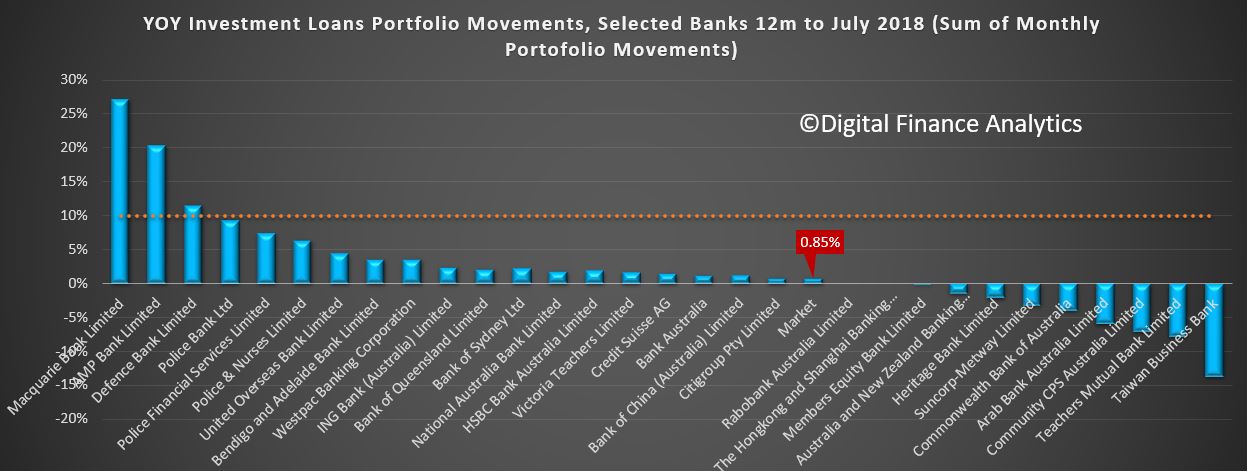

Analysis of the 12 month portfolio movements also reveals the some of the smaller players, and Macquarie have grown their portfolios faster than the majors, and Westpac had the strongest growth among the big four. Market growth continues to fall, at 0.85%.

Analysis of the 12 month portfolio movements also reveals the some of the smaller players, and Macquarie have grown their portfolios faster than the majors, and Westpac had the strongest growth among the big four. Market growth continues to fall, at 0.85%.

The tighter credit conditions are now biting – finally – which explains the recent spate of ultra-low rates on offer to lower risk new borrowers and those seeking to refinance who fall within the new criteria. But many are excluded, prisoners of higher rates as they do not fall within these now tighter (and rightly so) guidelines.

The tighter credit conditions are now biting – finally – which explains the recent spate of ultra-low rates on offer to lower risk new borrowers and those seeking to refinance who fall within the new criteria. But many are excluded, prisoners of higher rates as they do not fall within these now tighter (and rightly so) guidelines.

There will be howls of pain from the sector and calls to relax lending standards to “save” the economy, but these must be resisted at all costs. We must not return to the over lax lending of past days as this will simply build even bigger risks later. Time I fear to face the music.

Anyone now game enough to forecast a rise in home prices? I suspect not. We will see what the RBA data tells us about the non-bank sector, their data just came out. We will post on this soon….

I will be watching for a slowing in owner occupied growth, as confidence and sentiment ebbs away.

Hi Martin – at what level of credit growth does a funding shortfall open up (i.e. such that there isn’t enough credit to finance settlements on newly built property)?