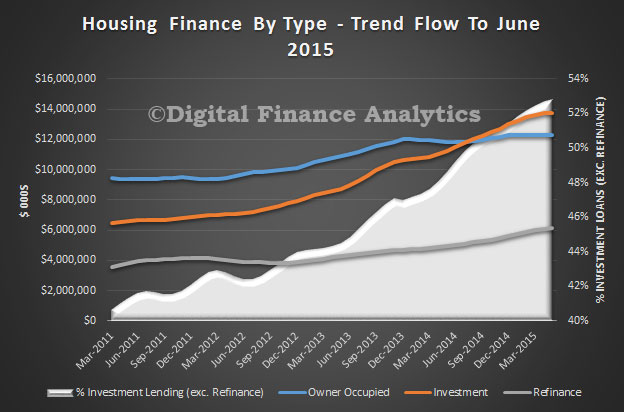

The latest housing finance data from the ABS to June 2015 shows continued growth, especially in refinancing and investment lending. Excluding refinance, 52.8% of all loans written in the month were for investment purposes – another record. No sign of any impact of tighter regulation showing yet. Total lending in the month (trend) was $32.2 billion (up 0.16% from last month), of which owner occupied loans were $12.2 billion (down 0.18%), refinance $6.1 billion (up 0.21%) and investment lending $13.7 billion (up 0.75%). The ABS rolls in refinance into the owner occupied numbers, which overall went up 0.1%.

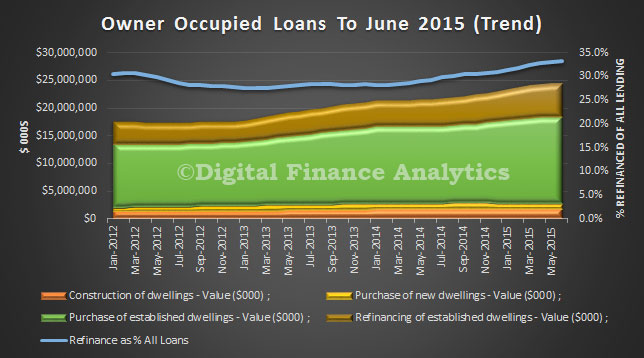

Within owner occupied loans, the trend changes clearly show that the purchase of new dwellings continues to grow the strongest, Refinancing was up as a percentage of all lending to 33.2%. Another record.

Within owner occupied loans, the trend changes clearly show that the purchase of new dwellings continues to grow the strongest, Refinancing was up as a percentage of all lending to 33.2%. Another record.

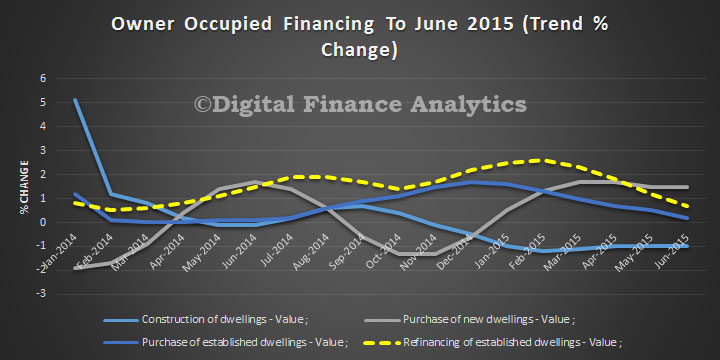

The rate of change of owner occupied refinancing is slowing, along with construction lending and purchased of established dwellings.

The rate of change of owner occupied refinancing is slowing, along with construction lending and purchased of established dwellings.

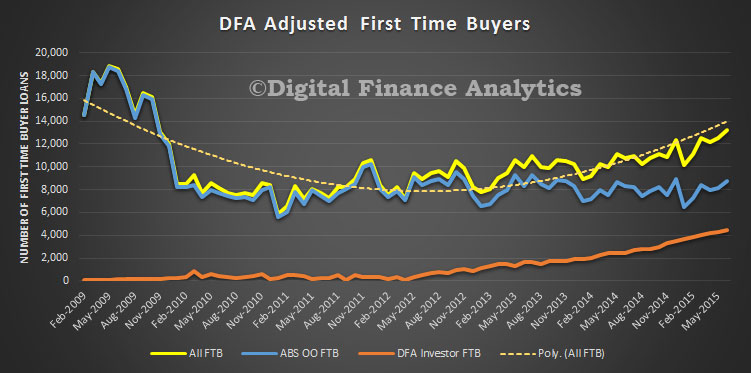

The number of first home buyer commitments as a percentage of total owner occupied housing finance commitments rose to 15.9% in June 2015 from 15.6% in May 2015. First time buyers were active, with the original number of first time owner occupied borrowers up 6.8%, to 8,737. In addition, we overlay the DFA household survey data of investor first time buyers, which rose by 3.5% in the month to 4,453. Whilst the bulk were in Sydney we are continue to see a rise in investors in other states. As a result the total number of first time buyer transactions was 13,191, up 5.65%.

The number of first home buyer commitments as a percentage of total owner occupied housing finance commitments rose to 15.9% in June 2015 from 15.6% in May 2015. First time buyers were active, with the original number of first time owner occupied borrowers up 6.8%, to 8,737. In addition, we overlay the DFA household survey data of investor first time buyers, which rose by 3.5% in the month to 4,453. Whilst the bulk were in Sydney we are continue to see a rise in investors in other states. As a result the total number of first time buyer transactions was 13,191, up 5.65%.