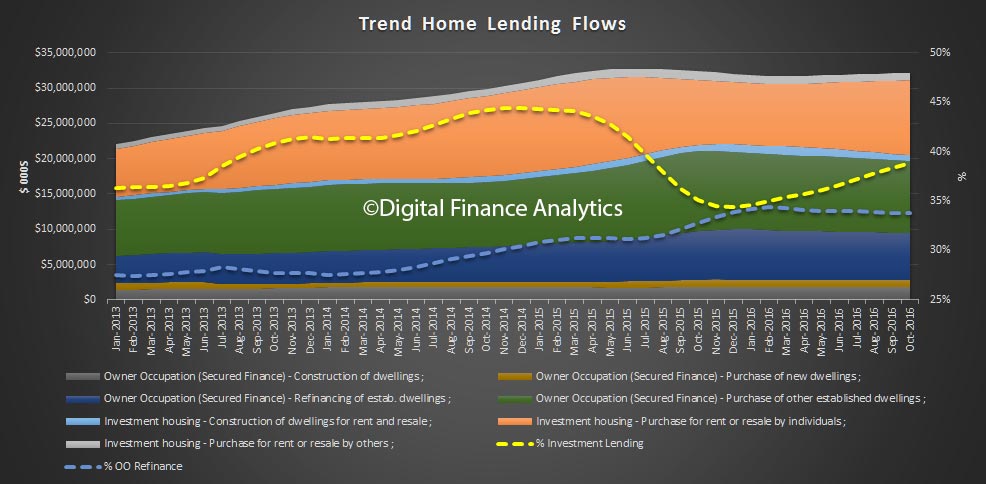

The latest housing finance statistics from the ABS, to October 2016 shows continued growth in investment mortgage lending, whilst owner occupied momentum slowed. In the month and in trend terms, $32 billion on new loans were written, up 0.25%. Within that, owner occupied flow fell 0.5% to $19.7 billion, whilst investment loans grew 1.5%, to $12.5 billion. Investment lending comprised 33.8% of all loans, up from 33.3% the previous month.

33.8% of owner occupied loans were a refinance of existing loans. 12.8% of loans were fixed rate, up from 11.2% last month – reflecting the low rate fixed offers which were available at the time.

33.8% of owner occupied loans were a refinance of existing loans. 12.8% of loans were fixed rate, up from 11.2% last month – reflecting the low rate fixed offers which were available at the time.

Looking at the segmentals, owner occupied lending for construction rose 0.06% to $1.8 billion, purchase of new dwellings fell 0.17% to $1 billion, refinance of established dwellings fell 0.74% to $6.6 billion and purchase of established dwellings fell 0.5% to $10.2 billion.

On the investment side of the ledger, construction of new investment dwellings fell 0.46% to $842 million, purchase of property for investment by individuals rose 2.11% to $10.6 billion and purchase by other investors rose 0.45% to $1 billion.

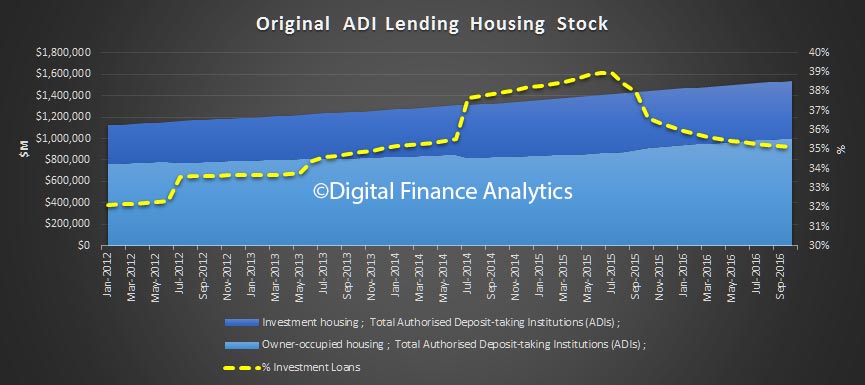

Looking at ADI loan stock, in original terms, total loans grew by 0.61% in the month, up $9 billion. Investment loans rose 0.5% or $2.7 billion and owner occupied stock rose 0.67% or $6.7 billion.

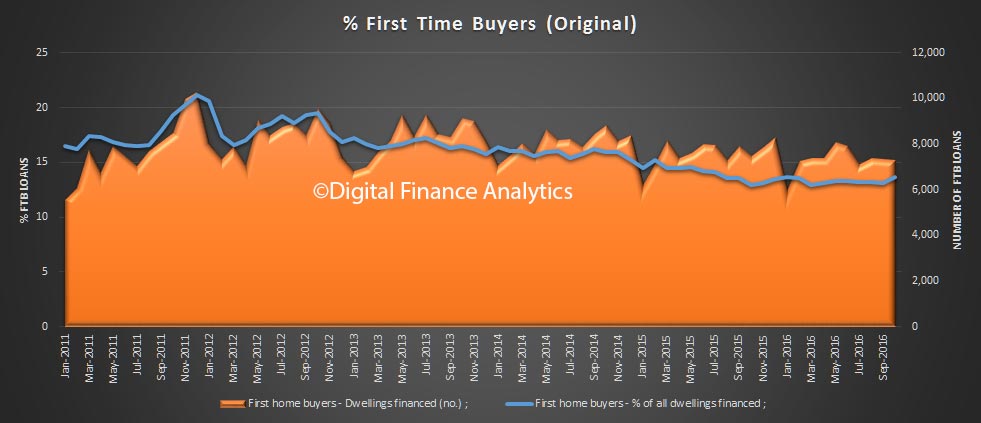

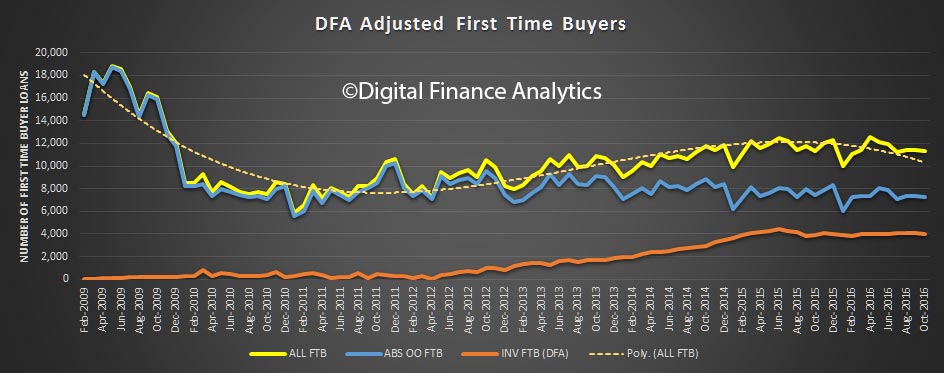

Turning to first time buyers,the volume of new owner occupied loans to first time buyers remained around 7,300, but because the number of non-first time buyers fell, it rose to 13.7% of all loans, up from 13.1%. The average loan size for first time buyers rose to $327,000, up 1% from last month, whilst the average non-first time buyer loan is $380,000, up 1.6%.

Turning to first time buyers,the volume of new owner occupied loans to first time buyers remained around 7,300, but because the number of non-first time buyers fell, it rose to 13.7% of all loans, up from 13.1%. The average loan size for first time buyers rose to $327,000, up 1% from last month, whilst the average non-first time buyer loan is $380,000, up 1.6%.

Looking at the DFA survey data we saw a slight fall in the number of first time buyers going directly to the investment sector, but another 4,000 joined the property investor ranks in the month.

Looking at the DFA survey data we saw a slight fall in the number of first time buyers going directly to the investment sector, but another 4,000 joined the property investor ranks in the month.

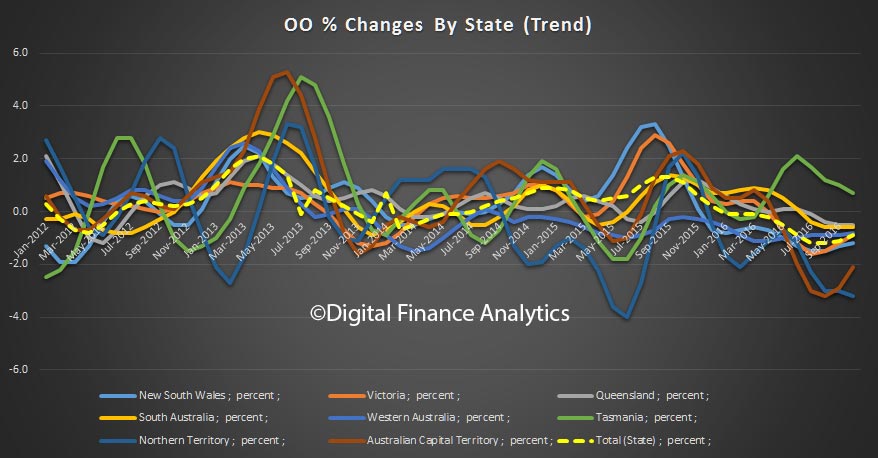

Finally, looking at the state-based data in trend terms, the largest falls in owner occupied loans were in NSW (down 1.2%) and ACT (down 2.1%). Tasmania was the only state to see a rise – up 0.7%.

Finally, looking at the state-based data in trend terms, the largest falls in owner occupied loans were in NSW (down 1.2%) and ACT (down 2.1%). Tasmania was the only state to see a rise – up 0.7%.