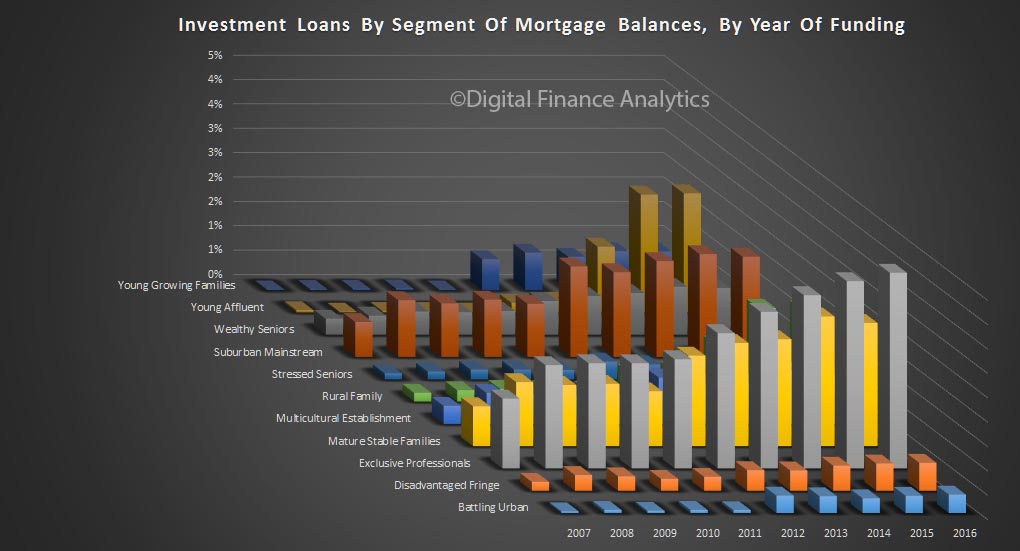

Continuing our series on the 10-year data from our household surveys, today we look at the investment mortgage portfolio. We find some interesting variations compared with the owner occupied borrowing segments, which we discussed recently.

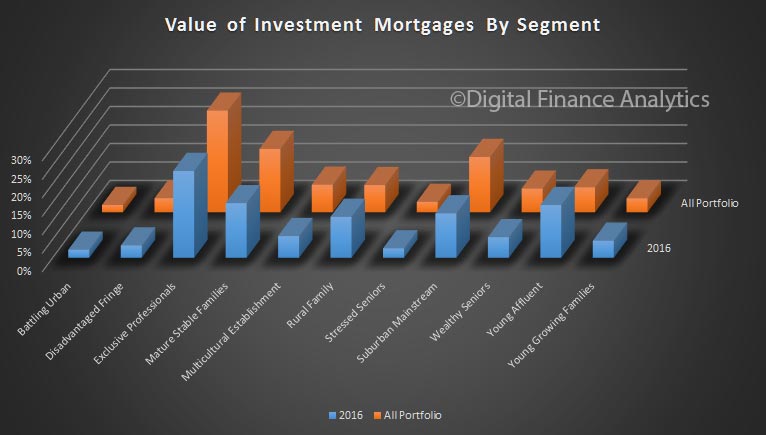

In value terms, 28% of the portfolio is held by exclusive professionals, 15% to suburban mainstream, 14% mature stable families, 10% to young affluent, 9% to rural and 5% to young growing families. 19% of the portfolio was written in 2016.

In value terms, 28% of the portfolio is held by exclusive professionals, 15% to suburban mainstream, 14% mature stable families, 10% to young affluent, 9% to rural and 5% to young growing families. 19% of the portfolio was written in 2016.

In 2016, 23% of the loans were to the exclusive professional segment, 14% to young affluent, 11% to rural, 17% to mature stable families, 12% to suburban mainstream, and 5% to young growing families. Young affluent households were more active last year, than across the entire portfolio.

In 2016, 23% of the loans were to the exclusive professional segment, 14% to young affluent, 11% to rural, 17% to mature stable families, 12% to suburban mainstream, and 5% to young growing families. Young affluent households were more active last year, than across the entire portfolio.

In 2016, the average value of the mortgage to exclusive professionals for investment purposes was $982,360 compared with $536,193 for young affluent, $652,812 for mature stable families and $412,924 for young growing families.

The analysis shows the penetration of investment properties touches most segments, but is also shows a skew towards more affluent groups.