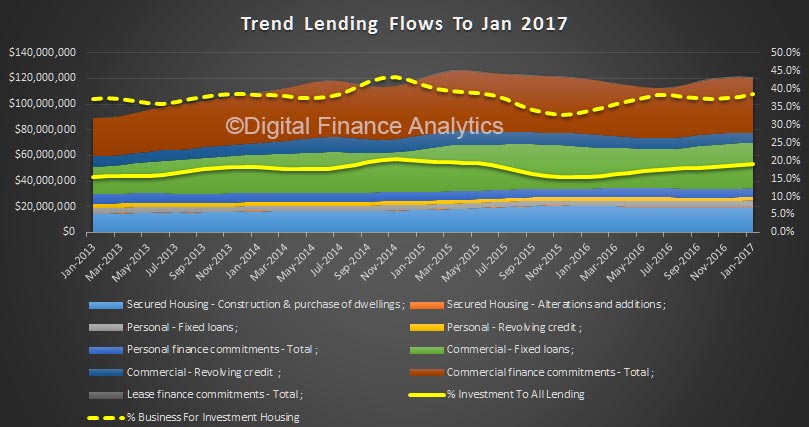

The latest data from the ABS for Lending Finance in January just reinforces the story that investor loans were so, so strong. Owner occupation housing finance grew 0.5%, to $20.1 billion, personal finance was up 0.4% to % 6.9 billion and overall commercial lending fell 0.9%, down to $43 billion (thanks to significant falls in non-investment housing)

However, the share of lending for investment properties, of fixed commercial lending rose to 38.4%, the highest proportion since May 2015, and the share of commercial lending for investment property now stands at 19.1% of all lending, again the highest since May 2015.

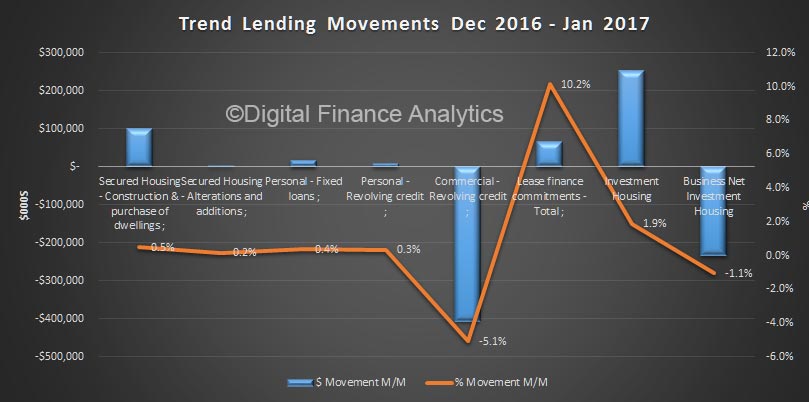

The individual monthly movements reinforce how strong investment lending was. There was also a 5.1% fall in revolving commercial lending.

The individual monthly movements reinforce how strong investment lending was. There was also a 5.1% fall in revolving commercial lending.

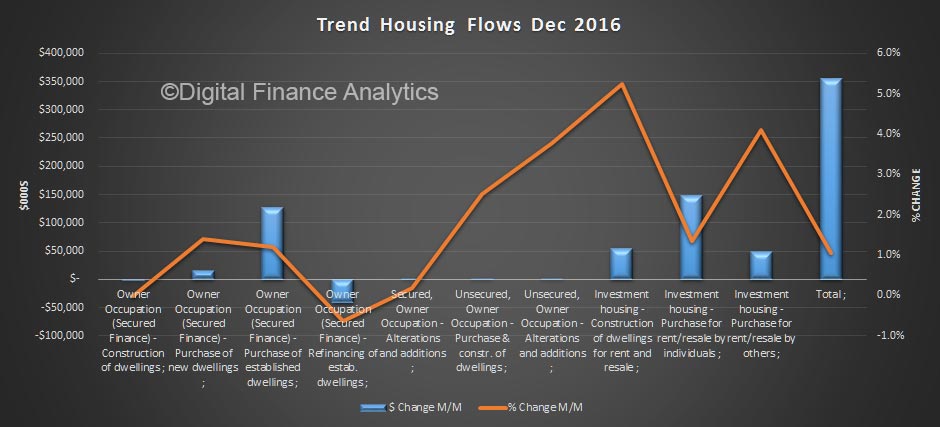

Another view, which looks just at housing confirms the story, with construction lending for investment up 5%, and investment lending for investment up well over 1%.

Another view, which looks just at housing confirms the story, with construction lending for investment up 5%, and investment lending for investment up well over 1%.

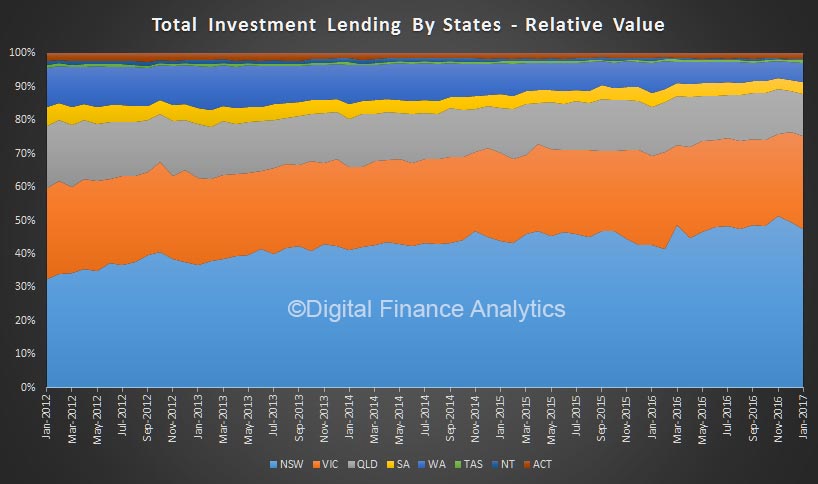

The state level data also confirms that the bulk of the investment property lending is in Sydney and down the east coast to Melbourne.

The state level data also confirms that the bulk of the investment property lending is in Sydney and down the east coast to Melbourne.

We say again, this is not good news, because such strong growth in finance for investment properties simply inflates banks balance sheets and home prices, raises household debt, and escalates systemic risks. We need to funnel investment into productive business enterprise, not more housing.

We say again, this is not good news, because such strong growth in finance for investment properties simply inflates banks balance sheets and home prices, raises household debt, and escalates systemic risks. We need to funnel investment into productive business enterprise, not more housing.

Expect regulatory intervention soon. Better (very) late than never.