Fitch Ratings says the recent pattern of trade flows in Asia suggests that the sharp decline in world trade growth in the second half of 2018 was primarily due to the slowdown in domestic demand in China rather than the direct impact of tariffs associated with increased US-China trade tensions.

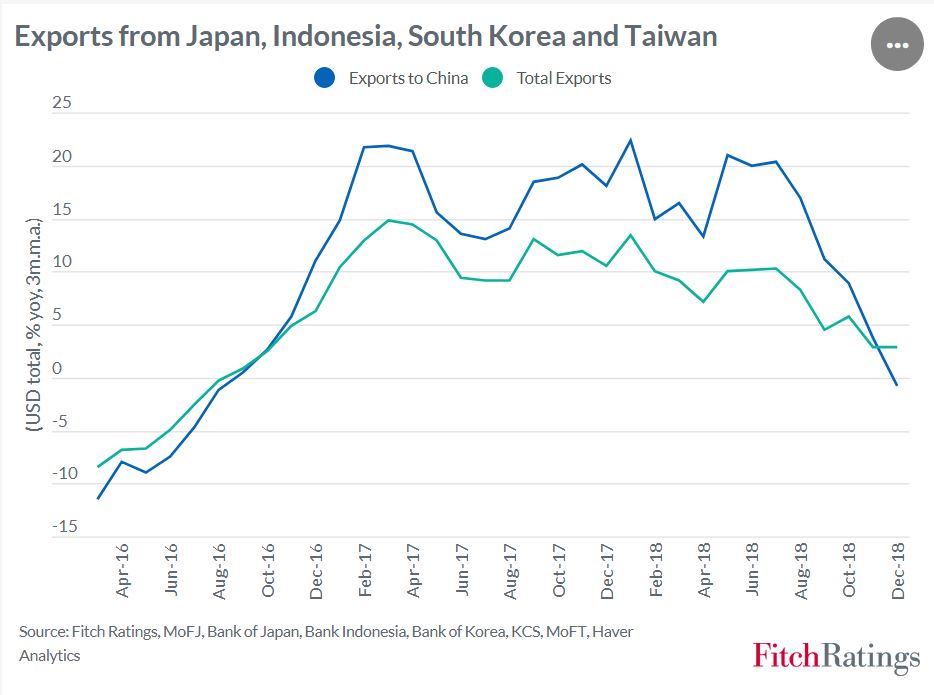

Fitch Ratings latest chart of the month shows that exports to China from a selection of other large economies in Asia have slowed much more sharply than their overall exports. Since intra-Asian trade flows are much less likely to have been affected by the tariff measures imposed by the US and China, this points to weakening domestic demand in China as a key driver of the slowdown. China’s year-on-year import growth (in nominal US dollar terms) turned negative at the end of 2018, despite rising import prices. This was the first decline since 2016 and reflects a slowdown in domestic investment and private consumption.

The US and the Eurozone have also seen their export growth to China falling more rapidly than total exports. Germany in particular has been hit hard by declining auto sales in China, although, for the Eurozone as a whole, exports have also been affected by declining sales in the UK and Turkey. US exports to China have fallen very sharply in recent months but these bilateral flows have been distorted by tariff measures, including possible front-loading of trade flows in mid-2018 ahead of anticipated further tariff hikes and the subsequent payback. The evidence from Asia suggests the outlook for Chinese domestic demand will be a key driver of global trade in 2019.

– Or search with the word “China” on “Wolfstreet”.

“WolfStreet” had some articles on why China is slowing down.

– https://wolfstreet.com/2018/09/09/implosion-of-chinas-p2p-lending-boom-hits-consumer-spending

– https://wolfstreet.com/2019/02/26/imports-by-china-emerging-asia-plunge-most-since-2008/