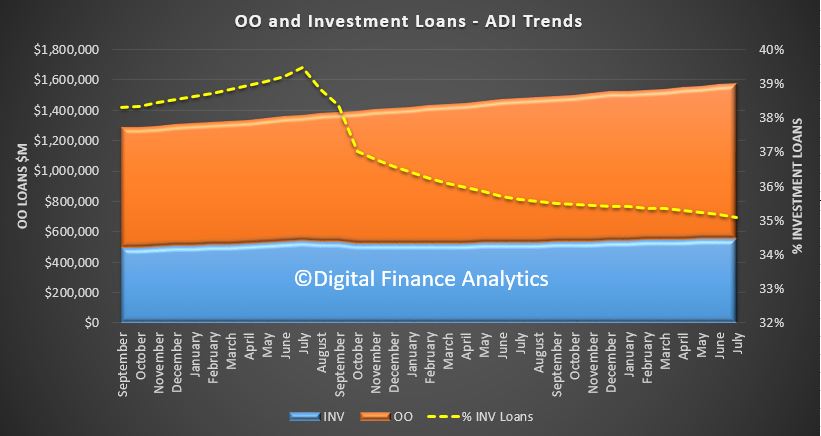

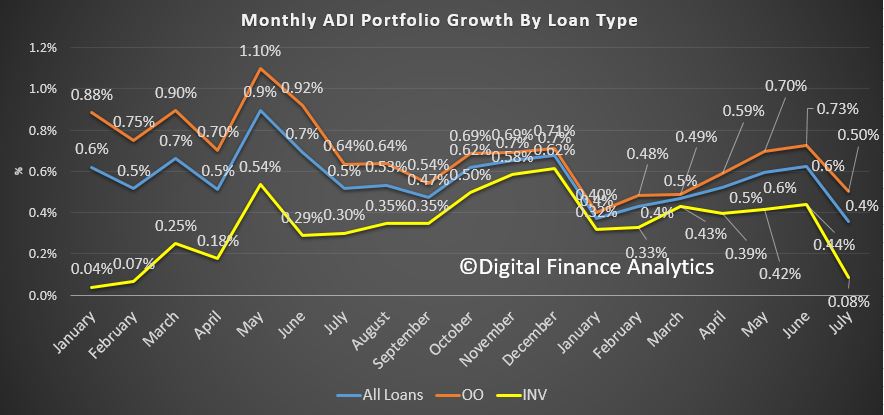

APRA has released their monthly banking stats to July 2017. We see a significant slowing in the momentum of mortgage lending. This data relates to the banks only. Their mortgage portfolio grew by 0.4% in the month to $1.58 trillion, the slowest rate for several month. This, on an annualised basis would still be twice the rate of inflation. Investment loans now comprise 35.08% of the portfolio, down a little, but still a significant market segment.

Owner occupied loans grew 0.5% to $1.02 trillion while investment loans grew just 0.085% to $552.7 billion. This is the slowest growth in investment loans for several years. So the brakes are being applied in response to the regulators.

Owner occupied loans grew 0.5% to $1.02 trillion while investment loans grew just 0.085% to $552.7 billion. This is the slowest growth in investment loans for several years. So the brakes are being applied in response to the regulators.

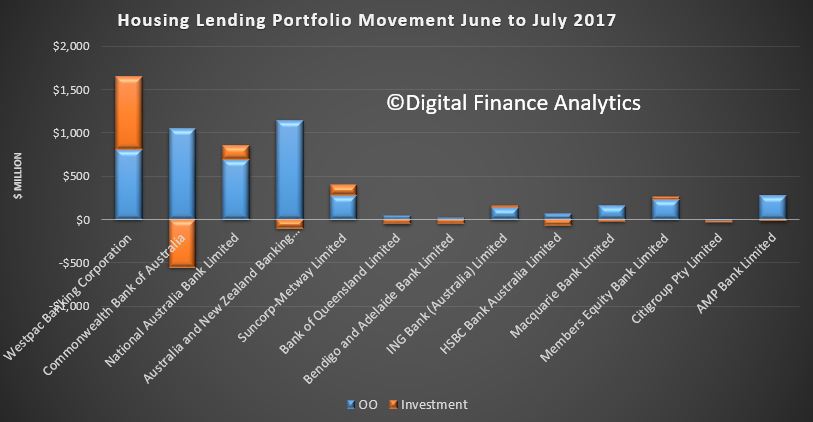

Looking at the individual lenders, the portfolio movements are striking. CBA has dialed back investor loans, along with ANZ, while Westpac and NAB grew their portfolios. Westpac clearly is still writing significant business, but they expect to be within the interest only limit to meet the regulatory guidance.

Looking at the individual lenders, the portfolio movements are striking. CBA has dialed back investor loans, along with ANZ, while Westpac and NAB grew their portfolios. Westpac clearly is still writing significant business, but they expect to be within the interest only limit to meet the regulatory guidance.

The overall market shares have only slightly changed, with CBA the largest OO lender, and WBC the largest investor lender.

The overall market shares have only slightly changed, with CBA the largest OO lender, and WBC the largest investor lender.

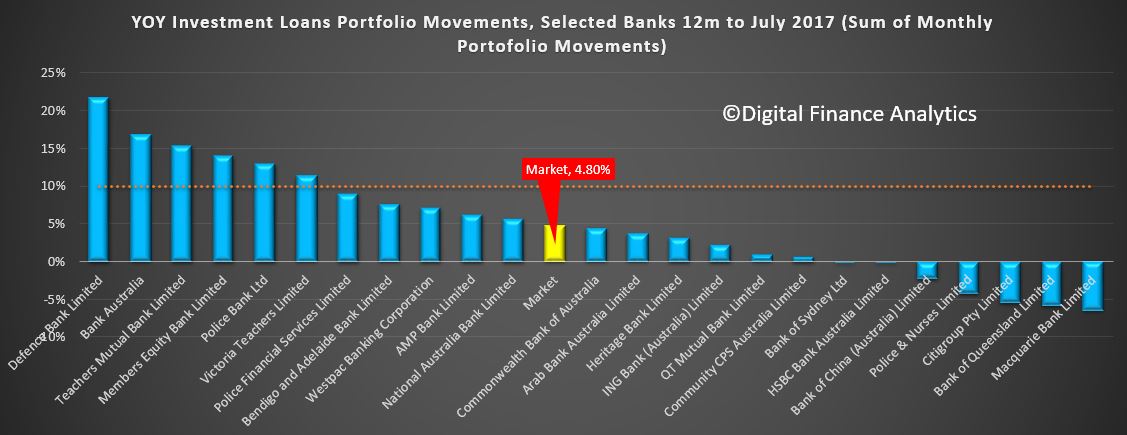

Looking at the 12m rolling growth, the market is now at around 4%, and all the majors are well below the 10% speed limit. Some smaller players are still speeding!

Looking at the 12m rolling growth, the market is now at around 4%, and all the majors are well below the 10% speed limit. Some smaller players are still speeding!

We will see what the RBA credit aggregates tell us about adjustment between owner occupied and investor lending, as well as non-bank participation. But it does look like the mortgage tide is going out. This could have a profound impact on the housing market. It also shows how long it takes to turn a slow lumbering system around.

We will see what the RBA credit aggregates tell us about adjustment between owner occupied and investor lending, as well as non-bank participation. But it does look like the mortgage tide is going out. This could have a profound impact on the housing market. It also shows how long it takes to turn a slow lumbering system around.

One thought on “Is The Mortgage Tide Receding?”