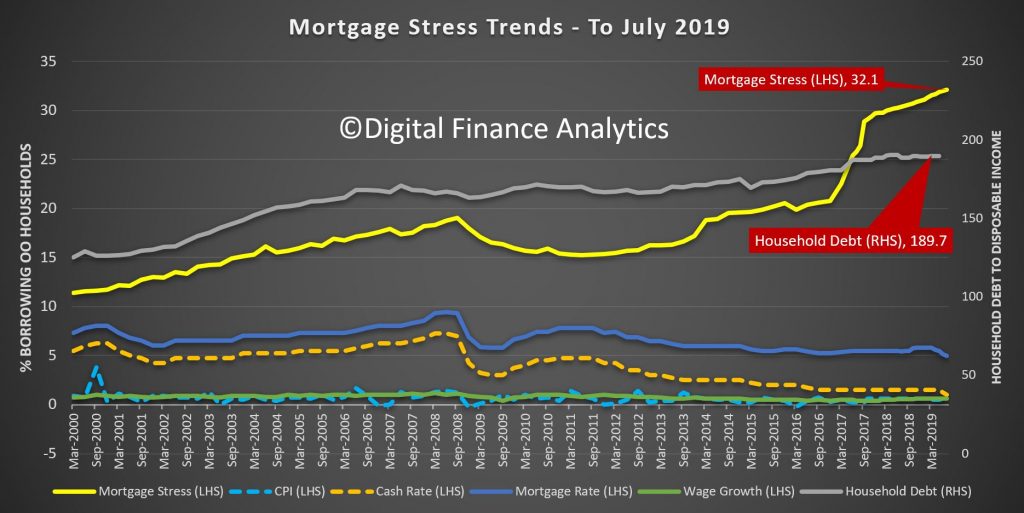

The DFA mortgage stress tracker to the end of July 2019 is released today. This is based on our rolling 52,000 household surveys and includes data up to the 31st July. More than 70,000 households risk default over the next 12 months.

Despite the two RBA rate cuts, and the tax refunds which some can claim, (after the legislation was passed in Parliament in July), the impact on household budgets with mortgages has yet to translate into a meaningful easing in mortgage stress. In fact, we doubt it will.

This is because the reductions in variable mortgage rates for existing customers have yet to work through the system, and the tax refund claims take some time to be processed. Meanwhile costs of living continue to escalate.

We also note that many households who have attempted to refinance to the much lower attractor rates and are in mortgage stress are being declined. In an absolute sense many of these households are locked into higher rates than the best available, and fall outside the revised (even if loser now) underwriting standards. We estimate there are more than 300,000 households who are mortgage prisoners as a result.

The total number of households estimated to be in mortgage stress in July 2019 is 1,080,000 or 32.1% of borrowing households. This is another record.

The RBA data to March 2019 showed that the ratio of household debt to income rose again to 189.7, and credit growth is still running at a faster rate than household incomes. And yet APRA reduced underwriting standards!

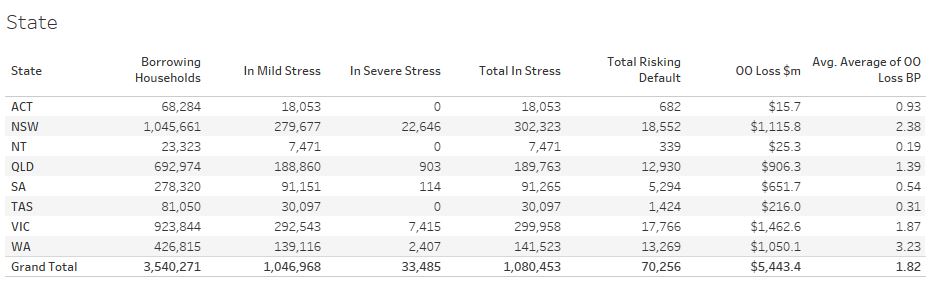

Analysis of stress across the country shows Western Australia still leads, but more households in New South Wales, Victoria and Queensland are under financial pressure.

We define households as “stressed” when current income does not cover current expenditure, including mortgage repayments. Households manage this deficit by cutting back on spending, putting more on credit cards and other loans, or try to refinance to a cheaper loan. Those in severe stress are deeply in deficit. It can take a household many months to slide from stressed to severely stressed, beyond this point, bank foreclosure or a forced sale in more likely.

We note that households in this severely stressed state are now much more likely to be forced to sell, as bank hardship schemes only protect households for a period. We note that in some post codes in Western Australia, where this has been an issue now for some time, defaults and foreclosures are running at three to four times the national average.

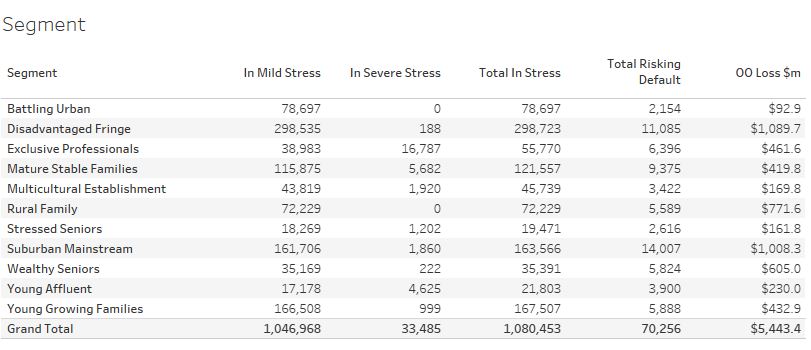

We also continue to see stress breaking out across most of our household segments, this is not just a factor running in battling households. Indeed, banks have been treating more wealthy groups very generously in terms of loan amounts, because they have other assets (even if they are also mortgaged). Risks in the affluent groups are rising still, and as the share market reverses, this will become significant.

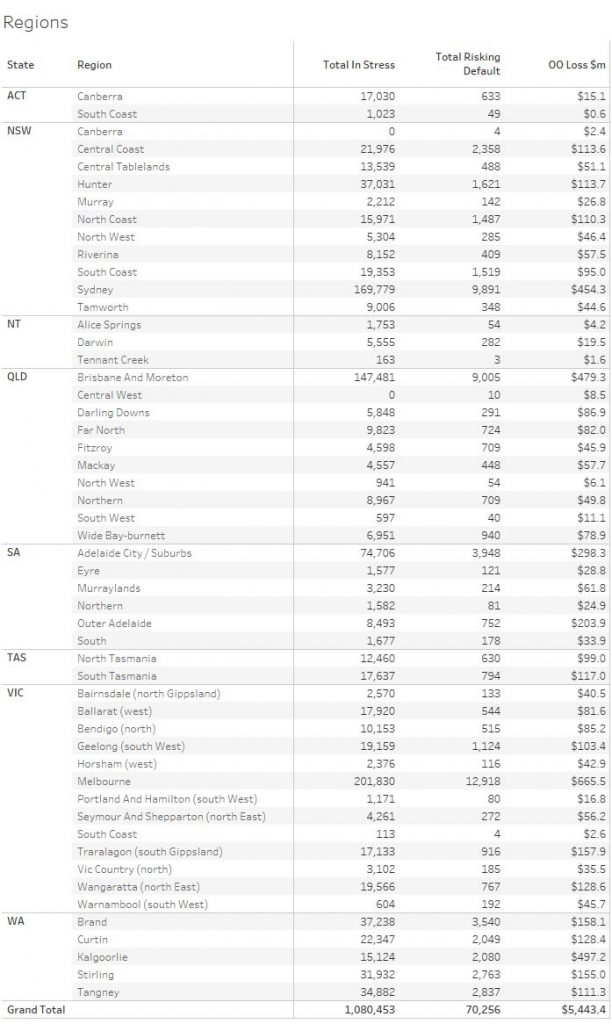

Stress does vary across the regions.

And finally, here are the top post codes in terms of mortgage stress.

WA postcode 6065, the area around Tapping and Hocking has the largest count of stressed households this month, followed by Cambelltown in NSW 2560, Toowoomba in QLD 4350, Liverpool in NSW 2170, Ballarat 3350 in VIC and Narre Warren in VIC, 3895. All these areas are locations where there has (and continues to be) considerable new construction. Many households purchased close to the top of the market, and are now experiencing negative equity, with prices in some locations down more than 30%. Some were first time buyers, others traded up to a new property.

We will discuss the drivers of stress when we publish the next edition of our surveys, but we note that households are reporting significant ongoing rises in fuel costs, child care costs, healthcare costs (especially health insurance), school fees, and local authority rates. In many cases any relief from lower mortgage rates is blotted up by other living costs. The truth is only significant increases in take-home pay would alleviate their financial pressures, but in the current situation, this is unlikely.

Finally, as I often say, many households do not maintain a household budget, so they do not know their true financial position. This is an essential first step to managing financial issues. The ASIC Money Smart Web site offers some useful tools.

Next, it is important to prioritise spending, and avoid using high rate credit cards. Pay these off first.

Third, if households are getting into difficulty financially, its important to act early, rather than hoping things will work out. And Banks have an obligation to help, to talk to them. So talk to your lender.