The ABS released their Housing Finance data to June 2018 today.

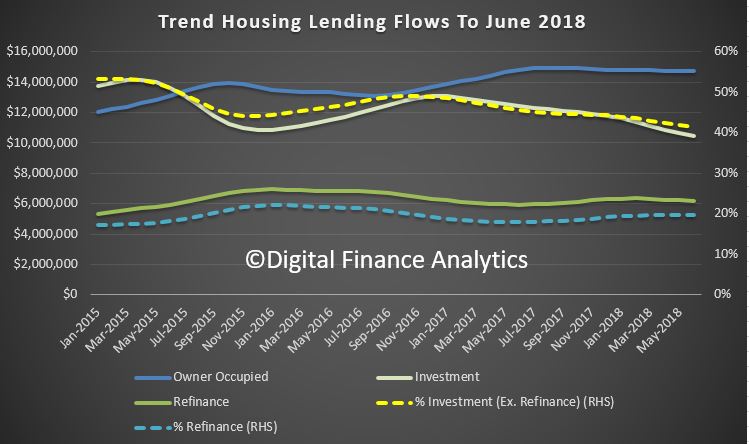

They reported that the trend estimate for the total value of dwelling finance commitments excluding alterations and additions fell 0.7%. Owner occupied housing commitments fell 0.2% and investment housing commitments fell 1.8%. In seasonally adjusted terms, the total value of dwelling finance commitments excluding alterations and additions fell 1.6%.

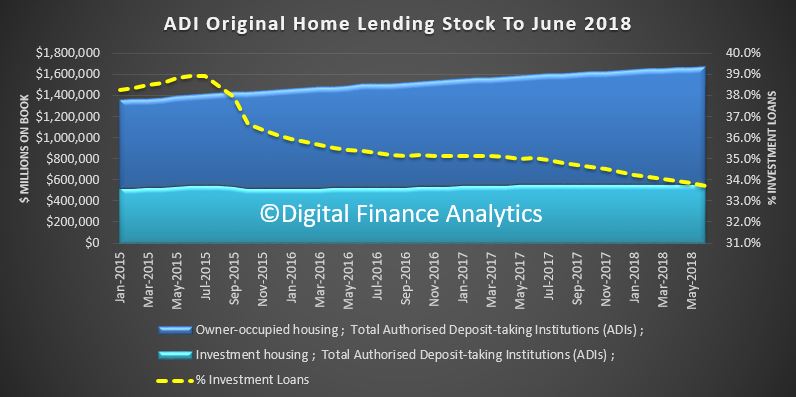

The proportion of loans for investment purposes, excluding refinance, was 41.4%, down from 53% in 2015. The proportion of refinanced owner occupied loans was 19.7%, similar to the past couple of months.

The proportion of loans for investment purposes, excluding refinance, was 41.4%, down from 53% in 2015. The proportion of refinanced owner occupied loans was 19.7%, similar to the past couple of months.

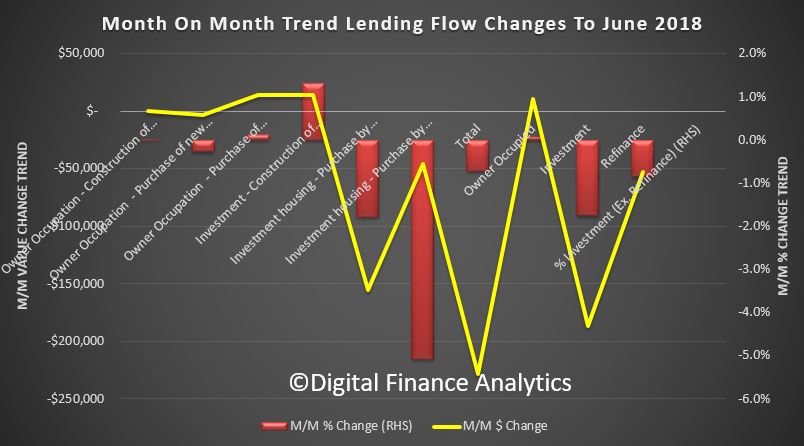

Looking at the changes month on month, owner occupied purchase of new dwellings fell 0.3%, while owner occupied purchase of established dwellings rose 0.1%, or $14,2 million. Investment construction lending rose 1.3%, or $14 million, borrowing for investment purposes by individuals fell 1.8%, down $154 million and investment by other entities fell 5.1% of $45.7 million. Refinance of owner occupied loans fell 0.9% or $53 million.

Looking at the changes month on month, owner occupied purchase of new dwellings fell 0.3%, while owner occupied purchase of established dwellings rose 0.1%, or $14,2 million. Investment construction lending rose 1.3%, or $14 million, borrowing for investment purposes by individuals fell 1.8%, down $154 million and investment by other entities fell 5.1% of $45.7 million. Refinance of owner occupied loans fell 0.9% or $53 million.

Overall around $31 billion of loan flows were written, down 0.7% in trend terms.

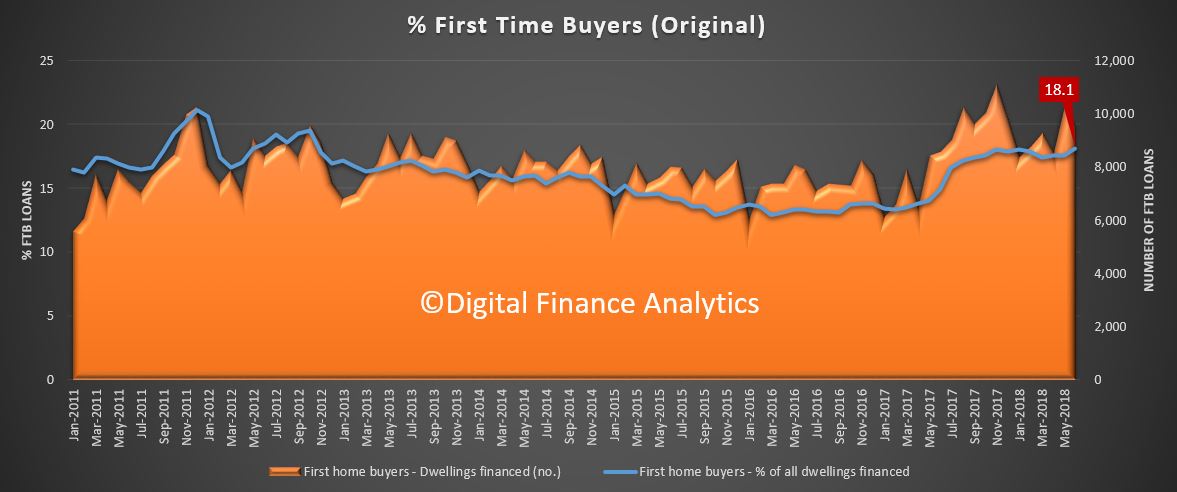

In original terms, the number of first home buyer commitments as a percentage of total owner occupied housing finance commitments rose to 18.1% in June 2018 from 17.6% in May 2018.

The number of loans fell 762 compared to last month, to 9,541. Within that we still some rises in NSW and VIC compared with a year ago, thanks to the recent FTB grants. The proportion of loans written at fixed rates fell again.

The number of loans fell 762 compared to last month, to 9,541. Within that we still some rises in NSW and VIC compared with a year ago, thanks to the recent FTB grants. The proportion of loans written at fixed rates fell again.

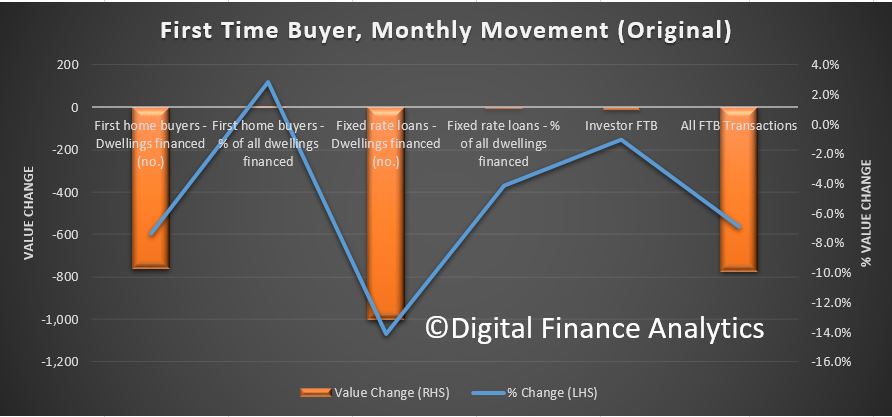

Out First Time Buyer Tracker, which includes an estimate of first time buyers going direct to the investment sector continued at a low level, compared with a year ago.

Out First Time Buyer Tracker, which includes an estimate of first time buyers going direct to the investment sector continued at a low level, compared with a year ago.

![]() Two final slides, first the original data showing the portfolio of loans outstanding at the banks registered an overall rise of $8 billion, and a fall in the proportion of loans for investment purposes to 33.7%, the lowest level for several years.

Two final slides, first the original data showing the portfolio of loans outstanding at the banks registered an overall rise of $8 billion, and a fall in the proportion of loans for investment purposes to 33.7%, the lowest level for several years.

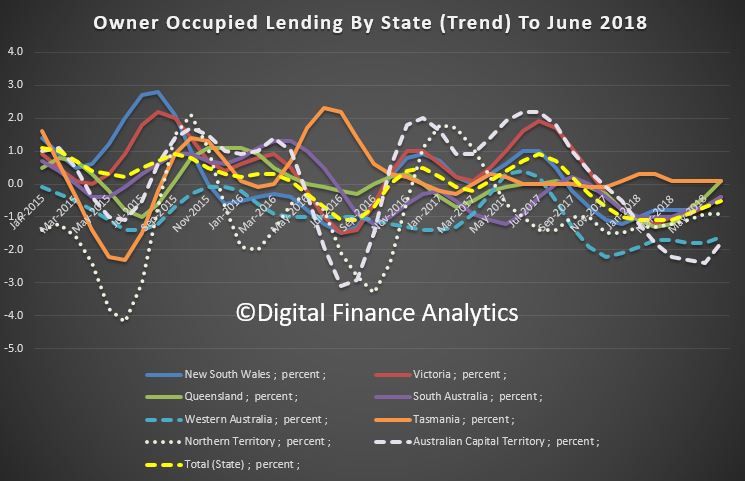

And the mix across states of owner occupied loans shows the strongest growth in Tasmania and Queensland, and falls in loan volumes most announced in ACT and Western Australia.

And the mix across states of owner occupied loans shows the strongest growth in Tasmania and Queensland, and falls in loan volumes most announced in ACT and Western Australia.

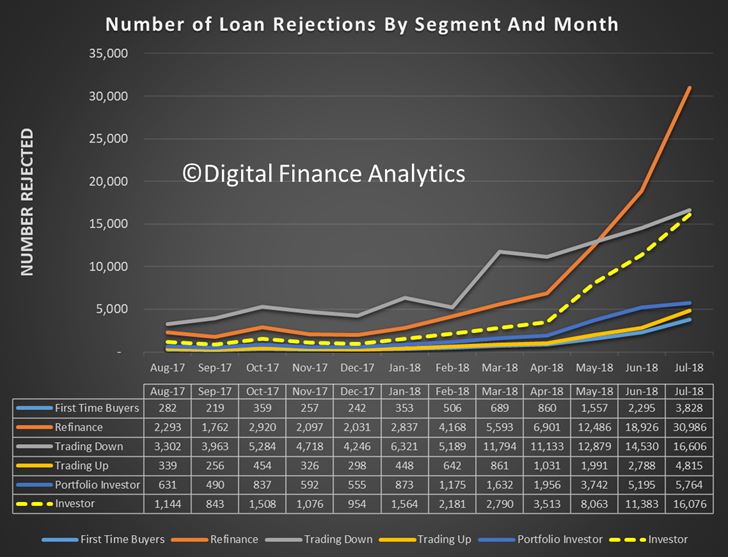

So the tighter lending conditions continue to bit, with investors less likely to get a loan. Some of this relates to demand (or lack of it) but also is being driven by the tighter lending requirements.

So the tighter lending conditions continue to bit, with investors less likely to get a loan. Some of this relates to demand (or lack of it) but also is being driven by the tighter lending requirements.

This is clearly seen in our surveys, where the number of rejected applications have risen significantly. This is especially true for those seeking to refinance an existing loan, including interest only loans.

The net portfolio growth, of around $9 billion, or 0.5% in the month in original terms, so overall lending remains quite strong, despite the weaker flows.

The net portfolio growth, of around $9 billion, or 0.5% in the month in original terms, so overall lending remains quite strong, despite the weaker flows.