The Fed appears to be concerned about end of the year liquidity, judging by their latest statement on their repo operations.

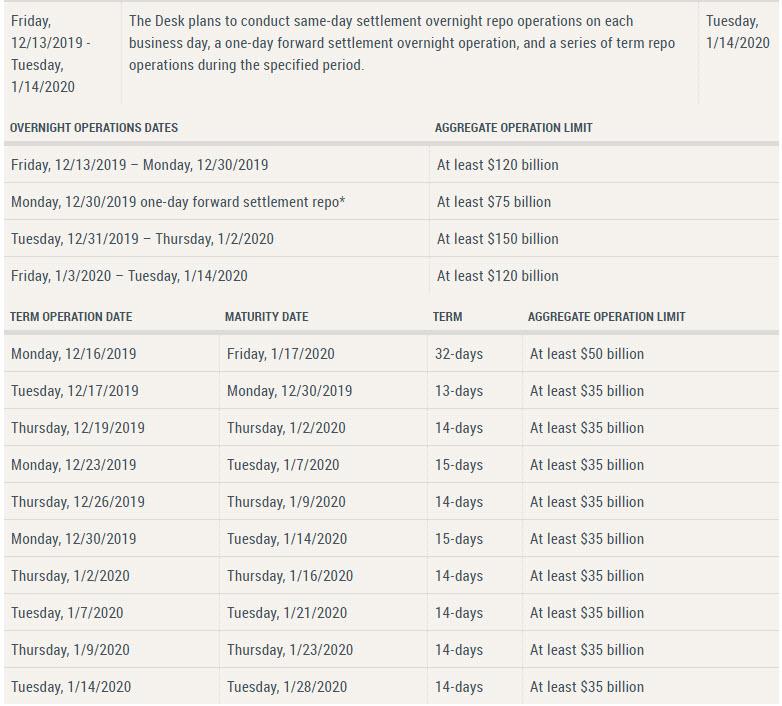

The Open Market Trading Desk (the Desk) at the Federal Reserve Bank of New York has released the schedule of repurchase agreement (repo) operations for the monthly period from December 13, 2019 through January 14, 2020. In accordance with the most recent FOMC directive, the Desk will conduct repo operations to ensure that the supply of reserves remains ample and to mitigate the risk of money market pressures around year end that could adversely affect policy implementation.

The Desk will continue to offer two-week term repo operations twice per week, four of which span year end. In addition, the Desk will also offer another longer-maturity term repo operation that spans year end. The amount offered in this operation will be at least $50 billion.

Overnight repo operations will continue to be held each day. On December 31, 2019 and January 2, 2020, the overnight repo offering will increase to at least $150 billion. In addition, on December 30, 2019, the Desk will offer a $75 billion repo that settles on December 31, 2019 and matures on January 2, 2020.

The Desk intends to adjust the timing and amounts of repo operations as needed to mitigate the risk of money market pressures that could adversely affect policy implementation, consistent with the directive from the FOMC.

Detailed information on the schedule and parameters of term and overnight repurchase agreement operations are provided on the Repurchase Agreement Operational Details site.

So, the NY Fed will continue to offer two-week term repo operations twice per week, four of which run across the end of the year end. Plus, they will also offer another longer-maturity term repo operation that spans year end. The amount offered in this operation will be at least $50 billion.

Beyond that, they announced that the overnight repo offering will increase to at least $150 billion to cover the “turn” in a flood of overnight liquidity. And on December 30, 2019, the Desk will offer a $75 billion repo that settles on December 31, 2019 and matures on January 2, 2020.

And they leave the door open to more if need by saying “intends to adjust the timing and amounts of repo operations as needed to mitigate the risk of money market pressures that could adversely affect policy implementation, consistent with the directive from the FOMC.”

So in essence, as well has growing the size its overnight repos to $150 billion, the Fed will run nine term repos covering the year-end turn from Dec 16th to Jan 14th, 8 of which will amount to $35 billion and the first will be $50 billion, for a total injection of $365 billion in the coming month.

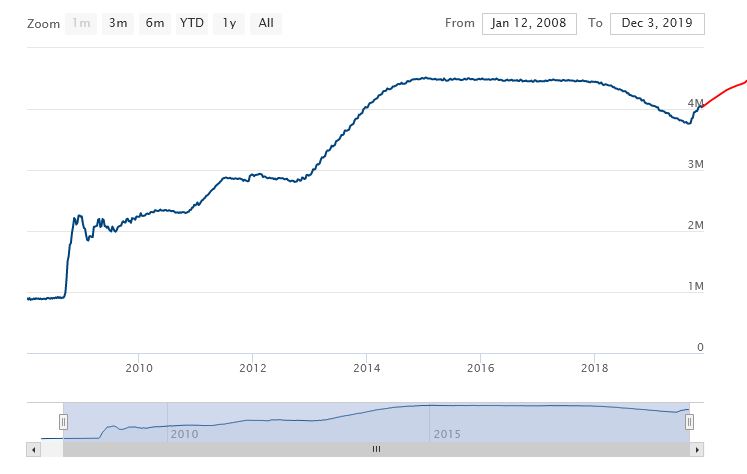

This is what the Fed Balance Sheet might look like. If this is not QE, I do not know what is….

The core question is what are they afraid of?