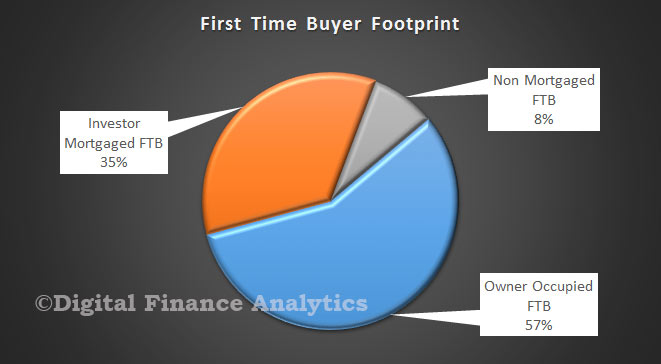

We continue our series using data from the latest DFA segmented household surveys. First time buyers are more than ever becoming property speculators. Whilst we have already quantified the number of first time buyers and first time investors in the market,

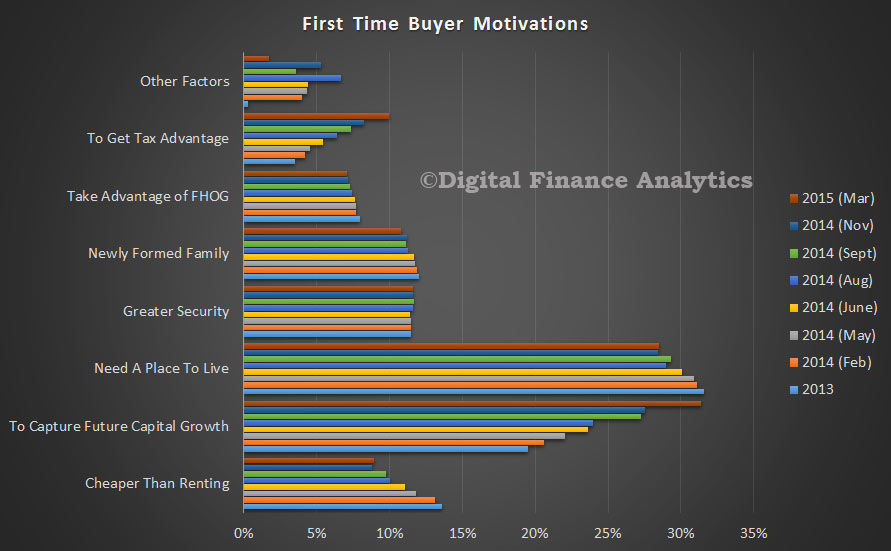

today we look at their underlying motivations. So, looking at these trends there are some striking observations. We see that the prospect of potential capital gains, is now the highest rated driver at 32%, whilst the desire for somewhere to live is just 28%. We see the prospect of gaining tax advantage is growing, now up to 10%, whilst the advantage of a First Home Owner Grant (FHOG) is falling away as these grants become less accessible. Fewer buyers now expect to pay less than renting, whilst the prospect of greater security remains about the same.

today we look at their underlying motivations. So, looking at these trends there are some striking observations. We see that the prospect of potential capital gains, is now the highest rated driver at 32%, whilst the desire for somewhere to live is just 28%. We see the prospect of gaining tax advantage is growing, now up to 10%, whilst the advantage of a First Home Owner Grant (FHOG) is falling away as these grants become less accessible. Fewer buyers now expect to pay less than renting, whilst the prospect of greater security remains about the same.

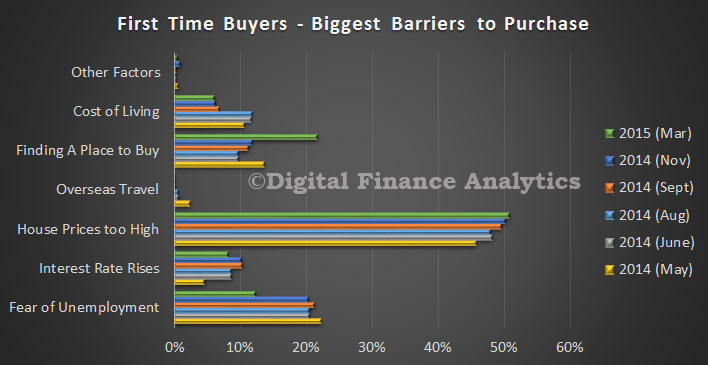

The biggest barrier to purchase are clearly current prices. This translates into too higher mortgages, or too bigger savings requirements to get into the market. The bank of “Mum and Dad” remains a prime source of funding. Fear of unemployment has diminished, whilst the problem of finding a place to buy has increased (now 22%). The impact of potential interest rates reduced slightly, in response to the RBA cut, and expectation of lower rates for longer. Many now assume rates will stay low for at least three years, and they plan on this basis.

The biggest barrier to purchase are clearly current prices. This translates into too higher mortgages, or too bigger savings requirements to get into the market. The bank of “Mum and Dad” remains a prime source of funding. Fear of unemployment has diminished, whilst the problem of finding a place to buy has increased (now 22%). The impact of potential interest rates reduced slightly, in response to the RBA cut, and expectation of lower rates for longer. Many now assume rates will stay low for at least three years, and they plan on this basis.

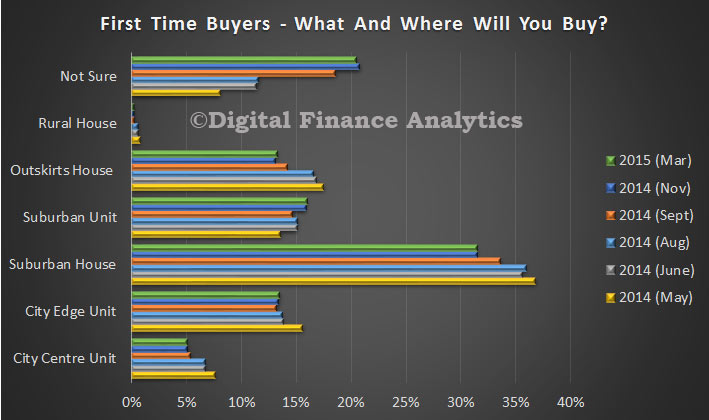

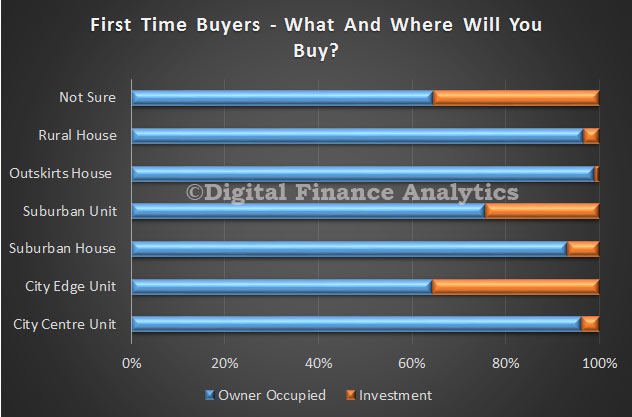

Looking at where they will buy, 20% of potential first time buyers are not sure where to purchase. Across all Australia a suburban home is still the most desired property type, but in Sydney, a unit is much more the expectation now, mostly on the urban fringe, or inner suburbs.

Looking at where they will buy, 20% of potential first time buyers are not sure where to purchase. Across all Australia a suburban home is still the most desired property type, but in Sydney, a unit is much more the expectation now, mostly on the urban fringe, or inner suburbs.

If we look at the split between owner occupied and investor first time buyers, we see investors are predominately going after units, either on the edge of the City (inner suburbs – e.g. in Sydney Hurstville, Wolli Creek), or suburban units.

If we look at the split between owner occupied and investor first time buyers, we see investors are predominately going after units, either on the edge of the City (inner suburbs – e.g. in Sydney Hurstville, Wolli Creek), or suburban units.

So putting this together, we conclude that first time buyers are reacting to the current house price boom in logical ways. They are however being infected by the notion that property is about wealth building, rather than somewhere to live. This notion, which served previous generations quite well (once they were on the property escalator), may be tested if interest rates rise later, or property prices fall from their current illogical stratospheric levels. The overriding result from the survey is the first time buyers are very fearful of missing out, and that delaying potential entry into the market will simply make it less affordable later. This is why we expect to see a continued rise in the number of first time investor buyers.

So putting this together, we conclude that first time buyers are reacting to the current house price boom in logical ways. They are however being infected by the notion that property is about wealth building, rather than somewhere to live. This notion, which served previous generations quite well (once they were on the property escalator), may be tested if interest rates rise later, or property prices fall from their current illogical stratospheric levels. The overriding result from the survey is the first time buyers are very fearful of missing out, and that delaying potential entry into the market will simply make it less affordable later. This is why we expect to see a continued rise in the number of first time investor buyers.