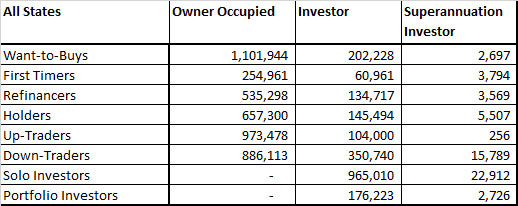

Today we continue our analysis of the DFA household survey data to March 2015 by looking at the cross segment comparative data. We use the DFA segment definitions and have updated our models to take account of changes in population, and property purchase type. The proportion of households who are excluded from property rose again, and the investment sector continues to grow strongly. The current distribution of households by segment are shown below.

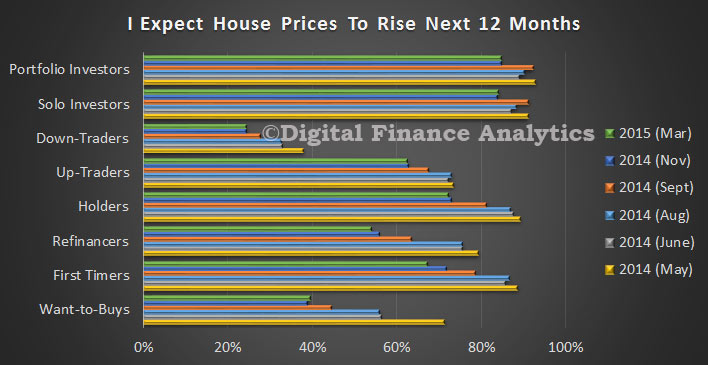

There is still significant expectation that house prices will continue to rise in the next 12 months, despite the recent gains, though Sydney centric households are most bullish. Investors have high expectations, and as we will see when we drill into this segment, capital gains are top of mind. Down traders are relatively less confident of prices continuing to rise, which explains why this segment still wants to sell now, to crystalise recent gains.

There is still significant expectation that house prices will continue to rise in the next 12 months, despite the recent gains, though Sydney centric households are most bullish. Investors have high expectations, and as we will see when we drill into this segment, capital gains are top of mind. Down traders are relatively less confident of prices continuing to rise, which explains why this segment still wants to sell now, to crystalise recent gains.

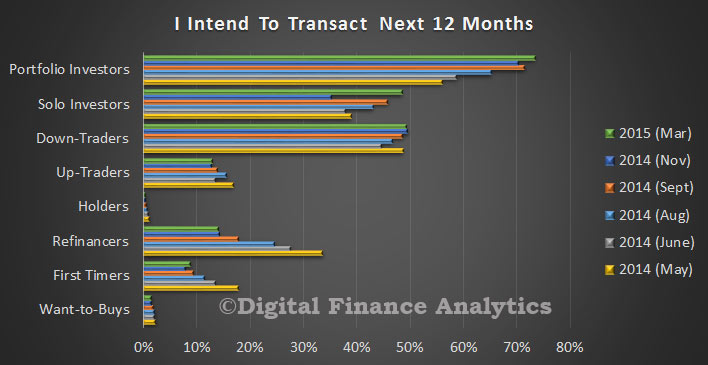

Looking at plans over the next 12 months, more investors are piling in, so we would expect to see this translate into further momentum in the investment sector. Last month more than half of loans were for investment purposes.

Looking at plans over the next 12 months, more investors are piling in, so we would expect to see this translate into further momentum in the investment sector. Last month more than half of loans were for investment purposes.

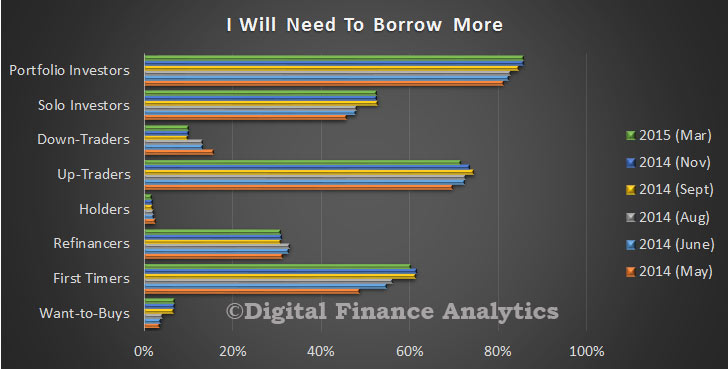

In terms of borrowing plans, investors, up-traders and first time buyers are the most likely to borrow. Those down traders who are thinking of grabbing an investment property are quite likely to gear, to take advantage of tax breaks.

In terms of borrowing plans, investors, up-traders and first time buyers are the most likely to borrow. Those down traders who are thinking of grabbing an investment property are quite likely to gear, to take advantage of tax breaks.

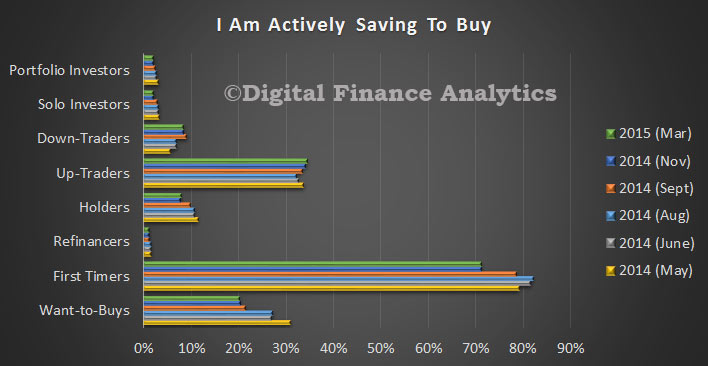

We see that up-traders, first time buyers and want to buys are most likely to be saving to buy, although the lower returns on deposits are proving to be a real problem for many.

We see that up-traders, first time buyers and want to buys are most likely to be saving to buy, although the lower returns on deposits are proving to be a real problem for many.

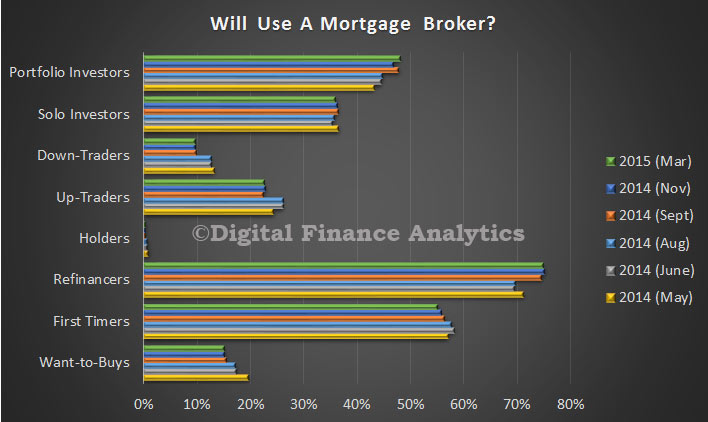

Finally, segments have different propensities to use a mortgage broker. Whilst refinancers, and first time buyers are most likely to use a broker, we also see a continued rise in the number of portfolio investors using a broker. However we see in the survey data a high level of dissatisfaction from this segment with the quality and range of advice from brokers as their needs are more complex, and many brokers tend to focus on simple binary transactions. We think there is an opportunity for brokers to better tailor their services to portfolio (a.k.a. more sophisticated) customers.

Finally, segments have different propensities to use a mortgage broker. Whilst refinancers, and first time buyers are most likely to use a broker, we also see a continued rise in the number of portfolio investors using a broker. However we see in the survey data a high level of dissatisfaction from this segment with the quality and range of advice from brokers as their needs are more complex, and many brokers tend to focus on simple binary transactions. We think there is an opportunity for brokers to better tailor their services to portfolio (a.k.a. more sophisticated) customers.

Next time we will look at the segment specific data drawn from the surveys.

Next time we will look at the segment specific data drawn from the surveys.

One thought on “Latest DFA Survey – House Prices Expected To Rise [Still]”