The RBA has updated their battery of statistics to June 2018 today. As always we go to the households ratios series –E2 HOUSEHOLD FINANCES – SELECTED RATIOS

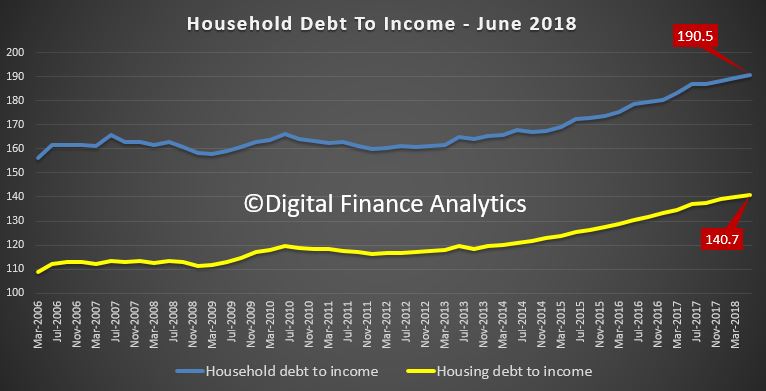

In short the debt to income is up again to 190.5, the ratio of interest payments to income is up, meaning that households are paying more of their income to service their debts, and the ratio of debt to home values are falling. All three are warnings. The policy settings are not right.

In more detail, we need to highlight that these ratios are for ALL households, whether they borrow or not, and also include small firms.

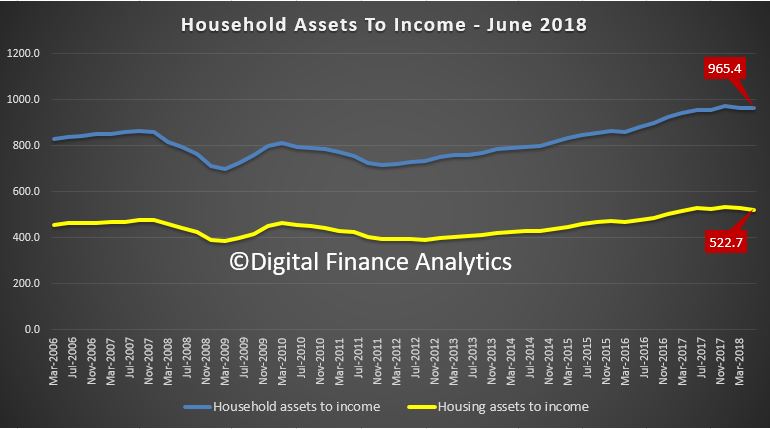

On average the value of household assets to income is up thanks to rising stock markets, but the value of housing assets to income is FALLING, as home prices slide. Expect more of this ahead.

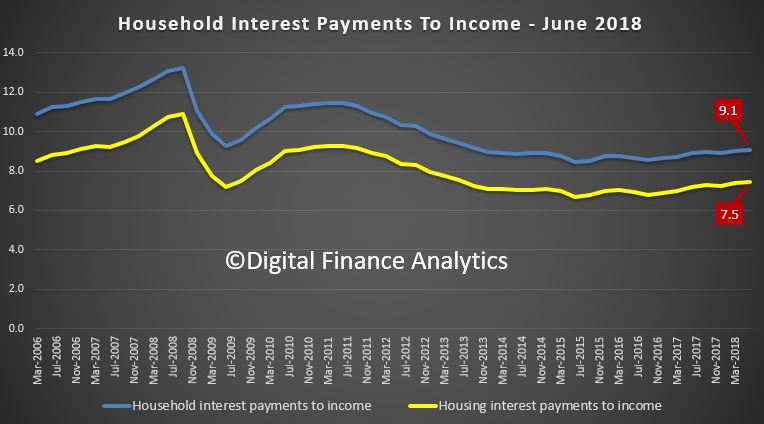

Looking at interest payments, these are rising, whether you look at housing debt or all debt. This is a combination of more debt. bigger loans, and some higher interest rates. Expect more ahead. OK, interest payments were higher when interest rates were higher, but the lose lending standards have enabled people to get bigger loans so they are move leveraged. As rates rise higher, this pressure multiplies.

Finally, the household debt to income is higher again at 190.5 now, and the housing debt to income is higher too.

Again on these numbers there is no justification to loosen lending standards, in fact to avoid a traffic accident later they still need to be tightened further.

Again on these numbers there is no justification to loosen lending standards, in fact to avoid a traffic accident later they still need to be tightened further.