Building on yesterday’s post which discussed the interest-only loan debt trap, today we show that lenders are having quite varied conversations with their borrowers.

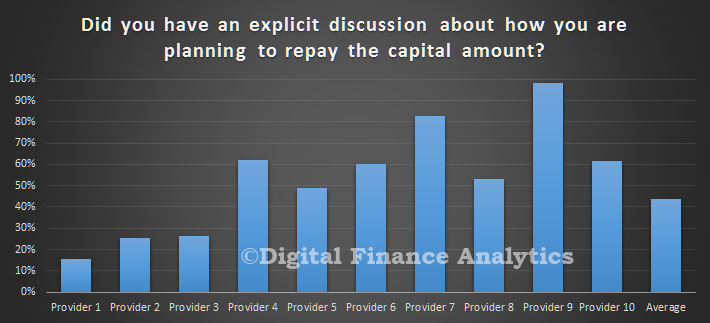

We took a cross section of households who have interest-only loans, and mapped their experience to a selection of specific lenders, looking at whether there was, as part of the purchase or refinance discussion, any explicit exploration of how the capital amount was to be repaid. Remember this is looking at the transaction from the perspective of the household, not the lender.

The average is that 43% of households with interest-only loans had an explicit discussion, but whilst some lenders achieved a score above 90%, others were much lower. A wide variation. The policy as set out by APRA is not being universally applied.

The average is that 43% of households with interest-only loans had an explicit discussion, but whilst some lenders achieved a score above 90%, others were much lower. A wide variation. The policy as set out by APRA is not being universally applied.

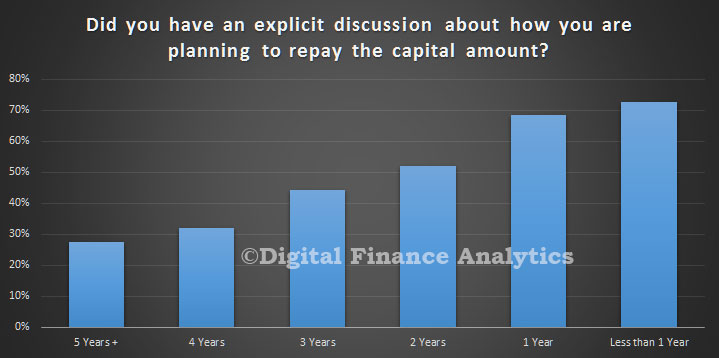

We also found that newer loans are more likely to be funded in the context of an explicit capital repayment discussion, whereas older loans were less likely to include such a discussion. This, we think, reflects lenders reacting the regulator guidance in the past couple of years. But there is clearly more to do.

It also reinforces the point there is a cadre of loans shortly to come to reset and review, where householders suddenly find they are asked some hard questions about capital repayment – perhaps for the first time. If they do not pass muster, an interest-only loan may not be available, forcing them to move to another lender (if available), or different loan structure, where repayments to principle are included. This could get quite nasty.

It also reinforces the point there is a cadre of loans shortly to come to reset and review, where householders suddenly find they are asked some hard questions about capital repayment – perhaps for the first time. If they do not pass muster, an interest-only loan may not be available, forcing them to move to another lender (if available), or different loan structure, where repayments to principle are included. This could get quite nasty.

Should, we ask, lenders be contacting borrowers, outside the review cycle, to preempt the problem? Unless they have a watertight record of an explicit capital repayment discussion, we think they should.