ASIC has released Report 604 Credit card lending in Australia – An update (REP 604), which sets out the changes being made by lenders to help consumers with credit card debt.

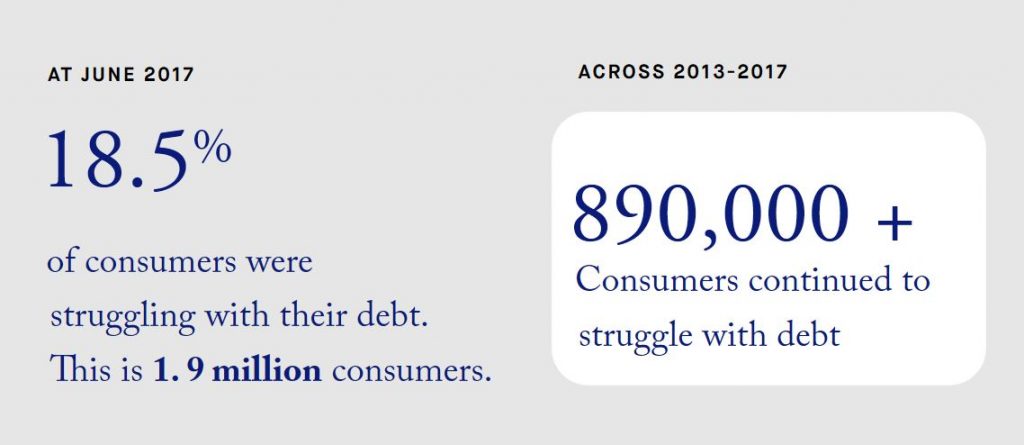

In July 2018, ASIC released Report 580 Credit card lending in Australia (REP 580), which found more than one in six consumers is struggling with credit card debt.

The report made it clear that ASIC expects credit providers to:

- take proactive steps to address problematic credit card debt and products that do not suit consumers

- minimise the extra credit provided to consumers who regularly exceed their credit limit, and

- allocate repayments for all credit cards in the more favourable way required for cards entered into after July 2012.

ASIC engaged with the ten largest credit providers that were part of our review (American Express, ANZ, Bendigo and Adelaide Bank, Citigroup, CBA, HSBC, Latitude, Macquarie, NAB and Westpac) and sought their commitment to change. Their commitments are described in their report released today.

Although these commitments are not required by the law, they are important in ensuring that the credit card market works for consumers, including vulnerable consumers.

Across the board, lenders have committed to changes to address the concerns by ASIC:

- 9 large credit providers committed to taking proactive steps to help consumers with problematic credit card debt

- 4 committed to fairer approaches for balance transfers, and

- 9 credit providers have committed to lower the amount by which consumers can exceed their credit limit.

Many credit providers are trialling measures — such as tailored communications and/or structured payment arrangements — to help consumers with potentially problematic credit card debt or who are failing to repay balance transfers.

Others are taking a fairer approach to balance transfers, such as by allowing interest free periods on new purchases and enhancing disclosure about cancelling old credit cards.

Macquarie, CBA and HSBC are the most progressed with implementing changes around credit card lending. Although American Express has committed to some changes, other lenders have proposed more comprehensive measures.

‘ASIC expects that all credit card lenders will address the issues raised in our review,’ ASIC Commissioner Sean Hughes said. ‘We will be monitoring lenders over the next two years to make sure they have taken action to address our concerns, and to ensure that consumer outcomes are improving in the credit card market.’

In REP 580, ASIC committed to conduct a follow-up review to see if there is an improvement in outcomes for consumers. ASIC will also not hesitate to use its future enforcement powers if necessary to bring about needed changes.

Background

In July 2018, ASIC published its report on credit card lending in Australia.

ASIC’s review of credit card lending found:

- In June 2017 there were almost 550,000 people in arrears, an additional 930,000 with persistent debt and an additional 435,000 people repeatedly repaying small amounts.

- Consumers carrying balances over time on high-interest rate cards could have saved more than $621 million in interest in 2016–17 if they had carried their balance on a card with a lower interest rate

- 63% of consumers did not cancel a card after a balance transfer and a substantial minority of consumers increased their total debt after transferring a balance.

Since REP 580 was released ASIC has prescribed a three-year period for credit card responsible lending assessments. This means that credit providers must not provide a credit card with a credit limit that the consumer could not repay within three years. This reform commences on 1 January 2019. More information about the reform is available in Report 590 Response to submissions on CP 303 Credit cards: Responsible lending assessments (REP 590).

The Government has implemented other reforms to help prevent problematic credit card debt. This includes banning unsolicited credit limit increase invitations and making it easier for consumers to cancel credit cards.

ASIC’s MoneySmart website has information for consumers about choosing and using credit cards, including information about balance transfers, how to pay off multiple cards and how to cancel a credit card.

Consumers can also use MoneySmart’s credit card calculator to work out the fastest way to pay off their card and how much they can save by paying it off sooner.