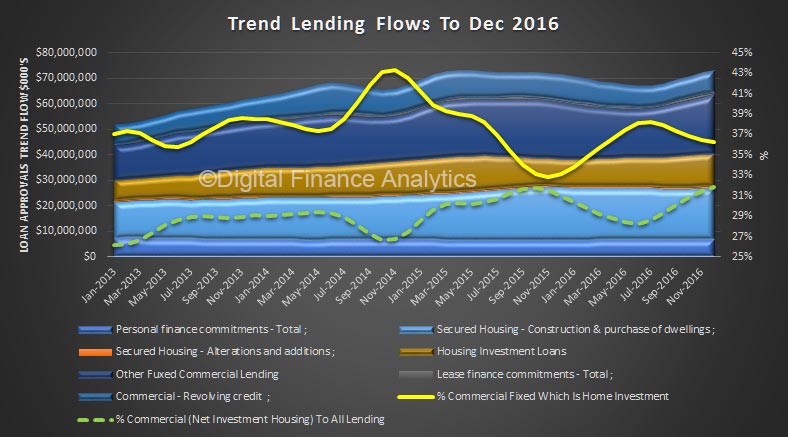

The latest release from the ABS provides lending flow data to December 2016. It reconfirms the growth in investment property loans at 36% of commercial lending (especially in Sydney which is at a 5 month peak), but also reveals more momentum in lending for other commercial proposes, (potentially a good thing if for productive business purposes) and a Christmas led growth in personal debt. Total trend borrowing grew 1.52% or $1.9 billion in the month (which would be a 12 month rate of 18.3%), way ahead of the current inflation rate of an annual (yes annual) rate of 1.5%! Total debt flows rose to $73 billion in the month. Australia is borrowing its way to obviation.

Looking in more detail at the trend data (which smooths out the monthly noise), owner occupied loans rose just 0.2% to $20 billion, lending for property alterations fell 0.6%, and personal finance rose 0.69% to $6.9 billion (fixed loans were up 0.52% to $4.4 billion and revolving loans/credit cards rose 0.97% to $2.5 billion.

Looking in more detail at the trend data (which smooths out the monthly noise), owner occupied loans rose just 0.2% to $20 billion, lending for property alterations fell 0.6%, and personal finance rose 0.69% to $6.9 billion (fixed loans were up 0.52% to $4.4 billion and revolving loans/credit cards rose 0.97% to $2.5 billion.

Investment housing loans rose 1.68% to 13.2 billion, (equivalent to an annual rate of 20.2%) other commercial fixed lending rose 2.86% to $23 billion and revolving commercial loans rose 1.62% to $8.7 billion.

Recent regulator moves are likely to slows investment housing lending in the next few months, but households are burdened with massive debts, which will start to bite should interest rates rise.

Meantime bank shareholders will be “laughing all the way TO the bank” thanks to higher loan volumes and improved margins following recent out of cycle rate rises.