We suspect that when Genworth went public a few years ago, they did not necessarily consider the extra scrutiny such a listing warrants, especially in a home lending sector which is now under more pressure. This pressure is reflected in their 1H18 results and is a bellwether for the wider housing sector. Actually I think they are doing much right, given the market context but its a tough gig.

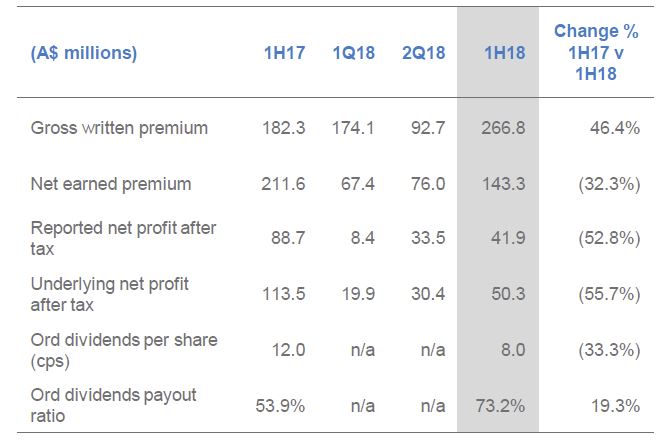

The Group reported a 2018 statutory interim net profit after tax of $41.9 million, down 52.7% from $88.7 million in the prior corresponding period mainly driven by the adverse impact from the change in earnings curve conducted in 2017 which resulted lower earned premium.

On 1 August 2018, the Directors declared a 100% ordinary franked dividend of 8.0 cents per share totalling $36,817,000 and a 100% franked special dividend for 4.0 cents per share totalling $18,409,000.

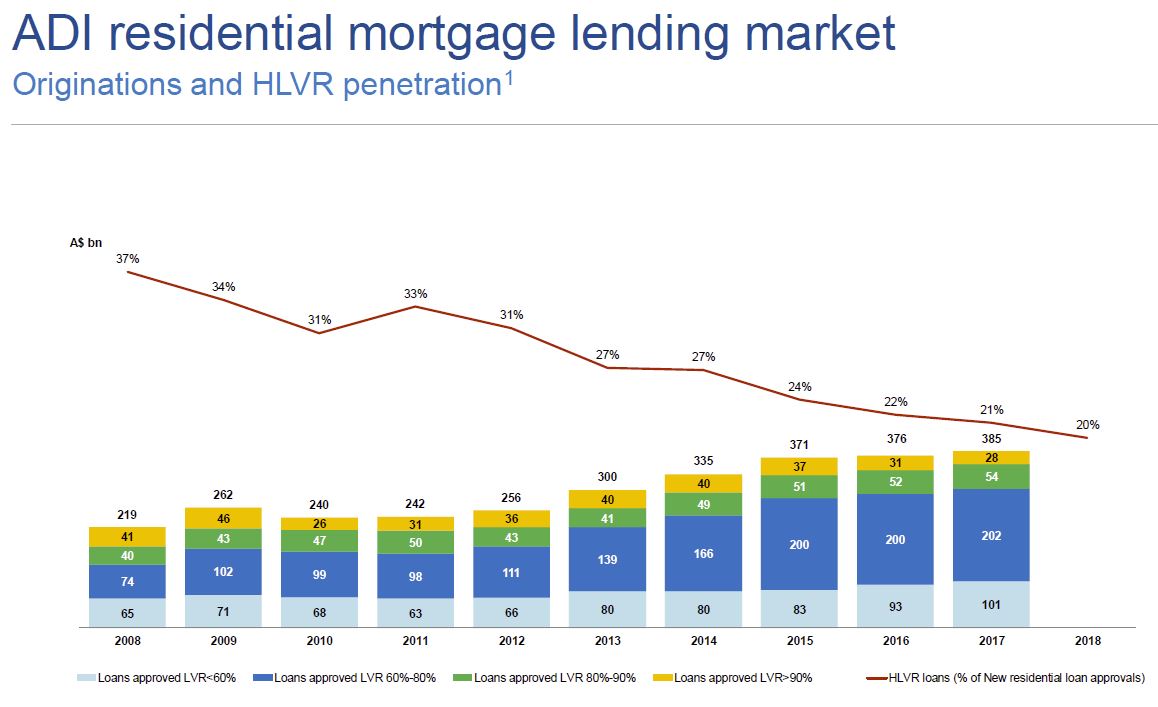

New business volume, as measured by New Insurance Written (NIW), decreased 21.4% to $10.3 billion in 1H18 compared with $13.1 billion in 1H17. NIW in 1H18 included $1.1 billion of bulk portfolio business versus $2.1 billion of bulk portfolio business in 1H17. NIW excludes the Company’s excess of loss reinsurance and the new business written via Genworth’s Bermudan entity.

New business volume, as measured by New Insurance Written (NIW), decreased 21.4% to $10.3 billion in 1H18 compared with $13.1 billion in 1H17. NIW in 1H18 included $1.1 billion of bulk portfolio business versus $2.1 billion of bulk portfolio business in 1H17. NIW excludes the Company’s excess of loss reinsurance and the new business written via Genworth’s Bermudan entity.

The decline in NIW in 1H18 compared to 1H17 reflects the $1.0 billion reduction in bulk portfolio business and the fact that 1H17 included business written pursuant to an agreement with the Company’s then second largest customer. This agreement terminated in April 2017 and represented $2.5 billion of NIW in 1H17.

Gross Written Premium (GWP) increased 46.4% to $266.8 million in 1H18 (1H17: $182.3 million). This includes the new business written via Genworth’s Bermudan entity and the new Micro Markets LMI business. As disclosed at the time of the Company’s 1Q18 Results announcement Genworth has retained $170.2 million of risk and placed the remainder with a consortium of global reinsurers through its Bermudan entity. Net of the premium to the consortium of global reinsurers, Genworth’s GWP increased 12.0% in 1H18 as a result of this transaction. For reporting purposes this risk is not reflected in NIW. In terms of the traditional LMI business, volumes were down 6% from 1H17 following termination of the Company’s then second largest customer contract in April 2017. This was partially offset by a higher LVR mix which resulted in a higher average price for written premiums.

The expense ratio increased to 32.9% from 25.9% in the prior corresponding period mainly reflecting lower net earned premium in the current period. The reported loss ratio increased from 34.8% at 30 June 2017 to 53.3% at 30 June 2018 reflecting primarily lower net earned premium in the current period.

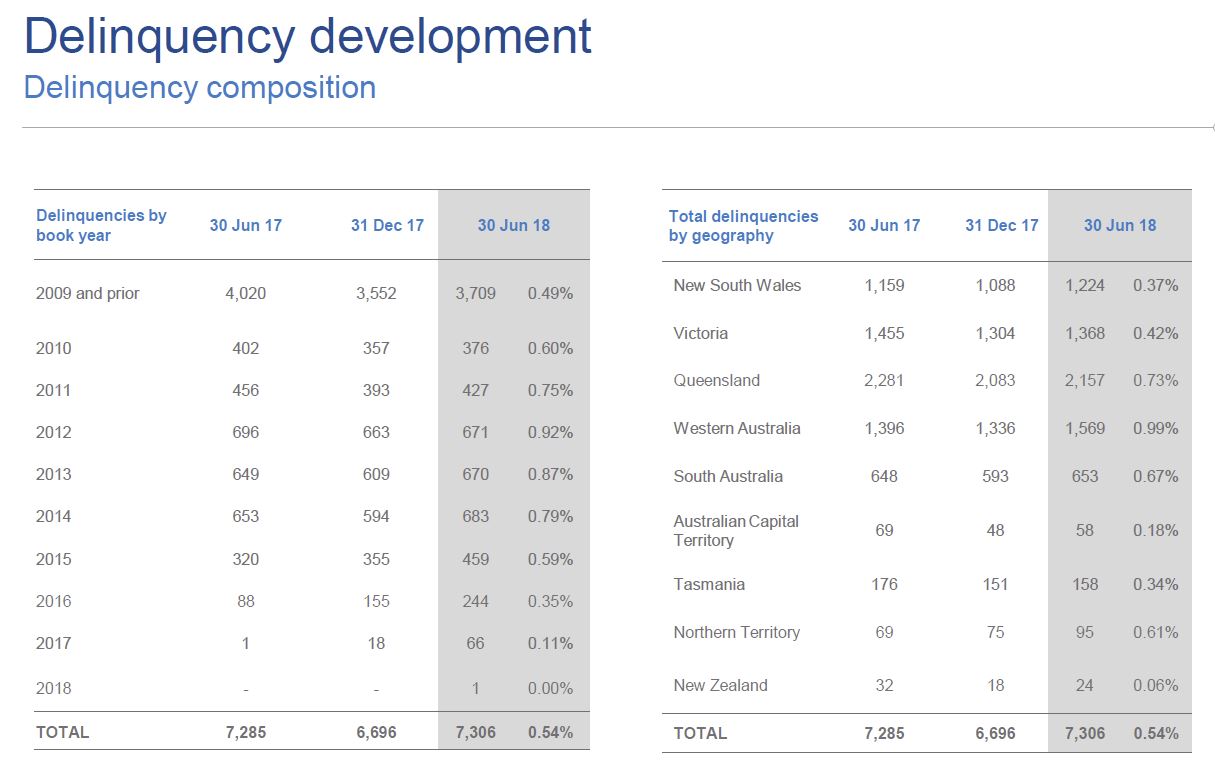

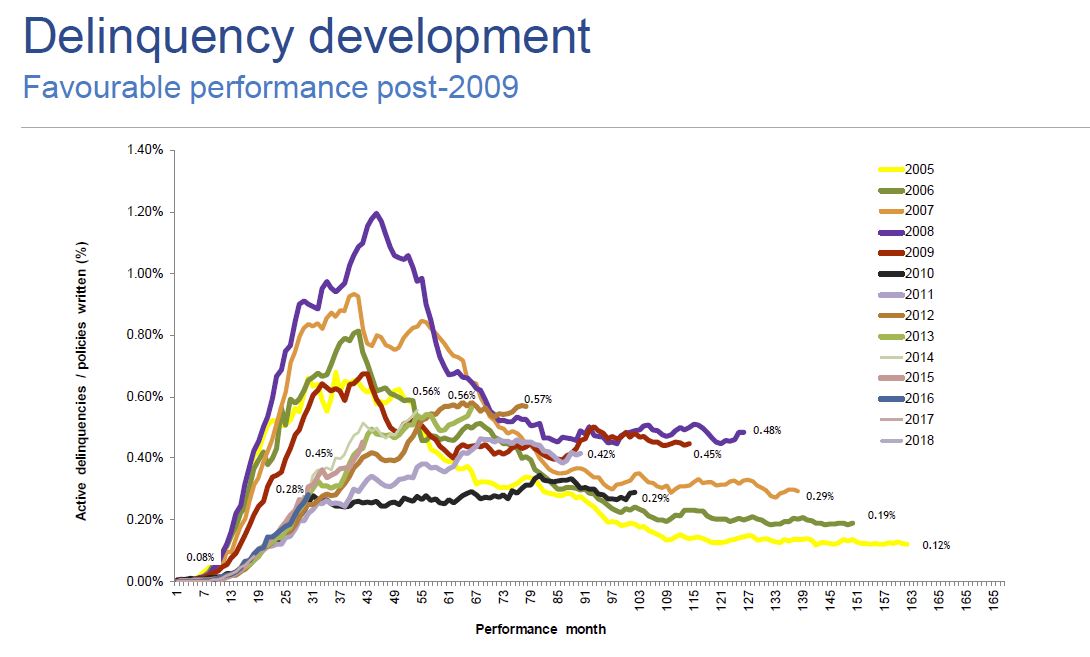

The Delinquency Rate (number of delinquencies divided by policies in force but excluding excess of loss insurance) increased from 0.51% in 1H17 to 0.54% in 1H18. This was driven by two factors. Firstly, there was a decrease in the policies in force following completion of the Lapsed Policy Initiative. The second (lesser) factor impacting the delinquency rate has been an increase in the number of delinquencies in Western Australia, New South Wales and to a lesser extent South Australia. This was partially offset by a decrease in delinquencies in Victoria and Queensland. New delinquencies were down in the half (1H18: 5,565 versus 1H17: 5,997). Delinquencies in mining areas are showing signs of improving. In non-mining regions there are indications of a softening in cure rates. These are being closely monitored to ascertain any developing adverse trends. WA continues as primary contributor to deterioration in 2013-14 vintages due to ongoing economic and housing market challenges following the downturn in the mining sector.

The Delinquency Rate (number of delinquencies divided by policies in force but excluding excess of loss insurance) increased from 0.51% in 1H17 to 0.54% in 1H18. This was driven by two factors. Firstly, there was a decrease in the policies in force following completion of the Lapsed Policy Initiative. The second (lesser) factor impacting the delinquency rate has been an increase in the number of delinquencies in Western Australia, New South Wales and to a lesser extent South Australia. This was partially offset by a decrease in delinquencies in Victoria and Queensland. New delinquencies were down in the half (1H18: 5,565 versus 1H17: 5,997). Delinquencies in mining areas are showing signs of improving. In non-mining regions there are indications of a softening in cure rates. These are being closely monitored to ascertain any developing adverse trends. WA continues as primary contributor to deterioration in 2013-14 vintages due to ongoing economic and housing market challenges following the downturn in the mining sector.

The market capitalisation of the Company as at 30 June 2018 was $1.2 billion based on the closing share price of $2.57.

The market capitalisation of the Company as at 30 June 2018 was $1.2 billion based on the closing share price of $2.57.

The Group’s regulatory capital at 30 June 2018 was 1.90 times the Prescribed Capital Amount (“PCA”) and the Common Equity Tier 1 (“CET1”) ratio was 1.71. Regulatory capital exceeds the Group’s targets and reflected a strong capital position.

In early 2017 Genworth commenced a Strategic Program of Work designed to enable it to effectively compete in a market of evolving borrower and lender expectations, resulting from technological advances and regulatory change.

As part of its Strategic Program of Work the Company announced in 1Q18 that it had entered into agreements with lender customers to provide new product offerings that are complementary to its traditional lenders mortgage insurance (LMI). These new offerings included a bespoke risk management solution via a newly established Bermudan insurance entity, micro markets LMI and excess of loss cover.

In 2Q18 the Company continued the momentum of its Strategic Program of Work. Over the past 12 months Genworth has worked with a technology partner to develop a new automated underwriting decision engine (Auto Decision Engine) which will be launched later this year. This initiative will deliver operational efficiencies and provide the business with greater underwriting risk management insights.

Also of note is Genworth’s investment in Tictoc Online Pty Limited (Tic:Toc). Tic:Toc is a fintech in the online origination space. In addition to a small equity stake in Tic:Toc, Genworth has been appointed the exclusive provider of LMI on Tic:Toc’s digital loan platform. Tic:Toc’s digital loan platform operates both as a direct-to-consumer platform and as a partner platform.