Completing the analysis of the residential APRA Property Exposure data, we look at selected loan type data across the different ADI lender categories. This analysis is based on relative numbers of transactions, not value.

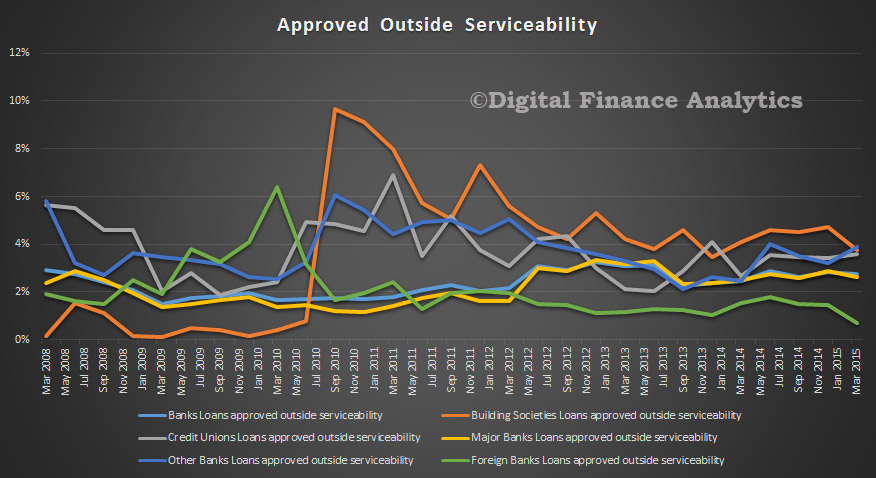

First we see that the proportion of loans approved outside normal serviceability criteria has drifted lower, though Building Societies, Credit Unions and the Smaller Banks are still most likely to bend the rules to get a loan written. Perhaps they have tighter rules in place to begin with?

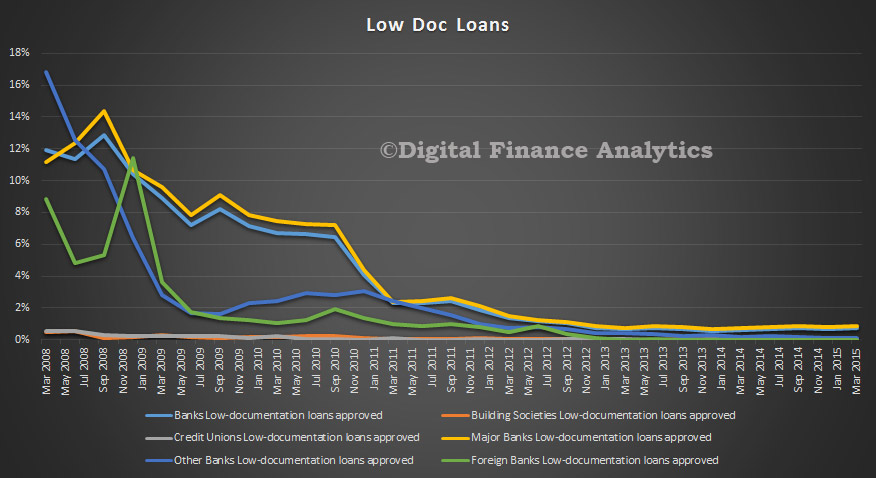

The proportion of low doc loans written is miniscule and now consistently low. Most low doc borrowers would now be knocking on the door of the non-ADI’s as they do not have the same heavy supervisory oversight and are tending to be more flexible – but there is little public data on this.

The proportion of low doc loans written is miniscule and now consistently low. Most low doc borrowers would now be knocking on the door of the non-ADI’s as they do not have the same heavy supervisory oversight and are tending to be more flexible – but there is little public data on this.

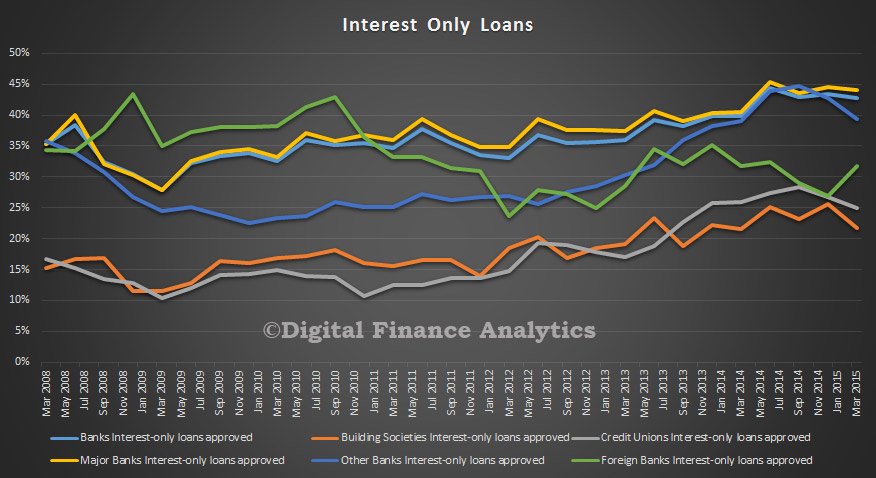

Turning to interest only loans, the Majors, and Other Banks are most likely to write this type of loan. However, we note the rising proportion of Credit Unions, Building Societies and Foreign Banks who will consider the proposition.

Turning to interest only loans, the Majors, and Other Banks are most likely to write this type of loan. However, we note the rising proportion of Credit Unions, Building Societies and Foreign Banks who will consider the proposition.

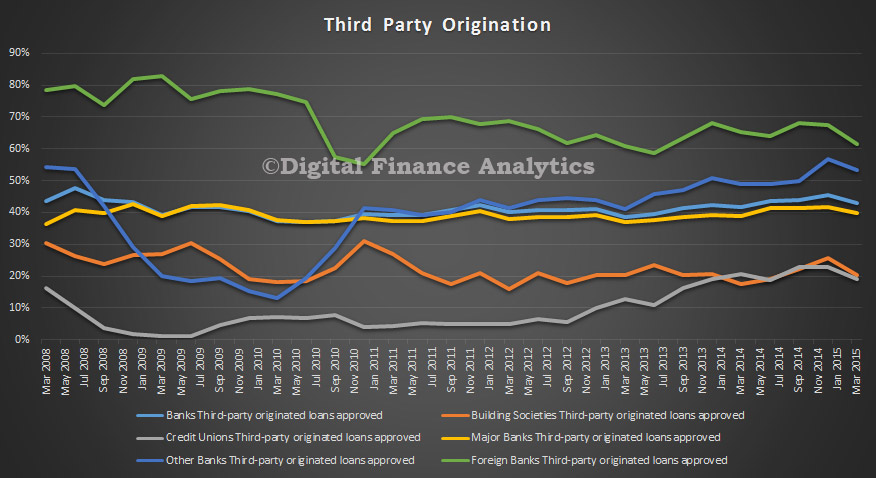

Finally, looking at the use of the broker channel, Foregin Banks originate the highest proportion this way, with the smaller Banks also in on the third party origination game. Credit Unions and Building Societies are less inclined to use Brokers, though there have been some increase in recent years.

Finally, looking at the use of the broker channel, Foregin Banks originate the highest proportion this way, with the smaller Banks also in on the third party origination game. Credit Unions and Building Societies are less inclined to use Brokers, though there have been some increase in recent years.