Continuing our analysis of the latest APRA data, we are looking at the LVR mix by type of lender by analysis of the relative ratio of LVR over time, (understanding that some lender categories are relatively small). APRA splits out the ADI data into sub categories, including Major Banks, Other Banks (excludes the Majors), Building Societies, Credit Unions and Foreign Banks. There are some interesting trend variations across these.

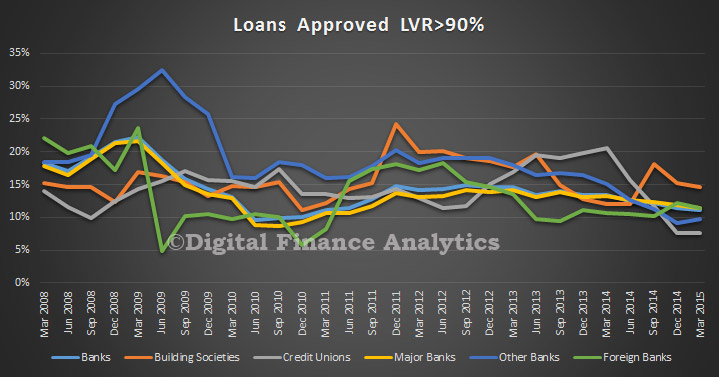

In the above 90% LVR category, we see a general drift down, Credit Unions took a dive last year, whilst Building Societies have the highest share of new 90%+ LVR loans, though we see this falling a little now. The Major Banks sit in the middle of the pack. Note that in 2009, Other Banks were writing more than 30% of their loans in this category, today its below 10%.

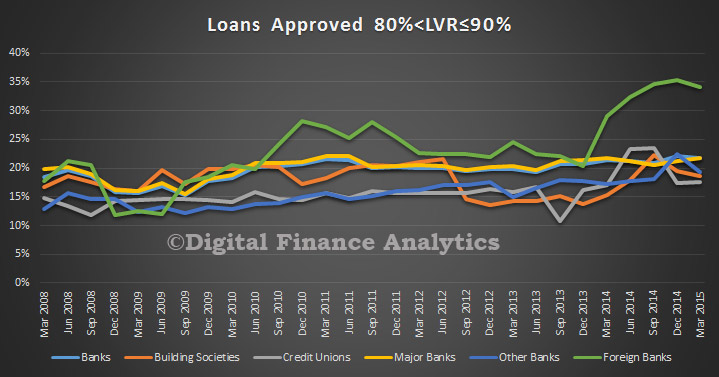

In the 80-90% LVR range, the Foreign banks, and Other Banks (ie not the big four) showed an uptick, though this may now be reversing. Building Societies and Credit Unions are below the Major Banks.

In the 80-90% LVR range, the Foreign banks, and Other Banks (ie not the big four) showed an uptick, though this may now be reversing. Building Societies and Credit Unions are below the Major Banks.

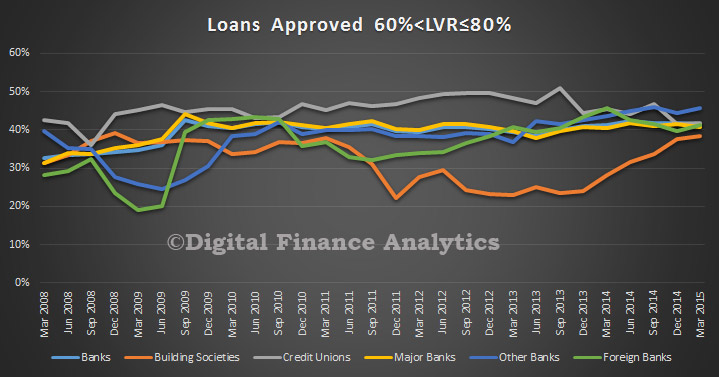

In the 60-80% range, we see the Building Society mix rising in this band, whilst the others have been relatively static.

In the 60-80% range, we see the Building Society mix rising in this band, whilst the others have been relatively static.

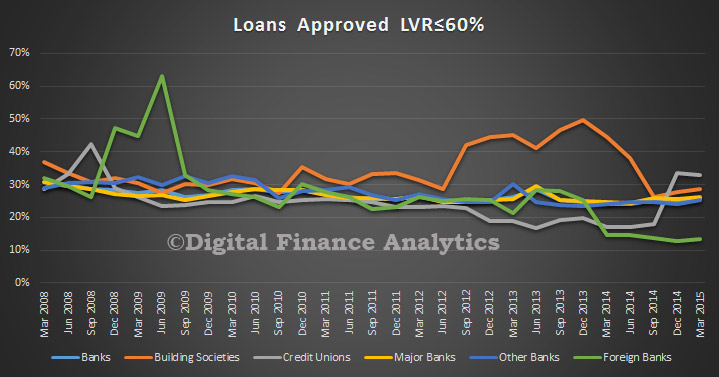

Finally, the loans below 60% LVR. Here the Building Society have drop a few points, as they move into the higher LVR bands, though that may be reversing a little now. Foreign Banks share in this band dropped recently, after a spike in 2009.

Finally, the loans below 60% LVR. Here the Building Society have drop a few points, as they move into the higher LVR bands, though that may be reversing a little now. Foreign Banks share in this band dropped recently, after a spike in 2009.