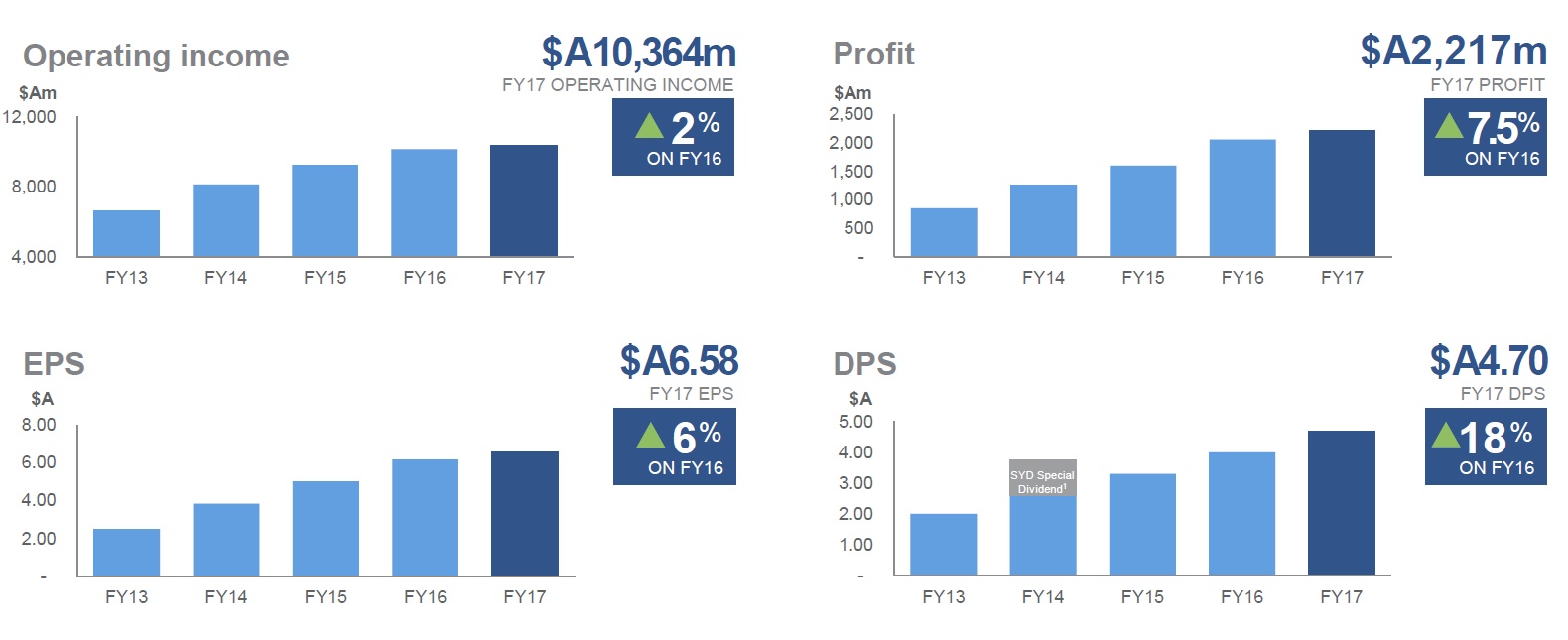

Macquarie Group has announced a net profit after tax attributable to ordinary shareholders of $A2,217 million for the full year ended 31 March 2017 (FY17), up 7.5 per cent on the full year ended 31 March 2016 (FY16).

Profit for the half-year ended 31 March 2017 (2H17) was $A1,167 million, up 11 per cent on the half-year ended 30 September 2016 (1H17) and up 18 per cent on the half-year ended 31 March 2016 (2H16).

Profit for the half-year ended 31 March 2017 (2H17) was $A1,167 million, up 11 per cent on the half-year ended 30 September 2016 (1H17) and up 18 per cent on the half-year ended 31 March 2016 (2H16).

There was a nine per cent decrease in combined net interest and trading income to $A3,954 million, an 11 per cent decrease in fee and commission income to $A4,331 million, a five per cent increase in net operating lease income to $A921 million, whilst other operating income and charges of $A1,107 million in FY17 increased significantly from $A66 million in FY16. The primary drivers were increased gains on the sale of investments and businesses; and lower charges for provisions and impairments across most operating groups. Total operating expenses increased two per cent whilst staff numbers were down.

Macquarie Group Managing Director and Chief Executive Officer (CEO) Nicholas Moore said: “Macquarie’s annuity-style businesses (Macquarie Asset Management (MAM), Corporate and Asset Finance (CAF) and Banking and Financial Services (BFS)), which represent approximately 70 per cent of the Group’s performance5, continued to perform well, with combined net profit contribution of $A3,249 million, up four per cent on FY16.

“Macquarie’s capital markets facing businesses (Commodities and Global Markets (CGM) and Macquarie Capital) also performed well with a combined net profit contribution of $A1,454 million, up 12 per cent on FY16.”

Net operating income of $A10,364 million in FY17 was up two per cent on FY16, while operating expenses of $A7,260 million were also up two per cent on FY16.

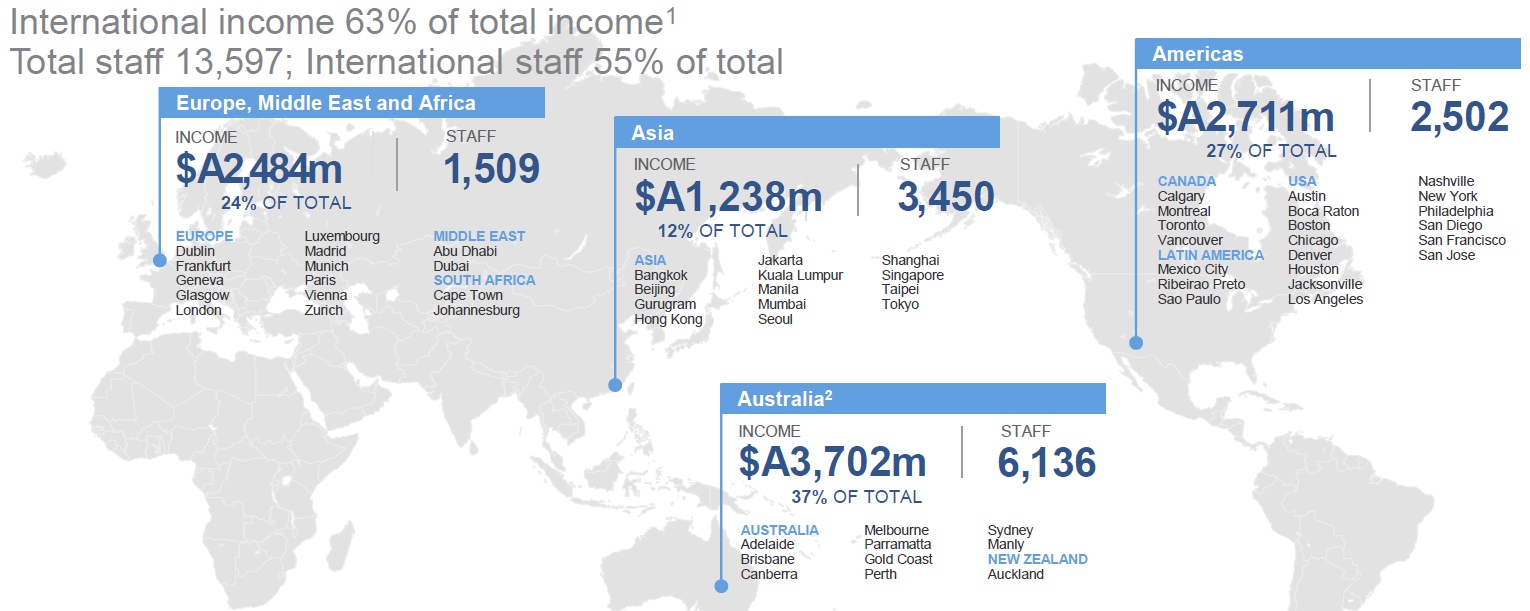

While Macquarie continued to build on the strength of its Australian franchise, its international income accounted for 63 per cent of the Group’s total income for FY17. Total international income was $A6,433 million in FY17, a decrease of five per cent on FY16.

Macquarie’s assets under management (AUM) at 31 March 2017 were $A481.7 billion, broadly in line with $A478.6 billion at 31 March 2016, due to favourable market movements and additional fund investments in Macquarie Infrastructure and Real Assets (MIRA), partially offset by a decrease in insurance assets and unfavourable foreign exchange movements.

Macquarie announced a 2H17 final ordinary dividend of $A2.80 per share (45 per cent franked), up from the 1H17 interim ordinary dividend of $A1.90 per share (45 per cent franked) and up from the 2H16 final ordinary dividend of $A2.40 per share (40% franked). The total ordinary dividend payment for the year of $A4.70 per share, is up from $A4.00 in the prior year. This represents an annual ordinary dividend payout ratio of 72 per cent. The record date for the final ordinary dividend is 17 May 2017 and the payment date is 3 July 2017.

Macquarie currently expects the year ending 31 March 2018 (FY18) combined net profit contribution from operating groups to be broadly in line with the year ended 31 March 2017 (FY17). The FY18 tax rate is currently expected to be broadly in line with FY17. Accordingly, the Group’s result for FY18 is currently expected to be broadly in line with FY17.

Operating group performance

- Macquarie Asset Management delivered a net profit contribution of $A1,538 million for FY17, down six per cent from $A1,644 million in FY16. FY17 base fees of $A1,574 million were broadly in line with FY16. Base fee income benefited from investments made by MIRA-managed funds, growth in the MSIS Infrastructure Debt business and positive market movements in MIM AUM, largely offset by asset realisations by MIRA-managed funds, net AUM outflows in the MIM business and foreign exchange impacts. Performance fee income of $A264 million, predominately from infrastructure assets, was down from a particularly strong $A693 million in FY16. Investment-related income included principal gains from the partial sale of MIRA’s holdings in MQA and MIC, the sale of the trustee-manager of APTT as well as the sale of unlisted real estate and infrastructure holdings. Assets under management of $A480.0 billion were broadly in line with 31 March 2016.

- Corporate and Asset Finance delivered a net profit contribution of $A1,198 million for FY17, up six per cent from $A1,130 million in FY16. The increase reflected the full year contribution of the AWAS and Esanda acquisitions as well as lower provisions for impairment, partially offset by the impact of lower loan volumes in the Lending portfolio, unfavourable foreign exchange and the sale of nine aircraft in the aircraft leasing portfolio. The AWAS and Esanda acquisitions continue to perform in line with expectations. CAF’s asset and loan portfolio of $A36.5 billion decreased seven per cent on 31 March 2016 due to the impact of unfavourable foreign currency movements, net repayments and realisations in the Lending portfolio and asset depreciation.

- Banking and Financial Services delivered a net profit contribution of $A513 million for FY17, up 47 per cent from $A350 million in FY16. The improved result reflects increased income from growth in Australian lending, deposit and platform average volumes, as well as a gain on sale of Macquarie Life’s risk insurance business. This was partially offset by a loss on the disposal of the US mortgages portfolio, increased impairment charges predominately on equity investments and intangible assets, increased costs mainly due to elevated project activity as well as a change in approach to the capitalisation of software expenses in relation to the Core Banking platform. BFS deposits of $A44.5 billion increased ten per cent on 31 March 2016 and funds on platform of $A72.2 billion increased 24 per cent on 31 March 2016. The Australian mortgage portfolio of $A28.7 billion increased one per cent on 31 March 2016, representing approximately two per cent of the Australian mortgage market. NIM up across Australian mortgages and business lending portfolios,

partially offset by lower NIM across business banking deposits. - Commodities and Global Markets delivered a net profit contribution of $A971 million for FY17, up 15 per cent from $A844 million in FY16. The result reflects an increase in investment-related income generated from the sale of a number of investments and a reduction in provisions for impairment compared to the prior year. This was partially offset by reduced commodities-related net interest and trading income compared to FY16 due to mixed results in power markets and base metals partially offset by increased client activity in precious metals. CGM continued to experience strong results for the energy platform, particularly in Global Oil and North American Gas and increased customer activity in foreign exchange, interest rates and futures markets due to ongoing market volatility. Equities was down on a strong prior year which benefited from strong equity market activity, particularly in China. Macquarie was awarded the 2016 Commodity House of the Year for the third consecutive year.

- Macquarie Capital delivered a net profit contribution of $A483 million for FY17, up seven per cent from $A451 million in FY16. The increase was largely due to improved M&A Advisory in the US and Europe and DCM in the US and a decline in impairment charges partially offset by a decline in ECM income due to subdued equity market conditions in Australia. During FY17, Macquarie Capital advised on 417 transactions valued at $A159 billion including being joint lead manager, joint bookrunner and joint underwriter to Boral Limited’s ~$A2.1 billion equity raising to partially fund its acquisition of Headwaters Incorporated; financial adviser for a consortium led by Maeda Corporation for the privatisation of eight toll roads in Aichi Prefecture, Japan; financial adviser and debt arranger to a group of North American infrastructure investors on the acquisition of Cleco Corporation; exclusive financial adviser on Laureate Education’s $US400 million of convertible securities; capital raising and acquisition in conjunction with CGM of a 50 per cent Principal Investment in the 299MW Tees Renewable Energy Plant; and acquisition of a 25 per cent stake in the £1.6 billion, 573MW Race Bank offshore wind farm, also advising MIRA on the acquisition of a 25 per cent stake in the project.

Full year result overview

Chief Financial Officer (CFO) Patrick Upfold said: “Net operating income of $A10,364 million for FY17 was up two per cent on FY16, while total operating expenses of $A7,260 million were also up two per cent on FY16.”

Key drivers of the change from the prior year were:

- A nine per cent decrease in combined net interest and trading income to $A3,954 million, down from $A4,346 million in FY16. CGM was impacted by limited trading opportunities in equity markets compared to FY16 which benefited from strong activity, particularly in China, as well as lower levels of commodities-related client activity and trading opportunities in energy markets compared to a strong FY16. Additionally, CAF was impacted by lower loan volumes in the CAF Lending portfolio and the full year impact of funding costs of the AWAS portfolio. Partially offsetting these declines was growth in average volumes and improved margins across the Australian loan portfolios in BFS, a stronger performance in foreign exchange, interest rates and credit markets products in CGM and the full year contribution of the Esanda dealer finance portfolio.

- An 11 per cent decrease in fee and commission income to $A4,331 million, down from $A4,862 million in FY16. Performance fees were $A264 million in FY17, down 63 per cent on a particularly strong FY16 which benefited from significant performance fees of $A714 million. Brokerage and commissions income of $A813 million was down eight per cent from $A888 million, mainly in equities due to reduced client trading activity. Mergers and acquisitions, advisory and underwriting fees of $A963 million in FY17 was broadly in line with $A962 million in FY16 with a strong performance in mergers and acquisitions and debt capital markets fees partially offset by reduced fee income from equity capital markets activities, particularly in Australia due to subdued equity market conditions.

- A five per cent increase in net operating lease income to $A921 million, up from $A880 million in FY16, mainly driven by the full year contribution of the AWAS portfolio acquisition in CAF, partially offset by unfavourable foreign currency movements for GBP denominated energy assets.

- Other operating income and charges of $A1,107 million in FY17 increased significantly from $A66 million in FY16. The primary drivers were increased gains on the sale of investments and businesses; and lower charges for provisions and impairments across most operating groups with the largest decrease in CGM as a result of reduced exposures to underperforming commodity-related loans. Gains on the sale of investments and businesses included the sale of the trustee-manager of Asian Pay Television Trust (APTT) and the partial sale of holdings in Macquarie Atlas Roads (MQA) and Macquarie Infrastructure Corporation (MIC) by MAM, a significant gain from BFS’ sale of Macquarie Life’s risk insurance business to Zurich Australia Limited, as well as the sale of a number of investments in the energy and related sectors in CGM.

- Total operating expenses increased two per cent, mainly due to higher employment expenses driven by increased share-based payments expenses relating to increased retained equity awards granted in previous years, higher performance-related remuneration expense largely driven by the improved overall performance of the operating groups and increased fixed remuneration due to a small increase in average headcount, partially offset by favourable foreign currency movements.

Staff numbers were 13,597 at 31 March 2017, down from 14,372 at 31 March 2016.

The income tax expense for FY17 was $A868 million, a six per cent decrease from $A927 million in FY16. The decrease was mainly due to changes in the geographic composition of earnings, with increased income being generated in Australia and the UK, and lower income in the US, combined with reduced tax uncertainties. These were partially offset by an increase in operating profit before income tax and the write-off of certain tax assets. The effective tax rate of 28.1 per cent was down from 31.0 per cent in FY16.

Strong funding and balance sheet position

“Macquarie remains well funded with a solid and conservative balance sheet, while pursuing its strategy of diversifying funding sources by continuing to grow its deposit base and accessing a variety of funding markets.” Mr Upfold said.

Total customer deposits increased by 9.6 per cent to $A47.8 billion at 31 March 2017 from $A43.6 billion at 31 March 2016. During FY17, $A10.5 billion of new term funding was raised covering a range of tenors, currencies and product types.

Capital management

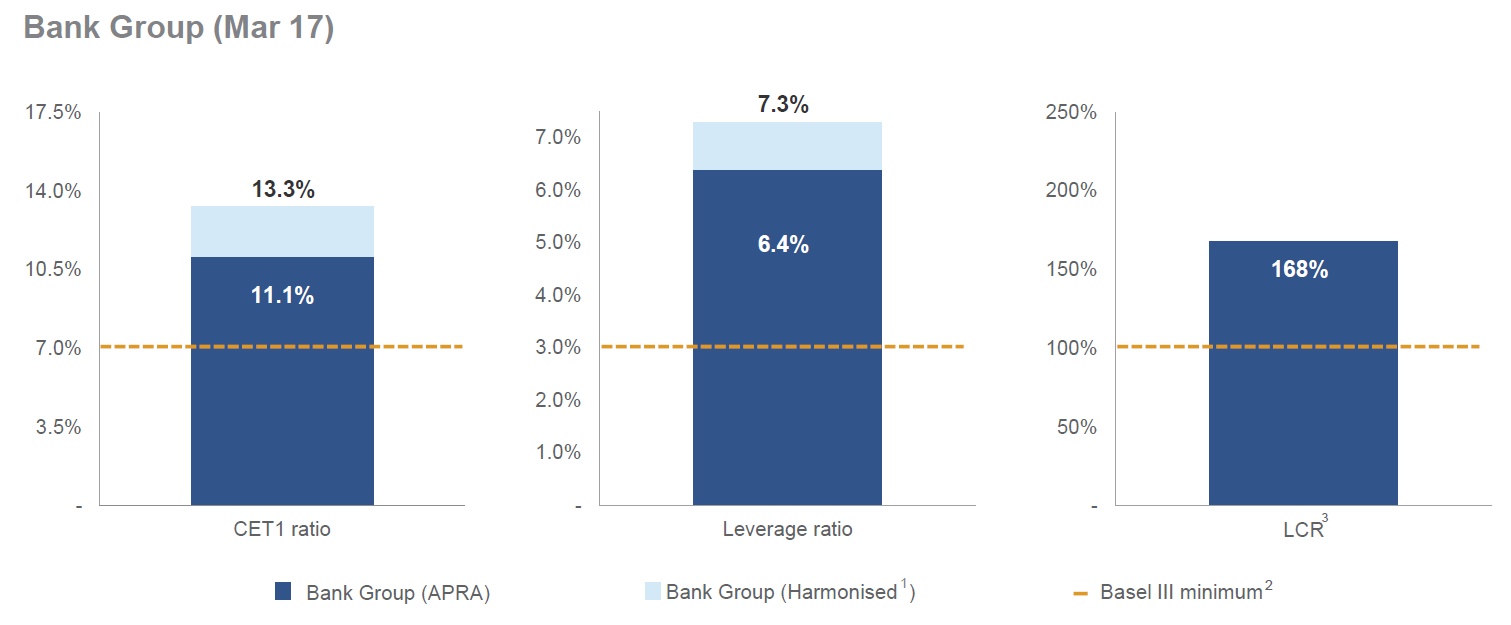

Macquarie’s financial position comfortably exceeds APRA’s Basel III regulatory requirements, with Group capital surplus of $A5.5 billion at 31 March 2017, which was up from $A3.9 billion at 31 March 2016. The Bank Group APRA Basel III Common Equity Tier 1 capital ratio was 11.1 per cent (Harmonised: 13.3 per cent) at 31 March 2017, up from 10.7 per cent (Harmonised: 12.5 per cent) at 31 March 2016. The Bank Group’s APRA leverage ratio was 6.4 per cent (Harmonised: 7.3 per cent) and LCR was 168 per cent.

Macquarie intends to purchase shares, to satisfy the MEREP requirements of approx. $A378 million. The buying period for the MEREP will commence on 16 May 2017 and is expected to be completed by 7 July 2017. No discount will apply for the 2H17 DRP and the shares are to be acquired on-market.

Macquarie intends to purchase shares, to satisfy the MEREP requirements of approx. $A378 million. The buying period for the MEREP will commence on 16 May 2017 and is expected to be completed by 7 July 2017. No discount will apply for the 2H17 DRP and the shares are to be acquired on-market.

Exchangeable Capital Securities buyback

Macquarie today announced that following the issue of $US750 million Macquarie Additional Capital Securities (MACS) hybrid capital in March 2017, it intends to buyback $US250 million Exchangeable Capital Securities (ECS) hybrid capital in June 2017. The ECS are Basel III – transitional Additional Tier 1 securities listed in 2012. Under the proposed transaction, a Resale of ECS will take place, whereby all ECS Holders will sell to a third party financial institution for par value on 20 June 2017 after interest has been paid. Macquarie Bank Limited (London Branch) will buyback ECS immediately following the Resale such that no Exchange to Macquarie’s ordinary shares will occur. A Resale Notice will be required to be delivered to ECS Holders shortly in accordance with the ECS Terms.

Regulatory update

The Basel Committee has delayed the finalisation of proposals to amend the calculation of certain risk weighted assets under Basel III. Any impact on capital will depend upon the final form of the proposals and local implementation by APRA.

APRA has delayed until at least 1 January 2019 the implementation of a new standardised approach for measuring counterparty credit risk exposures on derivatives (SA-CCR); and capital requirements for bank exposures to central counterparties (CCPs). APRA will consult again on these requirements in 2017. APRA has also announced that it does not expect to finalise a new market risk standard until at least 2020, with implementation from 2021 at the earliest.

APRA will give more detail around the middle of the year on how it proposes to address the Financial Systems Inquiry recommendation that Australian Authorised Deposit-Taking Institutions (ADI’s) capital ratios should be unquestionably strong.

APRA released final Net Stable Funding Ratio (NSFR) requirements at the end of 2016, however the exact application of certain elements of the standard remains under discussion. The NSFR and associated changes to APRA ADI Prudential Standard APS 210 will be effective from 1 January 2018. Macquarie Bank’s NSFR was greater than 100 per cent at 31 March 2017.