Interesting Panel remarks by Claudio Borio Head of the BIS Monetary and Economic Department, who argues that a core assumption implicit in policy setting is that macroeconomics can treat the economy as if it produced a single good through a single firm. The net effect of this assumption is to drag down interest rates and productivity.

The truth is much more complex, and within the economy there are “zombie firms”where resources are effectively misallocated, leading to reduced productivity and lower than expected economic outcomes, which will cast a long shadow through the economic cycle.

The truth is much more complex, and within the economy there are “zombie firms”where resources are effectively misallocated, leading to reduced productivity and lower than expected economic outcomes, which will cast a long shadow through the economic cycle.

In my remarks today, I would like to suggest that the link between resource misallocations and macroeconomic outcomes may well be tighter than we think. Ignoring it points to a kind of blind spot in today’s macroeconomics.

It would thus be desirable to bridge the gap, investigate the nexus further and explore its policy implications. Today’s conference is a welcome sign that the intellectual mood may be changing.

As an illustration, I will address this question from one specific angle: the role of finance in macroeconomics. As we now know, the Great Financial Crisis (GFC) has put paid to the notion that finance is simply a veil of no consequence for the macroeconomy – another firmly and widely held notion that has proved inadequate. I will first suggest, based on some recent empirical work, that the resource misallocations induced by large financial expansions and contractions (financial cycles) can cause material and long-lasting damage to productivity growth. I will then raise questions about the possible link between interest rates, resource misallocations and productivity. Here I will highlight the interaction between interest rates and the financial cycle and will also present some intriguing empirical regularities between the growing incidence of “zombie” firms in an economy and declining interest rates. I will finally draw some implications for further analysis and policy.

Their research shows first, credit booms tend to undermine productivity growth as they occur and second, the subsequent impact of the labour reallocations that occur during a financial boom is much larger if a banking crisis follows.

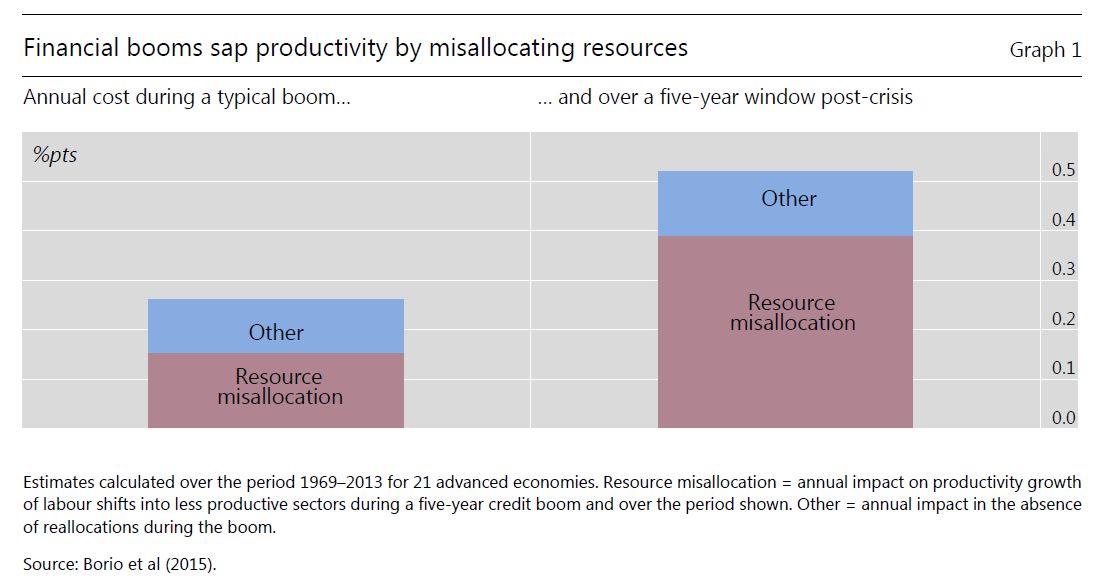

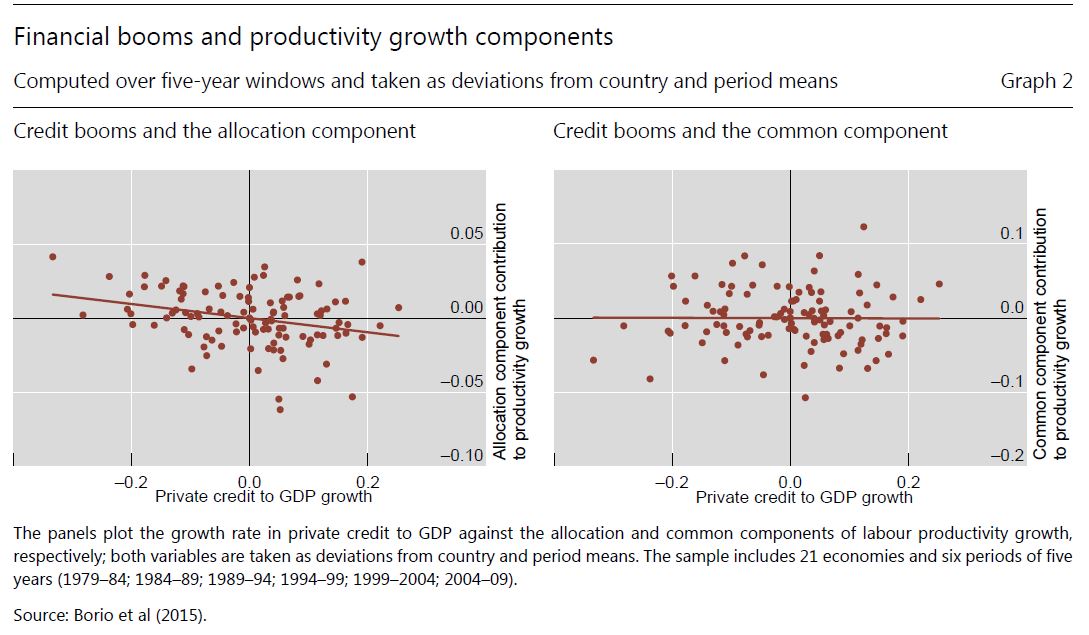

For a typical credit boom, a loss of just over a quarter of a percentage point per year is a kind of lower bound (Graph 1, lefthand column). The key mechanism is the credit boom’s impact on labour shifts towards lower productivity growth sectors, notably a temporarily bloated construction sector. That is, there is an economically and statistically significant relationship between credit expansion and the allocation component of productivity growth (compare the left-hand panel with the right-hand panel of Graph 2). This mechanism accounts for slightly less than two thirds of the overall impact on productivity growth (Graph 1, left-hand column, blue portion).

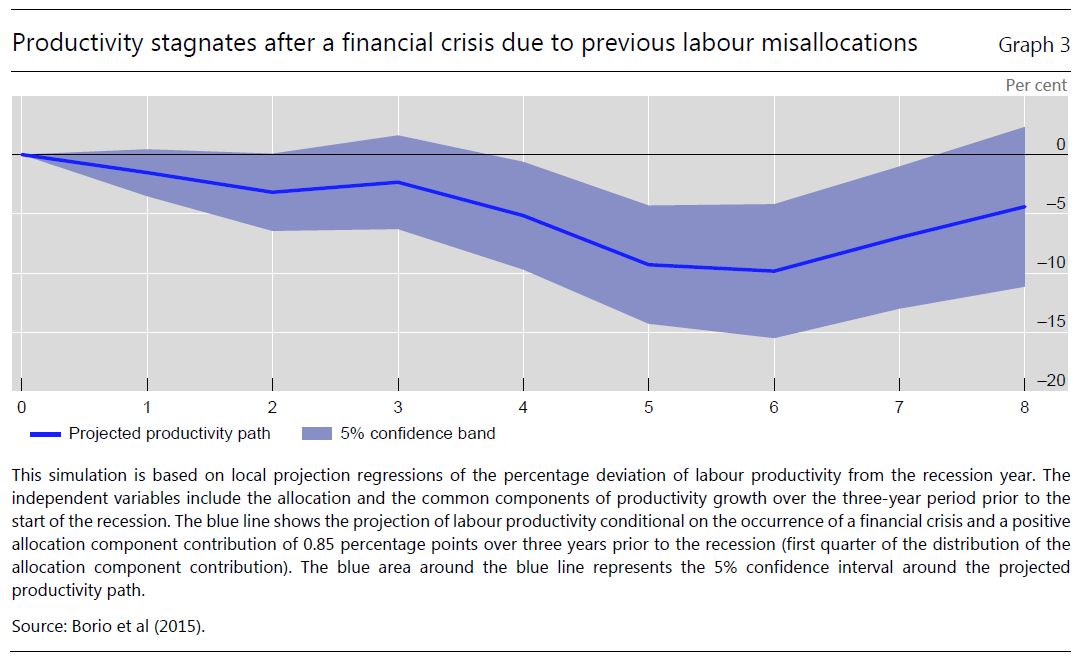

Second, the subsequent impact of the labour reallocations that occur during a financial boom is much larger if a banking crisis follows. The average loss per year in the five years after a crisis is more than twice that during the boom, around half a percentage point per year (Graph 1, right-hand column). Indeed, as shown in the simulation presented in Graph 3, the impact of productivity growth in that case is very long-lasting. The reallocations cast a long shadow.

Let me conclude by highlighting the key takeaways of my remarks for analytics and policy.

I believe we need to go beyond the stark distinction between resource allocation and aggregate macroeconomic outcomes often implicit in current analysis and debates – a kind of blind spot in today’s macroeconomics. There is a lot to be learned from studying their interaction as opposed to stressing their independence. I have illustrated this with a focus on the long-neglected link between finance and macroeconomic fluctuations. The financial cycle can cause first-order and long-lasting damage to productivity growth through its impact on resource misallocations. And we need to understand much better also the possible link between interest rates and such misallocations.

Policy, too, needs to be much better aware of these interactions. Some lessons are well understood, if not always put into practice. For instance, one such example is the need to tackle balance sheet repair head-on following a banking crisis so as to lay the basis for a strong and sustainable recovery. Such a strategy is also important to relieve pressure on monetary policy. Doing so, however, has proved quite difficult in some jurisdictions following the GFC . Other aspects need to be better incorporated into policy considerations. The impact of persistently low rates is one of them. How well all of this is done may well hold one of the keys to the resolution of the current policy challenges.