Two of Australia’s big four banks have changed their appetite for broker-originated loans in a move that could curb the growth of the third-party channel, according to a market analyst.

Digital Finance Analytics (DFA) principal Martin North believes underperforming branch networks and regulatory pressure to curb investor and interest-only lending has led CBA and Westpac to rethink their broker strategies.

“Two or three months ago, CBA said they were really looking to drive more momentum through their branch channels and offset the volumes through brokers. Westpac also showed in their latest results a little bit of a fall in broker momentum,” Mr North told The Adviser.

“There is a change of strategy from these lenders. They are trying to figure out what to do with their branch networks. If you think about the digital migration that’s happening, the branch is becoming less and less relevant,” he said.

Mr North believes the two Sydney-based banks are looking to drive home lending through their proprietary channels in an effort to avoid closing branches.

Westpac reported a six per cent fall in broker-originated loans over the year to 31 March. CEO Brian Hartzer told The Adviser that while the bank has “no issue” with brokers, who provide the group with “lots of new customers”, the bank is looking to ramp up its own channels.

“We want to do better in our proprietary channels. We know that customers like to come directly to us online. We know that customers like visiting our branches and talking to our people,” he said.

Mr North noted that recent changes to lending criteria are being used as a lever to control third-party flows.

Last week Westpac capped at 90 per cent its LVR for owner-occupiers on interest-only home loans. Meanwhile, CBA told brokers on Friday that it will reduce the maximum LVR from 95 per cent to 80 per cent for new owner-occupied, and from 90 per cent to 80 per cent for new investment home loan applications with IO payments. The changes will take effect from 10 June.

“They are less willing to take business from third-party channels for that particular category because they are trying to control the volume of those particular loans at the moment, thanks to the imposed speed limits and the need to reduce interest-only loans. It is a way of giving priority to their own channels,” Mr North said.

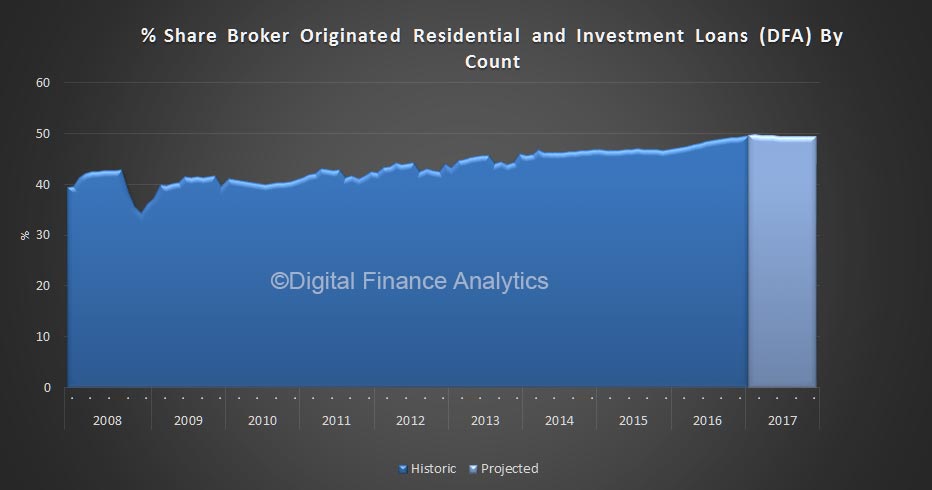

“The strategic positioning of those two majors is significant,” he said. “I was expecting broker penetration to go up to 60 per cent. But based on what we are seeing now from the two majors, I’m not so convinced that we will see more growth. I think it will hover around that 50 per cent mark.”

Mr North’s comments come after the MFAA released last week fresh figures showing mortgage brokers originated 53.6 per cent of new residential home loans over the March quarter.