More evidence of the rising costs of funds as ME Bank says it has lifted its standard variable rate on existing owner-occupier principal and interest mortgages, effective today, 19 April 2018.

ME’s standard variable rate for existing owner-occupier principal-and-interest borrowers with an LVR of 80% or less, will increase by 6 basis points to 5.09% p.a. (comparison rate 5.11% p.a.^).

Variable rates for existing investor principal-and-interest borrowers will increase by 11 basis points, while rates for existing interest-only borrowers will increase by 16 basis points.

ME CEO Mr Jamie McPhee said the changes are in response to increasing funding costs and increased compliance costs.

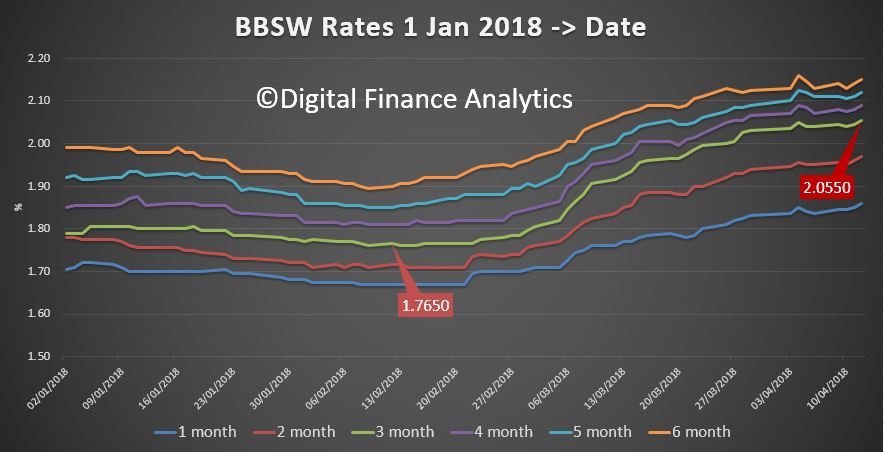

“Funding costs have been steadily increasing over the last few months primarily due to rising US interest rates that have flowed through to higher short-term interest rates in Australia.

“In addition, ME continues to transition its funding mix to ensure the requirements of the Net Stable Funding Ratio will be met, and this is also increasing our funding costs.

“At the same time, industry reforms and increasing regulatory obligations are increasing our compliance costs.

“Despite these increases ME’s standard variable home loan for owner-occupier principal-and-interest borrowers with LVR 80% or less, is still lower than the major banks as it has been since ME became a bank in 2001. In addition ME also continues to offer some of the highest deposit rates in the market.

“This was not an easy decision, but rising costs have forced us to reset prices to maintain a balance between borrowers, depositors and our industry super fund shareholders and their members, all while ensuring we continue to grow and provide a genuine long-term banking alternative,” McPhee said.

“We will continue to assess market conditions and make changes to prices to maintain this balance if necessary.”

More hikes will follow, across the industry together with reductions in rates paid on deposits as the fallout of the Royal Commission and higher international funding costs take their toll.

The 10-year US Bond rate is moving higher again, following some slight fall earlier in April. Have no doubt, funding cost pressure will continue to rise.

^Home loan comparison rates calculated on a loan of $150,000 for a term of 25 years, repaid monthly.

^Home loan comparison rates calculated on a loan of $150,000 for a term of 25 years, repaid monthly.