Industry super fund-owned bank ME today reported an after-tax underlying net profit of $40.4 million for the six months to 31 December 2016, a rise of 34% on the previous corresponding period.

ME CEO, Jamie McPhee, said it was a strong result in the face of margin pressures that are expected to continue throughout the year.

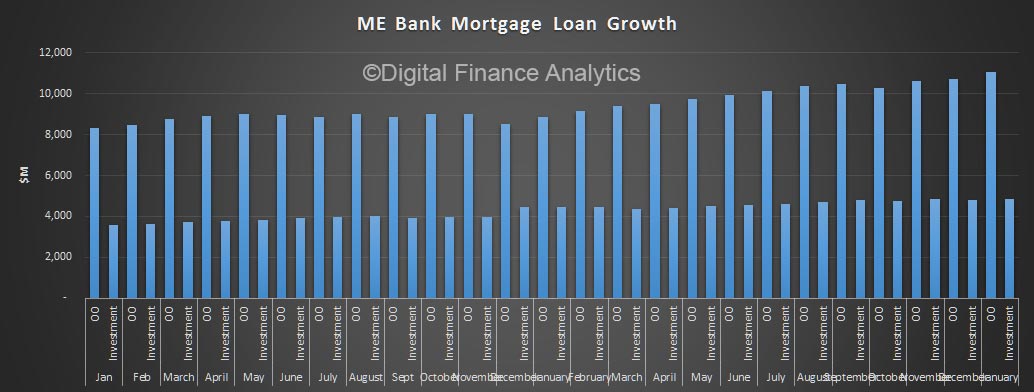

Home loan settlements hit $3.2 billion for the six months, up 54% compared to the previous corresponding period, while ME’s home loan portfolio grew 9% to $20.6 billion. Total assets grew 6% to $24.6 billion.

ME’s statutory profit after tax, which includes the amortisation of realised losses on hedging instruments, a loss on the sale of the business banking portfolio and transition costs associated with a significant new technology partnership with Capgemini, was $29.3 million (HY16: $34.5 million).

ME’s statutory profit after tax, which includes the amortisation of realised losses on hedging instruments, a loss on the sale of the business banking portfolio and transition costs associated with a significant new technology partnership with Capgemini, was $29.3 million (HY16: $34.5 million).

Net interest margin declined 3 basis points to 1.46% relative to the previous corresponding period due to competition for new customers and higher funding costs; however, the impact on earnings was offset by increased home loan sales.

ME’s digital strategy incorporates increasing levels of process automation, including credit assessments and valuations, leading to further improvements in the cost to income ratio.

Customer numbers grew 8% to 393,416 and the bank passed the 400,000-mark in in early March 2017.

Net interest income increased 9% to $162.4 million with total income up by 3% to $187.1 million. Total operating expenses decreased from $118.9 million to $117.2 million.

ME remains very well capitalised at 31 December 2016, with a Common Equity Tier 1 ratio of 10.40% and a Total capital ratio of 14.84%.

McPhee said several strategic initiatives with its industry super fund partners were progressing well including providing customers with a single view of their banking and super accounts through a partnership with Link Group, which is scheduled to be launched with a major industry super fund in the second half of FY17.

As reported in Australian Broker,

Over half of the bank’s home loan settlements came through the broker channel, Lino Pelaccia, ME’s general manager of broker, told Australian Broker.

“The contribution from brokers is slightly up on the same time as last year due mainly to our continued expansion into the broker market,” he said.

“Increasing numbers of brokers are considering ME home loans, we continue to improve our broker services and service levels have remained very consistent over the last 12 months with new technology, and we continue to offer very competitive prices compared to other banks.”

Looking at the breakdown of settlements between owner-occupier buyers and investors, Pelaccia said the ratio will not change much given APRA’s current cap on growth in investment lending.

“We also note ME is well below that cap at the moment and so have some room to win more investor business before the end of the financial year,” he said.