Industry super fund-owned bank ME has reported an underlying net profit after tax of $74.7 million for FY2016, a rise of 29% on the previous reporting period.

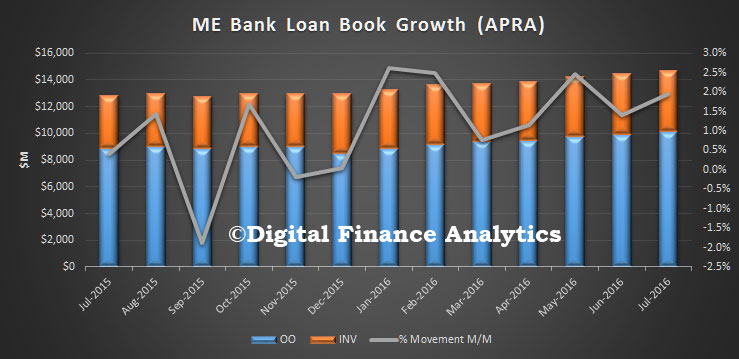

In FY16 ME settled over 16,000 new home loans totalling $4.6 billion. The Bank achieved home loan settlements of $2.6 billion in the second half of the year, which was a record for the Bank and ensures strong momentum heading into FY17.

The increase was driven largely by a 6% increase in total assets to $24.7 billion combined with stable net interest margin of 1.55%.

The increase was driven largely by a 6% increase in total assets to $24.7 billion combined with stable net interest margin of 1.55%.

ME CEO, Jamie McPhee, said the Bank has maintained a strong growth path over the last four years with the NPAT increasing by an annual compound growth rate of 32% since 2012.

The Bank’s Member Benefits Program, which capitalises on its relationship with its industry super fund and union network, grew to a record participation of more than 100 industry super funds and unions, and is now generating over 10% of ME’s home loan settlements.

Cost-to-income ratio continued to fall, reducing 270 points to 65.8%. McPhee said there was more work to do but the ratio had continued on its downward trajectory since June 2009 (when the ratio was 84.5%), and will further improve due to productivity gains from the new technology.

Customer numbers grew 8% to 365,520 in FY16 and have increased by a compound annual growth rate of 10% since 2012, while customer deposits grew by 19% to $10.5 billion reflecting the ongoing diversification of ME’s funding profile.

Return on Equity increased by 80 basis points to 8.2%, continuing the trend towards the medium term target of 10%.

The new brand identity and external brand campaign activities across TV, outdoor, radio, online, social media and cinema advertising resulted in a 10 point increase in prompted awareness during the financial year to 50%.