Last Wednesday, the Australian Prudential Regulation Authority (APRA) proposed key revisions to its capital framework for authorized deposit taking institutions (ADIs). The revisions cover the calculation of credit,

market and operational risks. These proposed changes are credit positive for Australian ADIs because they will improve the alignment of capital and asset risks in their loan portfolios. Moody’s says the key proposals are as follows:

- Revisions to the capital treatment of residential mortgage portfolios under the standardized and advanced approaches, with higher capital requirements for higher-risk segments

- Amendments to the treatment of other exposures to improve the risk sensitivity of risk-weighted asset outcomes by including both additional granularity and recalibrating existing risk weights and credit

conversion factors for some portfolios - Additional constraints on the use of ADIs’ own risk parameter estimates under internal ratings-based approaches to determine capital requirements for credit risks and introducing an overall floor to riskweighted assets for ADIs using the standardized approach

- Introduction of a single replacement methodology for the current advanced and standardized approaches to operational risks

- Introduction of a simpler approach for small, less complex ADIs to reduce the regulatory burden without compromising prudential soundness

A particularly significant element of the new regime is a reform of the capital treatment of residential mortgages, given that more than 60% of Australian banks’ total loans were residential mortgages as of January 2018.

The improved alignment of capital to risk for residential mortgages will come from hikes in risk weights on several higher-risk loan segments. APRA proposes increased risk weights for mortgages used for investment purposes, those with interest-only features and those with higher loan-to-valuation ratios (LVR). At the same time, risk weights for some lower-risk segments likely will drop. For example, under the standardized approach, standard mortgages with LVR ratios lower than 80% will require risk weights of only 20%-30%, down from 35% under current requirements.

The higher capital charges on investment loans will better reflect their higher sensitivity to economic cycles. During periods of economic strength investment loans perform well. As Exhibit 1 shows, on a national basis

and during a time of strong economic growth, defaults on investment loans have been lower than owner occupier loans.

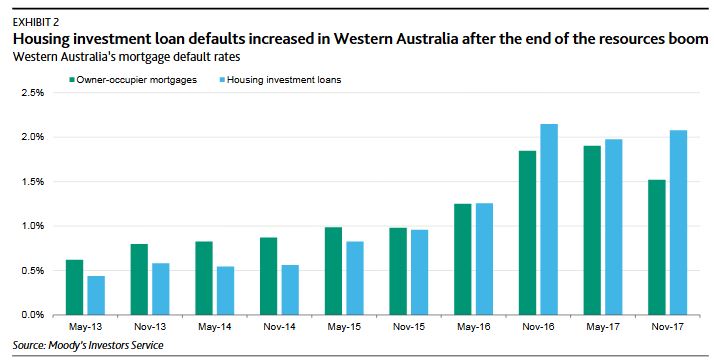

However, in Western Australia, where the economy has deteriorated following the end of the investment boom in resources, defaults on investment loans have been higher than owner-occupier loans, as Exhibit 2 shows.

However, in Western Australia, where the economy has deteriorated following the end of the investment boom in resources, defaults on investment loans have been higher than owner-occupier loans, as Exhibit 2 shows.

Investment loans also are sensitive to the interest rate cycle. During periods of rising interest rates, investment loans tend to experience higher default rates than owner-occupier loans, as shown in Exhibit 3.

Investment loans also are sensitive to the interest rate cycle. During periods of rising interest rates, investment loans tend to experience higher default rates than owner-occupier loans, as shown in Exhibit 3.