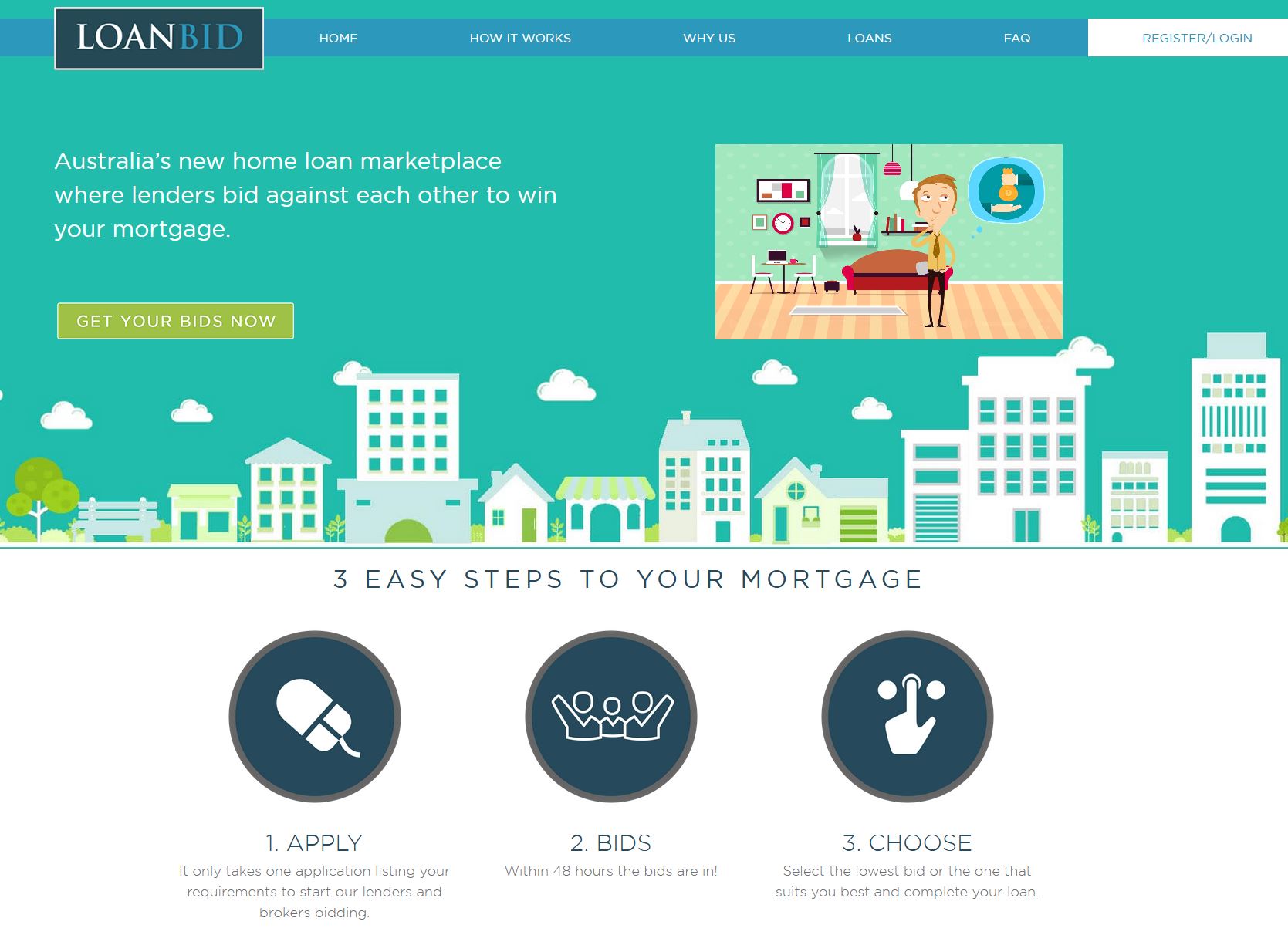

Another new player has entered the contested mortgage origination sector. Just launched is Loanbid which says it empowers borrowers with access, choice, and competition to secure a loan from one website.

Using an auction model, borrowers enter their details and requirements once. Lenders and brokers can then assess the information and enter a virtual auction to win the loan with their one time best bids. The platform currently has 18 lenders on its panel, including many of the usual suspects.

All offers are shown to applicants via dashboard and are ranked according to the total cost of the loan. Email alerts are also part of the process. The applicant is not committed to taking a loan, and Loanbid does not offer any advice.

The platform does not charge customers an upfront fee or take trail commissions from lenders. If the loan is settled, Loanbid receives a referral fee from the successful lender or broker. So they are essentially “clipping the ticket.”

Borrowers are only identified by a reference number, so remain anonymous throughout the process. Loan proposals are independently and individually assessed without any impact on their credit rating. Normal loan verification is then undertaken by the successful lender or broker.

Borrowers are only identified by a reference number, so remain anonymous throughout the process. Loan proposals are independently and individually assessed without any impact on their credit rating. Normal loan verification is then undertaken by the successful lender or broker.

“Borrowers need to wait for just 48 hours for the lenders and brokers to come back to them with a loan best suited to their needs and financial situation, with the borrower to choose the right loan,” said Loanbid partner Paul Dwyer, formerly a banker at St George.

“We will put the power of choice back in the hands of borrowers, who can potentially access thousands of loans based on the information they provide through an obligation-free bidding process,” said Dwyer.

“We have been fastidious in deciding on our partners on the platform, to give our borrowers the best opportunity to ensure they get the right loan for their requirements and lifestyle,” said former NAB banker Darren Roach, a partner at Loanbid.