In Australia, lending conditions are tightening and we are already seeing the housing market slow in major cities. It is tricky to determine the extent of any fall ahead, and most predictions will of course be wrong. But the more significant factor in play is the significant change in the atmospherics around the housing sector. More are going negative. And when the largest lender in Australia signals they expect a fall, even mild, this is significant.

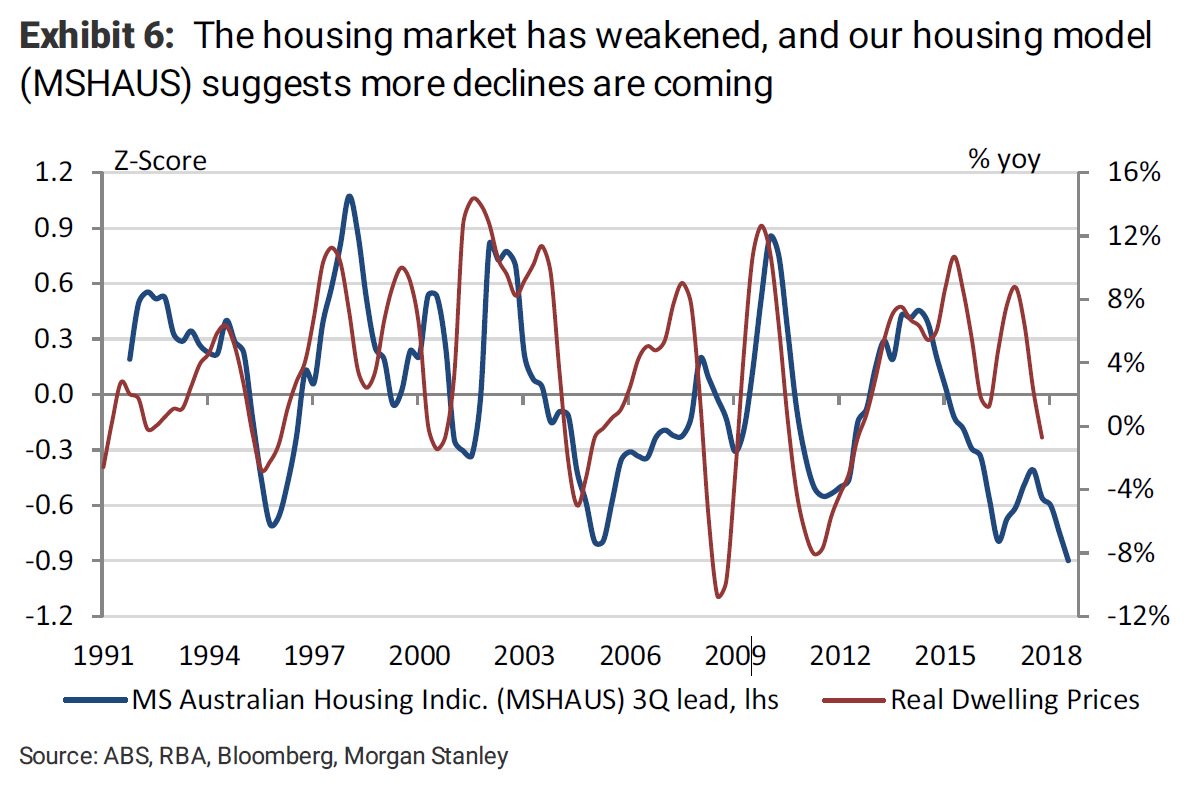

Recently Morgan Stanley said it is predicting property prices could fall by about 8% in 2018, and lending by more than a third.

Recently Morgan Stanley said it is predicting property prices could fall by about 8% in 2018, and lending by more than a third.

Morgan Stanley suggests there’ll not only be further price weakness in the months ahead, but also the likelihood of renewed softening in building approvals. It says these two factors will likely weigh on household consumption and building activity, seeing Australian economic growth decelerate, rather than accelerate, this year.

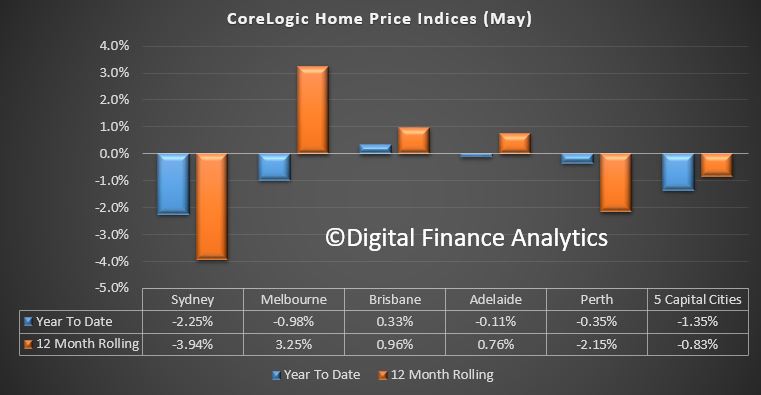

CBA has also gone negative on housing, now forecasting a mild correction. Gareth Aird, senior economist at CBA says that Australian residential property prices have fallen over the past six months. Additional declines appear likely over the next 1½ years due to a further tightening in lending standards, a continued lift in supply, potentially higher mortgage rates and more rational price expectations from would-be buyers. But he says a hard landing, however, looks unlikely and “is not our central scenario”.

CBA has also gone negative on housing, now forecasting a mild correction. Gareth Aird, senior economist at CBA says that Australian residential property prices have fallen over the past six months. Additional declines appear likely over the next 1½ years due to a further tightening in lending standards, a continued lift in supply, potentially higher mortgage rates and more rational price expectations from would-be buyers. But he says a hard landing, however, looks unlikely and “is not our central scenario”.

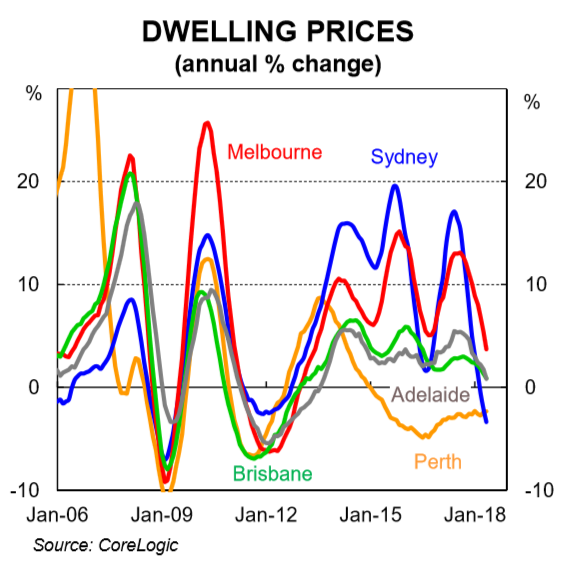

Stepping through the argument he posits first dwelling prices go through both long-run super cycles as well as shorter-term cyclical trends. The recent evidence suggests that Australia’s latest residential property short-run cycle has come to an end. After a little over five years of incredibly strong property price growth, driven by Sydney and Melbourne, dwelling prices have been deflating.

It is our view that prices will to continue to deflate over the next 1½ years. Credit standards are likely to be further tightened, supply will continue to lift, mortgage rates are more likely to go up than down and buyer expectations have adjusted downwards from exuberance to more rational levels. We do not expect a hard landing, however. Population growth, driven by net immigration, is expected to remain strong. And rental growth is still positive, which ensures yields look reasonable in a low interest rate world. We also expect the unemployment rate to gradually drift lower, which means that the risk of default is low.

Author and economist Harry Dent thinks property prices could fall even more. Harry is the editor of Harry Dent Daily and has been recently touring around Australia.

And, as he told Australian Property Investor recently, ‘the real estate bubble is like a popcorn popper with different markets frothing over and peaking at different times, but all will burst ultimately.’

We can consider ourselves lucky if the property market corrects by only 10–20%. He has consistently been negative on Australian property.

“Your problem is you’ve got the second highest real estate costs compared to income in the world. I see Australia as the best house in a bad neighbourhood, but you can’t escape a global crisis.

“I think this time your real estate will come back 20, 30, 40, 50 per cent. That’s good. When young people have to pay 12 times their incomes for a house, that’s not good, so this is where the reset needs to come. I think you will have a recession this time.”