The August 2020 data from our surveys continues to tell a sorry tale of more households feeling the pinch, whether they are mortgaged, renting or investing. Within the numbers there was a slid in Victoria in particular reflecting the latest lock down and the rising pressure on business there.

We discussed this at length in our live show yesterday. Here is a link to the HD edition:

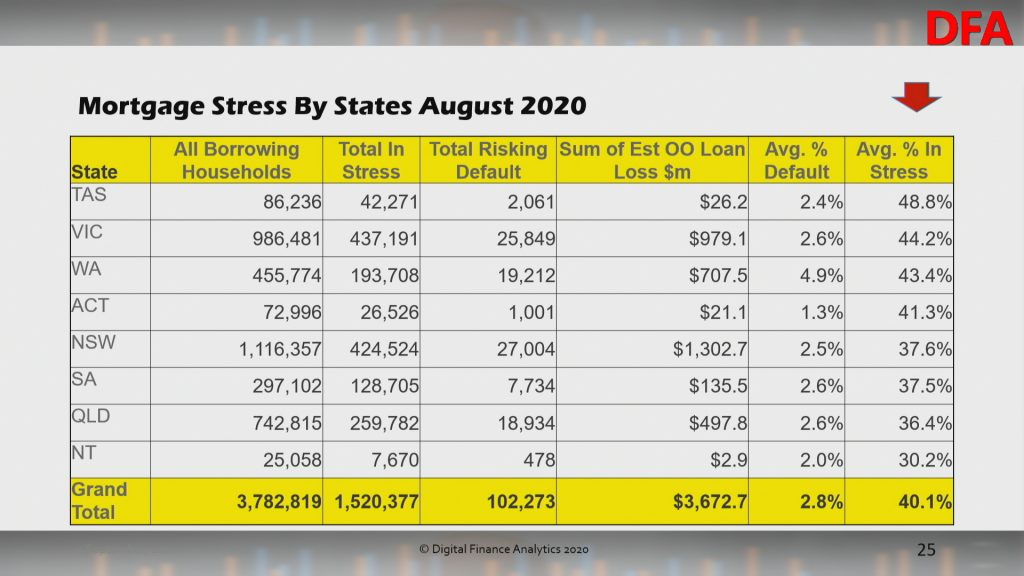

Overall mortgage stress came in at 40.1%:

This equates to 1.52 million households, with TAS, VIC and WA leading the pack.

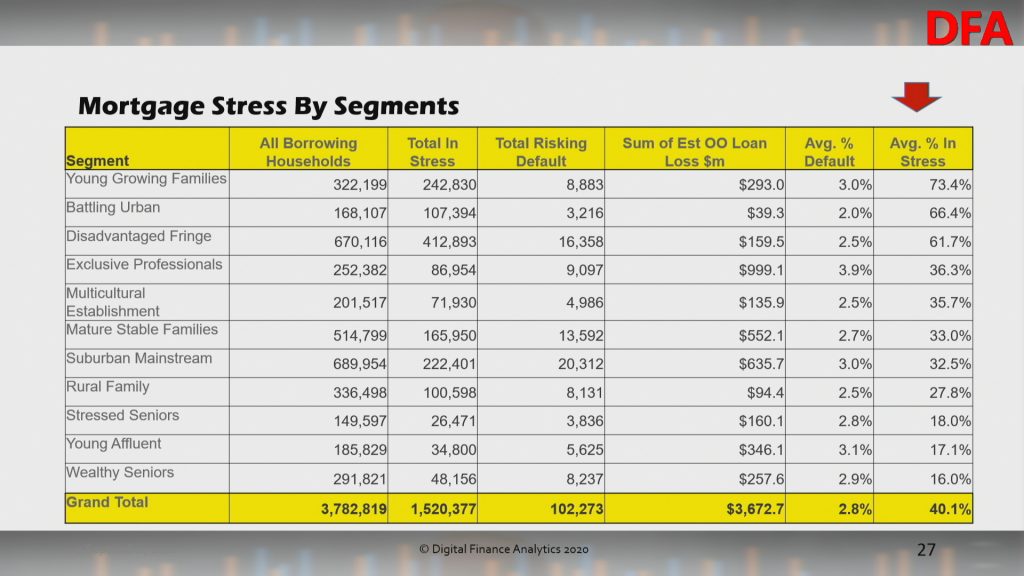

Young Growing Families, and Urban Fringe households are most strongly represented. This includes significant swathes of First Time Buyers.

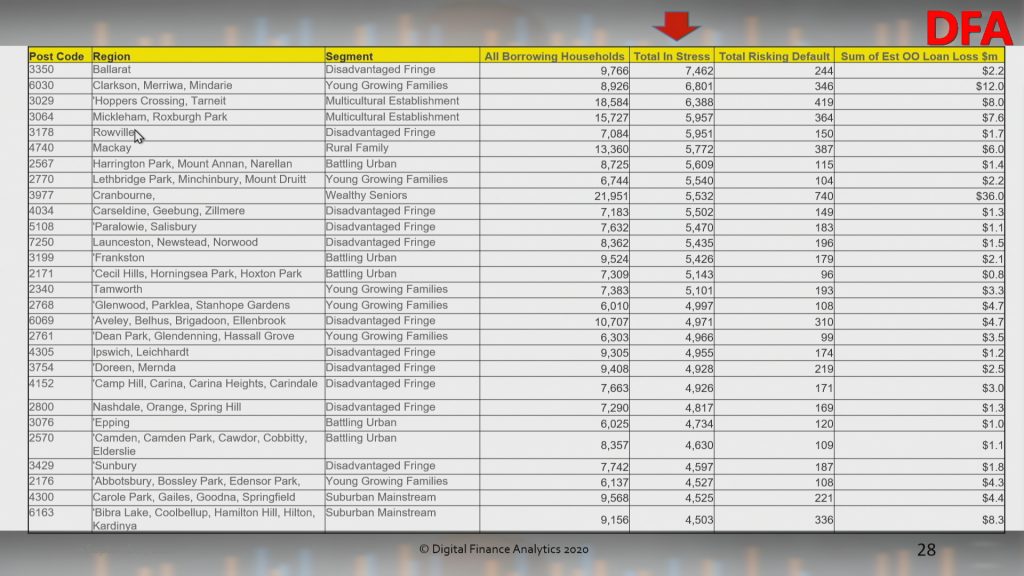

The post codes with the largest counts of stressed households coincide with areas of high recent development, where households have large mortgages, and VIC is over represented thanks to the lock downs.

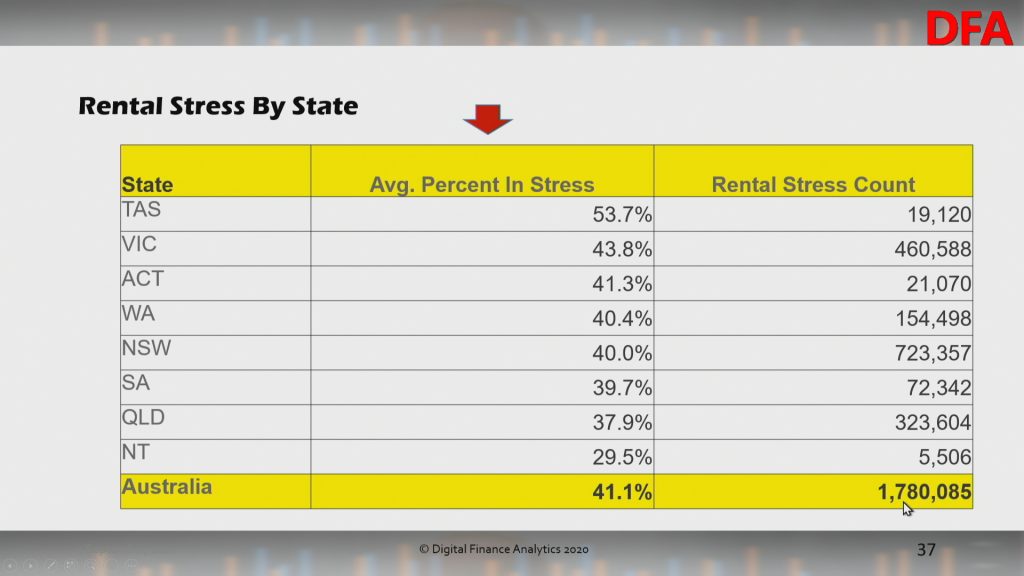

Rental stress remains a significant issue also, with 41.1% of Renters in difficulty, or 1.78 million households.

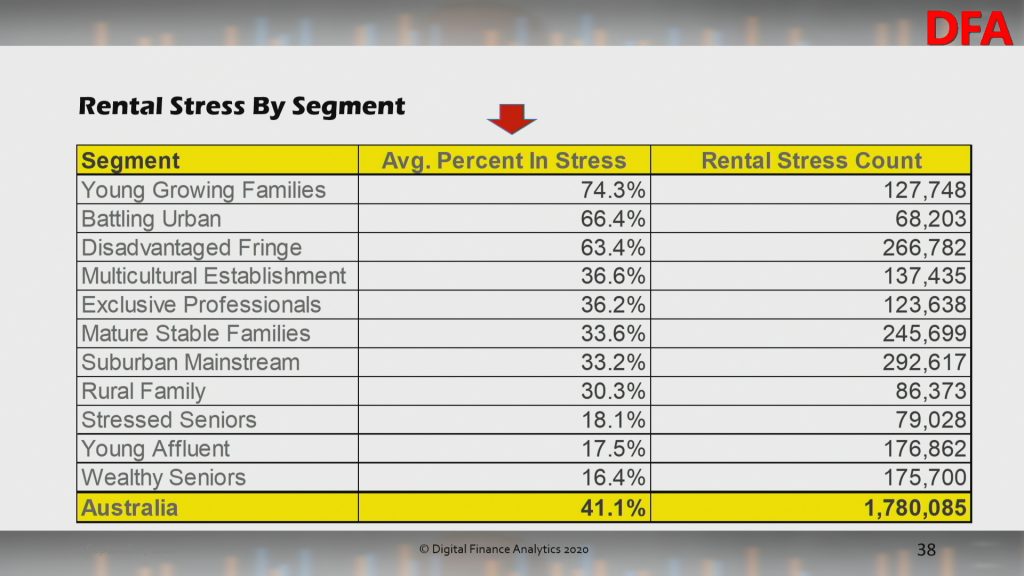

Within the segments, again Young Growing Families are most impacted.

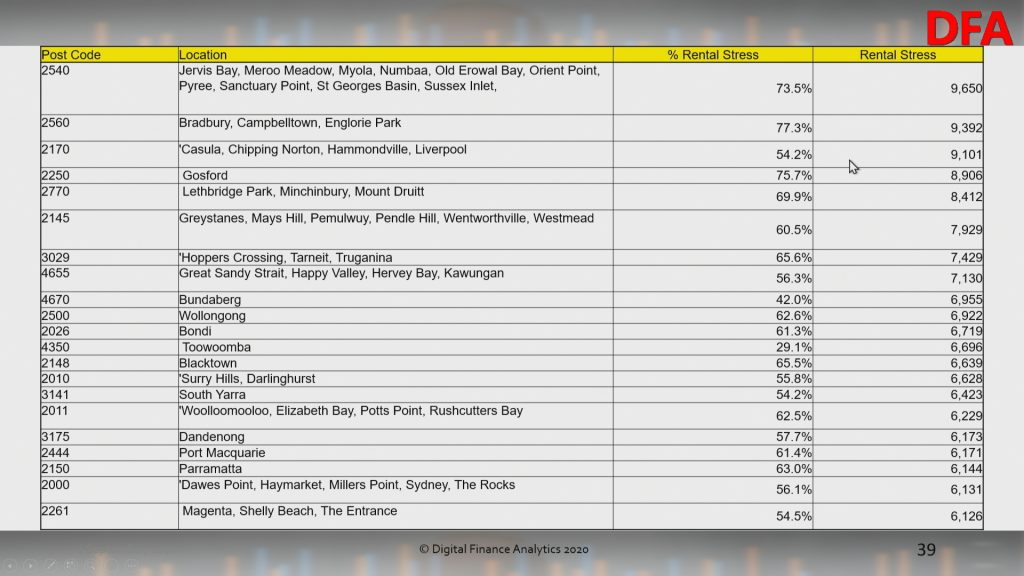

The post codes with the largest counts are revealed here.

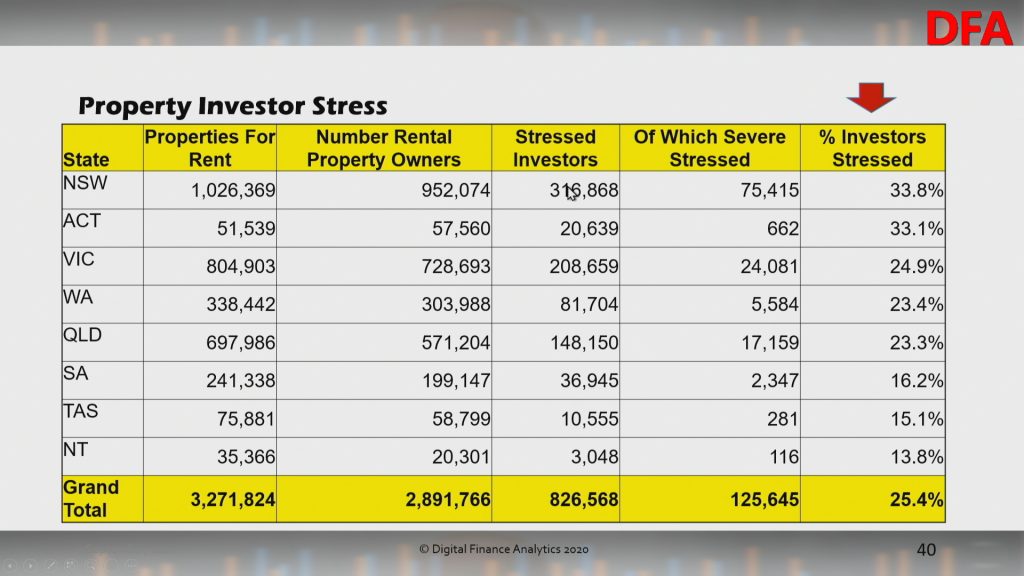

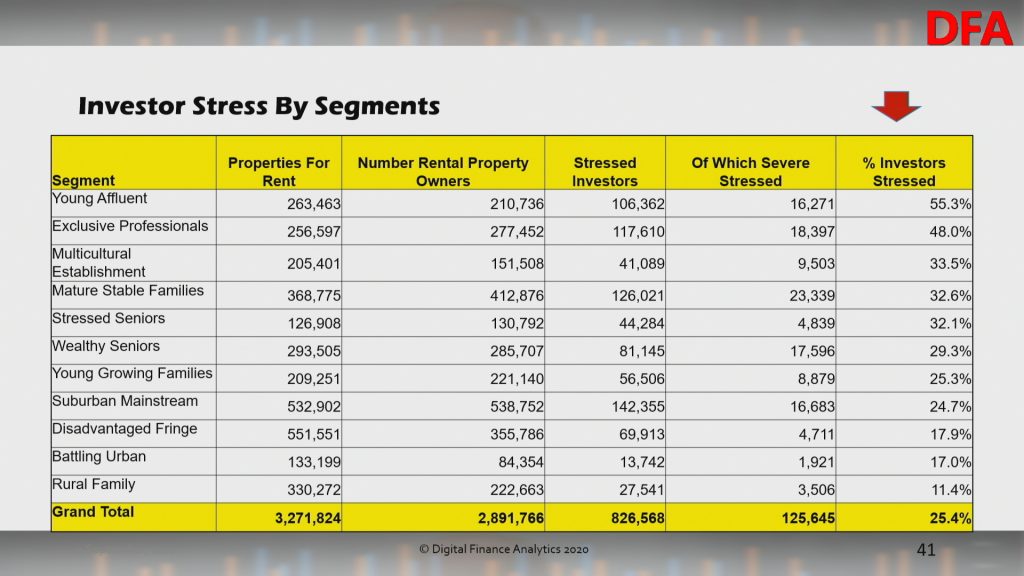

Finally, investors remain in crunch territory, with 25.4%, or 826,000 under water, or trying to sell as rentals slide, and property values ease.

More affluent households are most impacted.

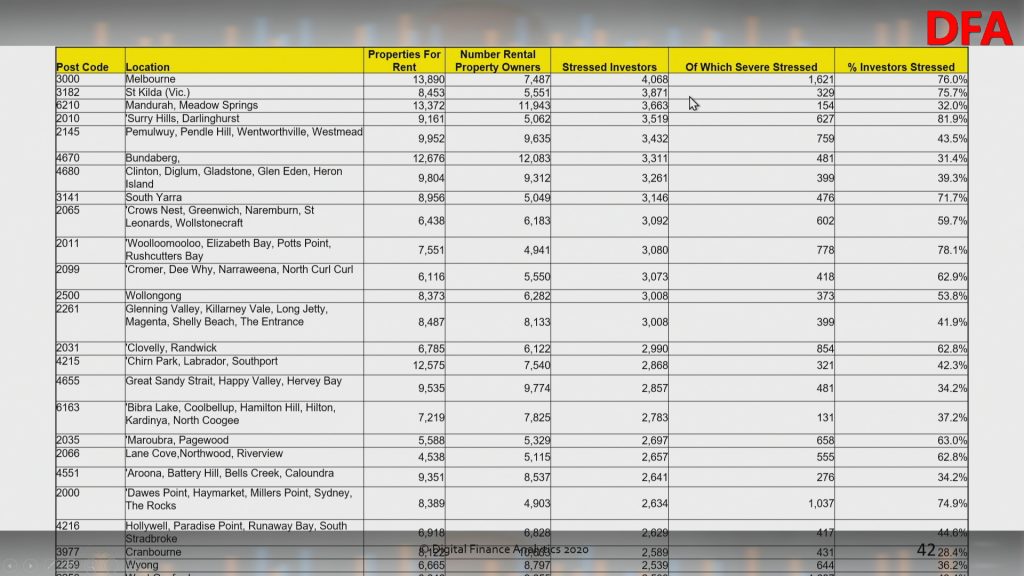

Once again Melbourne 3000 contains the latest number of stressed property investors (their investment portfolios can be anywhere, this is where they reside).

We will publish some stress mapping later, but clearly the fiscal cliff, which is now leglislated, will push more over the edge. Expect higher default levels over the next few month, more forced sales and less household consumption.