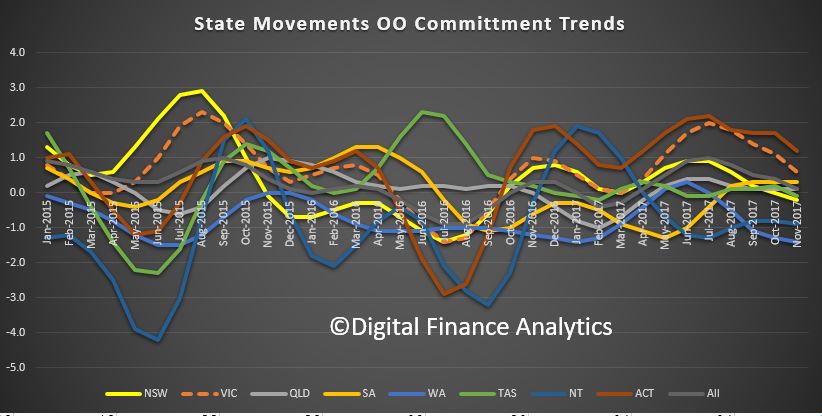

The ABS released their housing finance series for November today. In essence, there was a small rise (0.1%) in overall lending flows, in the smoothed trend series, with around $33 billion of loans written in the month. Total ADI housing loans stood at $1.63 trillion, in original terms. But the percentage changes fell in NSW 0.2% and 1.4% in WA. Lending rose in VIC, up 0.6% and SA, 0.3%. The original series showed a much stronger result, up 11.4% (but this is a volatile series).

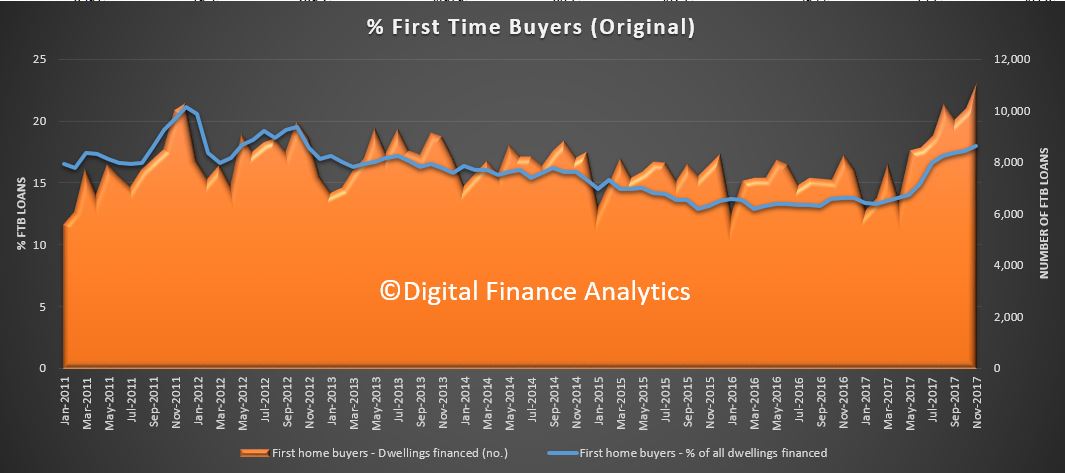

We do not think the data gives any support for the notion that regulators should loosen the lending rules, as some are suggesting. That said the “incentives” for first time buyers are having an effect – in essence, persuading people to buy in at the top, even as prices slide. I think people should be really careful, as the increased incentives are there to try and keep the balloon in the air for longer.

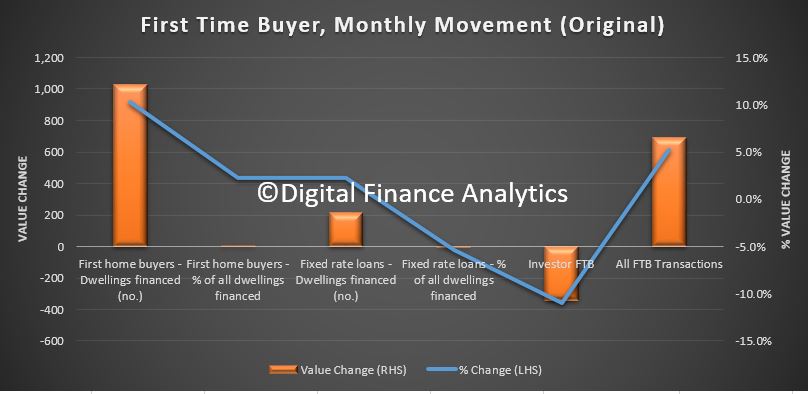

A highlight was the rise in first time buyer owner occupied loans, up by around 1,030 on the prior month, as buyers reacted to the incentives available, and attractor rates. This equates to 18% of all transactions. Non-first time buyers fell 0.5%. The average first time buyer loan rose again to $327,000, up 1% from last month. The proportion of fixed rate loans fell, down 5.4% to 15.8% of loans.

A highlight was the rise in first time buyer owner occupied loans, up by around 1,030 on the prior month, as buyers reacted to the incentives available, and attractor rates. This equates to 18% of all transactions. Non-first time buyers fell 0.5%. The average first time buyer loan rose again to $327,000, up 1% from last month. The proportion of fixed rate loans fell, down 5.4% to 15.8% of loans.

We saw a fall in first time buyer investors entering the market, thanks to tighter lending restrictions, and waning investor appetite. This will continue.

We saw a fall in first time buyer investors entering the market, thanks to tighter lending restrictions, and waning investor appetite. This will continue.

Overall, first time buyers are more active (though still well below the share of a few years ago).

Overall, first time buyers are more active (though still well below the share of a few years ago).

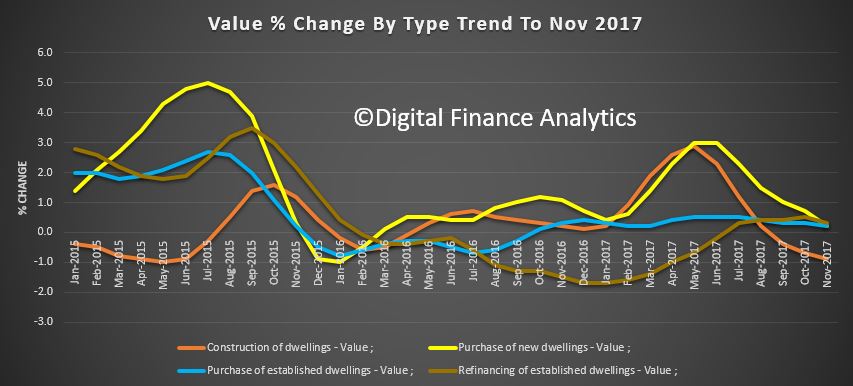

![]() Looking more broadly across the portfolio, trend purchase of new dwellings rose 0.2%, refinance rose 0.3%, established dwellings 0.2%, all offset by a 0.9% drop in the value of construction. The indicators are for a smaller number of new starts (despite recent higher approvals). We are concerned about apartment construction in Brisbane and Melbourne.

Looking more broadly across the portfolio, trend purchase of new dwellings rose 0.2%, refinance rose 0.3%, established dwellings 0.2%, all offset by a 0.9% drop in the value of construction. The indicators are for a smaller number of new starts (despite recent higher approvals). We are concerned about apartment construction in Brisbane and Melbourne.

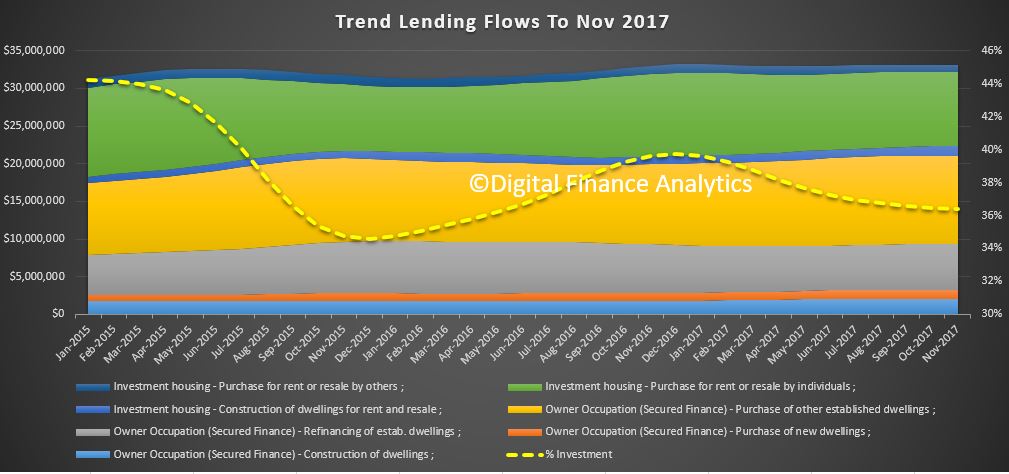

The share of investor loans continues to drift lower, but is still very high at around 36.4% of all loans written, but down from 44% in 2015. In fact the total value of finance, in trend terms was just $16m lower compared with last month.

The share of investor loans continues to drift lower, but is still very high at around 36.4% of all loans written, but down from 44% in 2015. In fact the total value of finance, in trend terms was just $16m lower compared with last month.

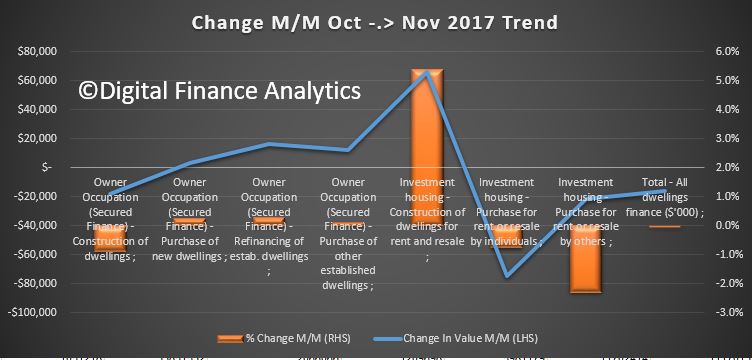

The monthly movements show a rise of 5.44% in loans for investment construction ($65m), Refinance 0.3% ($16m), Purchase of new dwellings up 0.2% ($3m) but a fall of $17m (down 0.9%) for construction of dwellings. Purchase of existing property for investment fell $74m, down 0.8% and for other landlords were down 2.3% of of $21m. The overall trend movement was down $16m. In comparison the original flow was up more than $3bn or 11%.

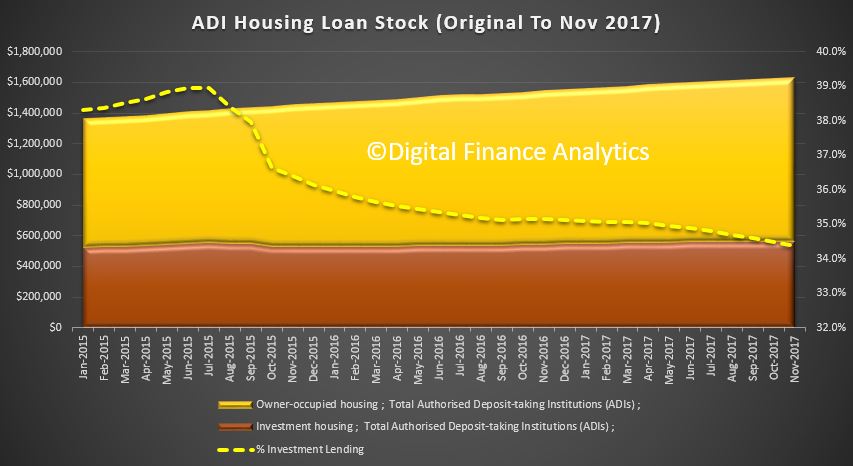

Looking at the original loan stock data, the share of investment loans slipped again to 34.4%, so we are seeing a small fall, but still too high. Investment loans rose 0.10% or $527 million, while owner occupied loans rose $5.5 billion.or 0.52%. Relatively Building Societies lost share.

Looking at the original loan stock data, the share of investment loans slipped again to 34.4%, so we are seeing a small fall, but still too high. Investment loans rose 0.10% or $527 million, while owner occupied loans rose $5.5 billion.or 0.52%. Relatively Building Societies lost share.