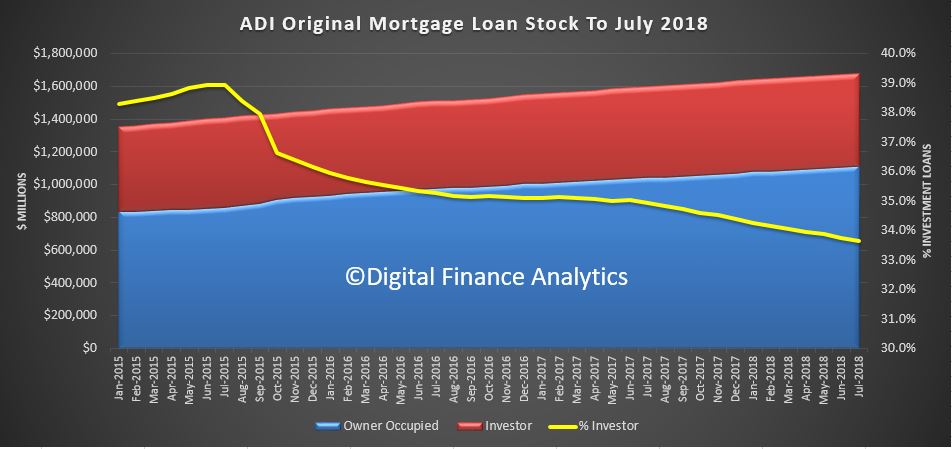

The ABS has released their data to July 2018 for Housing Finance. Investors continue to fee the market, and even first time buyers are getting twitchy, while refinancing transactions props up the numbers a little. All as expected, and this underscore more falls in lending flow, and home prices ahead. The rate of decline is increasing. Loan stock grew 0.26% in the month, but that was in the owner occupied segment. Investor loan stock fell.

The trend estimate for the total value of dwelling finance commitments excluding alterations and additions fell 0.6%. Owner occupied housing commitments was flat, while investment housing commitments fell 1.7%.

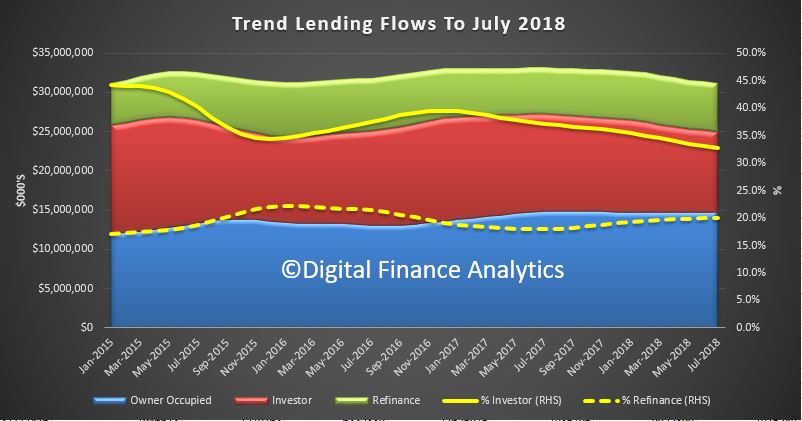

As a result the proportion of loan flows for investment property purposes continues to drift lower to 32.7%, the lowest in recent years, while there was no change in owner occupied lending and refinance rose just a little to 20%.

As a result the proportion of loan flows for investment property purposes continues to drift lower to 32.7%, the lowest in recent years, while there was no change in owner occupied lending and refinance rose just a little to 20%.

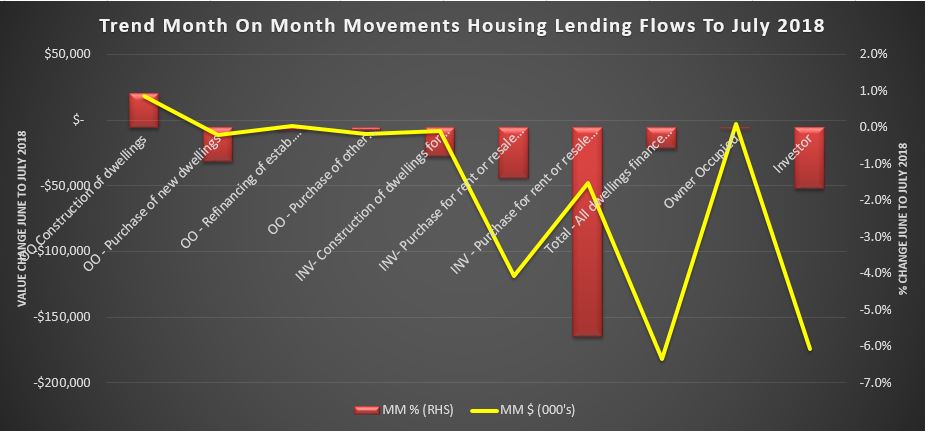

In trend terms, the number of commitments for the purchase of new dwellings fell 1.8%, the number of commitments for the purchase of established dwellings fell 0.2%, while the number of commitments for the construction of dwellings rose 0.2%. In fact that was the only positive indicator!

In trend terms, the number of commitments for the purchase of new dwellings fell 1.8%, the number of commitments for the purchase of established dwellings fell 0.2%, while the number of commitments for the construction of dwellings rose 0.2%. In fact that was the only positive indicator!

In trend terms, overall, the number of commitments for owner occupied housing finance fell 0.2% in July 2018.

In trend terms, overall, the number of commitments for owner occupied housing finance fell 0.2% in July 2018.

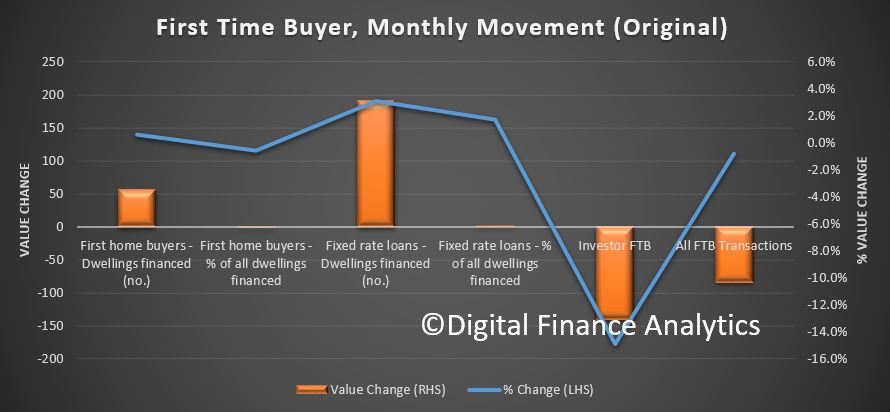

In original terms, the number of first home buyer commitments as a percentage of total owner occupied housing finance commitments fell to 18.0% in July 2018 from 18.1% in June 2018.

![]() The number of FTB loans for owner occupied borrowers rose by around 50. There was a small rise in the number of fixed loans, and the average FTB loan fell by $4,000 perhaps indicating tighter borrowing terms.

The number of FTB loans for owner occupied borrowers rose by around 50. There was a small rise in the number of fixed loans, and the average FTB loan fell by $4,000 perhaps indicating tighter borrowing terms.

The number of FTB investors continues to fall away in line with the broader trends in the investor sector.

The number of FTB investors continues to fall away in line with the broader trends in the investor sector.

![]() All this points to a continued tightening of lending standards and a likley continued decline in loan volumes – which is also a leading indicator of more home price falls ahead.

All this points to a continued tightening of lending standards and a likley continued decline in loan volumes – which is also a leading indicator of more home price falls ahead.