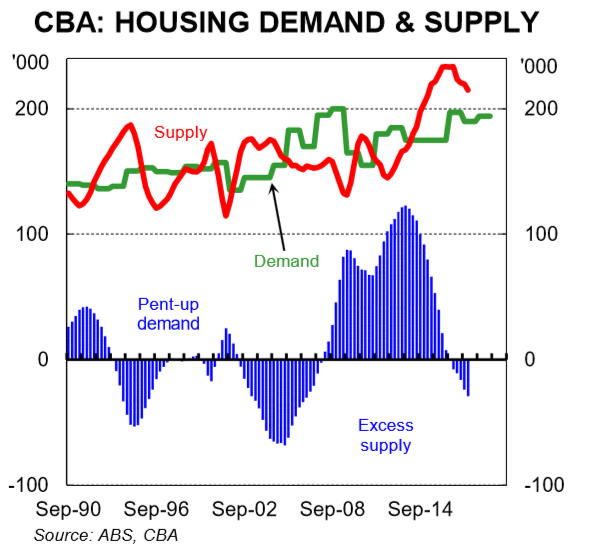

As the property market rotates, and demand slackens, property developers with a stock of newly built, or under construction dwellings – mostly high-rise apartments are trying tactics from deep discounting, cash bribes, or 100% mortgages to persuade people to buy. Remember there are around 200,000 units coming on stream over the next year or two and demand is falling.

Building approvals are also slowing. There is an air of desperation.

Building approvals are also slowing. There is an air of desperation.

So we were interested to see (thanks to a tip off from our community) a WA initiative which was recently announced by Apartments WA – “Backed by the foundations of the BGC Group – Western Australia’s largest residential home builder and largest private company, we make your buying journey a seamless process from finding you the right apartment, assisting with obtaining finance, right through to settlement and key handover”.

So we were interested to see (thanks to a tip off from our community) a WA initiative which was recently announced by Apartments WA – “Backed by the foundations of the BGC Group – Western Australia’s largest residential home builder and largest private company, we make your buying journey a seamless process from finding you the right apartment, assisting with obtaining finance, right through to settlement and key handover”.

They have “invented” the “Preposit”. In essence a buyer gets to live in a property, whilst saving for a deposit, and when that deposit is accumulated, they can complete a purchase. Its a way to get currently vacant apartments occupied by people who ultimately may buy. They call it ” the Afterpay© of the real estate industry”. The weekly payments, would cover the equivalent of rent and saving for a deposit.

Finance is provided by Perth based Harrisdale Pty Ltd trading as The Loan Company. They hold a financial service licence.

There are few details on the Preposit site, and we have no idea of the financial arrangements below the surface. So we suspect any prospective buyer should ask some hard questions about the overall risks and real effective costs. Remember that they are not an Authorised Depository Institution, so any money “saved” with them for a deposit could be at risk.

I put in a call to the company, who said they would call back to discuss “Preposit”, but they never did!

This is what the sponsored content on rewa says:

A new way of buying has hit the property market, allowing prospective buyers to live in their home, whilst saving for their deposit.

In a unique first for WA, “Preposit” is the Afterpay© of the real estate industry and means you can ‘move in today and pay for it tomorrow’.

The Apartments WA exclusive product allows you to move into an apartment immediately, then begin to make weekly payments that are stored away for you until you’ve saved your deposit.

Apartments WA Sales Manager Chad Toquero said Preposit addresses one of the biggest stumbling blocks in home ownership – the deposit.

“Preposit appeals to all buyers who can afford the loan repayments but are finding it difficult to save for a deposit – there is nothing else like this in the market and Preposit appeals to those looking to buy and those who are currently renting but want to own their own home in the future.”

Apartments WA have also partnered with Loan Co to offer their clients access to a wide range of lenders. As each person’s financial circumstance, and thus borrowing capacity is different, Loan Co will work with each individual to pre-qualify them for a loan upfront. Preposit just allows the buyer to live in the property, while saving for their deposit.

This new way of purchasing is flexible, negotiable and customised to suit the needs of every individual.

Mr Toquero believes Preposit has the potential to make home-ownership become a reality for more people.

“We want Preposit to make home ownership easier for those who want to take advantage of the property market now and their only hurdle is saving for a deposit,” he said.

“The only catch is you have to be able to afford your mortgage repayments and pre-qualify for a loan.

“As long as you can afford the repayments but don’t quite have the deposit right now, we can get you into one of our apartments.”

Here is their FAQ.

What is Preposit ?

Preposit is a unique initiative created by Apartments WA to help people save for their deposit, whilst being able to live in the apartment at the same time.So how does it work?

We help you find your dream apartment and then introduce you to our finance experts to work out how much you can afford to borrow. The difference between the purchase price and what you can borrow is the deposit you’ll need to save. Once you receive finance pre-approval to purchase the apartment, we give you the keys to move in and you start saving for your deposit in weekly payments. We then store away these payments away until your deposit amount is achieved, which we give back to you as your deposit toward purchasing the apartment.Is there a minimum amount required to qualify for Preposit?

No. Everyone’s individual situation is different, and we’ll work through finding the best solution for you.What properties is Preposit applied to?

We have a range of apartments in selected areas across Perth currently available.Is this a Government Scheme or Shared Equity?

No. Apartments WA understands that saving for a deposit is one of the biggest hurdles when looking to buy a property. And we want to help.Sounds too good. What’s the catch?

There’s no catch. You agree to purchase the property upfront, and then get to move in whilst you save for your deposit. Once you’ve reach your deposit amount, you settle on the apartment and then its yours.How do i know if i eligible?

Complete our enquiry form and we’ll give you a call.

A few weeks ago I attended an investor update for a group headed by one of the better known Australian investors. He gave an excellent global and Australian macro rundown – including highlighting very high levels of household leverage in Australia – and then proceeded to sit down to an “interview-style” discussion of a product that they were giving the hard sell to which was essentially warehousing of residential mortgage-backed securities. They stated that the regulatory crackdown was opening a brief window of opportunity which should be jumped on, and they stated they believed the investment would yield around 6.25% pa (or around 375 basis points above term deposits). They even joked about the “The Big Short”, but I felt like putting up my hand to tell the audience that watching “Margin Call” would be a whole lot more appropriate to help decide whether an extra 375 bps was worth the risk.

I was surprised by the quality of questions from the audience – not everyone was swallowing the “sell” – I was too polite to say what I really thought, which was that the sub-text of their investment case was a blind faith in “too big to fail” and even more moral hazard heaped upon what already exists, and continual (successful) can-kicking…

I also noted last week that “The Australian” discovered that in 2016-17 the Queensland Government purchased 30 apartments at an average of $412K (for a total of $12.36 million) from developers for public housing tenants. I would like to believe that was all about helping out struggling Queenslanders, but my experiences with the politics surrounding housing lead me to have a more cynical view…