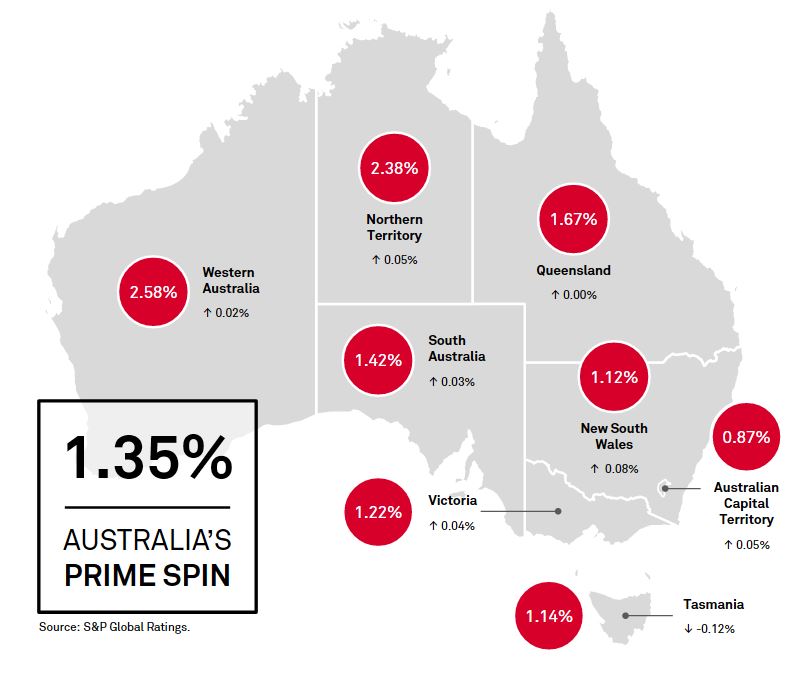

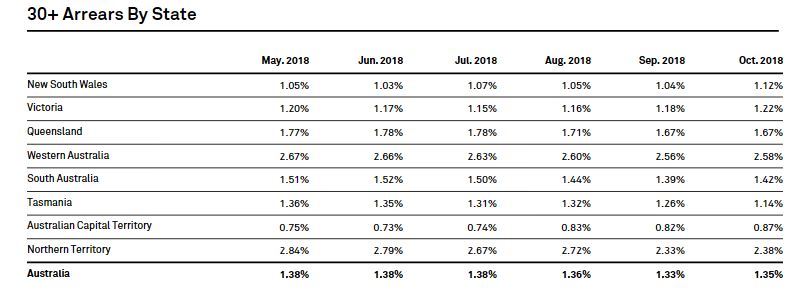

According to data from S&P Global Ratings relating to mortgage backed securities, the arrears rate rose in October 2018 (which is against normal trend).

Total SPIN index rose to 1.35%. The trend was consistent in all states and territories except Tasmania, where arrears fell to 1.14% in October from 1.26% the previous month. New South Wales recorded the largest increase in arrears in October, rising to 1.12% from 1.04% a month earlier. Arrears in New South Wales have been gradually rising throughout 2018, but remain the second lowest in the country, behind Australian Capital Territory.

WA stands out as the highest risk state, no surprise given the flat economy and many years of sliding home prices.

Investor and owner-occupier arrears increased in October. Investor arrears increased to 1.25% in October from 1.19% in September and owner-occupier arrears rose to 1.54% from 1.52% a month earlier. In our opinion, the larger increase in investor arrears during the month partly reflects the repricing of investor loans and interest-only loans, which are more common among investors. This is also reflected in the narrowing of the differential between investor and owner-occupier arrears, which peaked at 0.61% in January 2017. The differential had decreased to around 0.30% by October 2018, thanks to the ongoing repricing of investor loans.

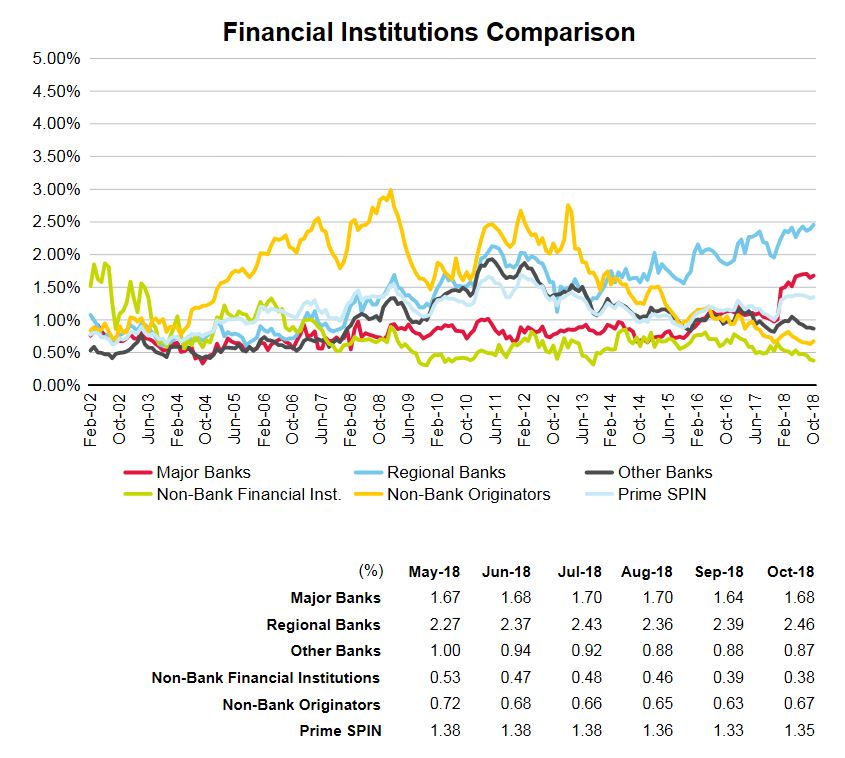

Arrears rose at the major and regional banks, offset by a small fall in the non-bank financial institutions. Defaults with non-bank originators rose.