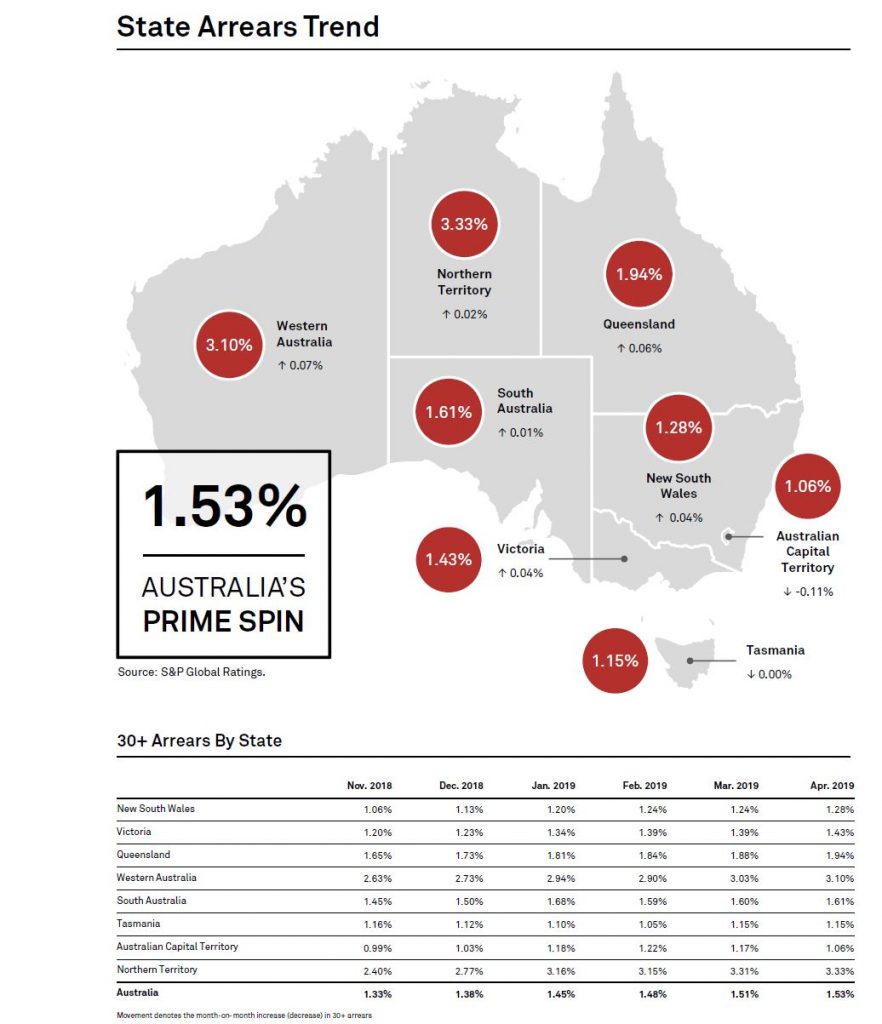

The S&P Spin Index for April shows a further rise in mortgage defaults, with WA and QLD leading the way. Only the ACT fell.

Now of course these are a myopic cross selection of loans, because they are those in the securitised pools. However, the rising trend continues.

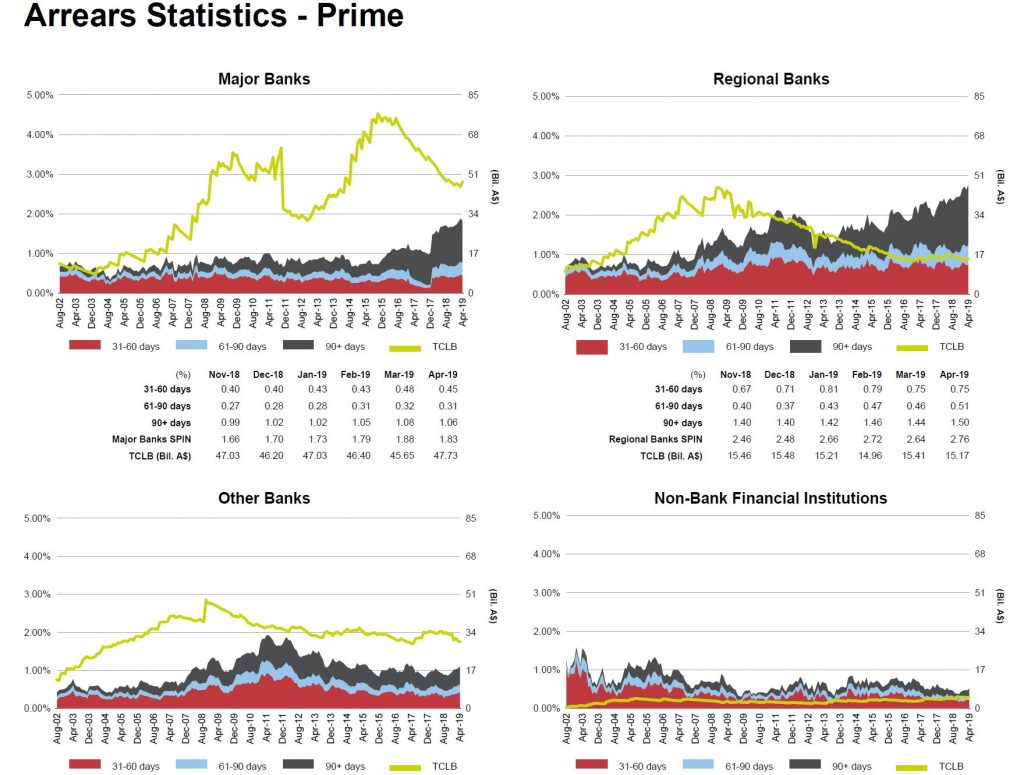

Within the mix, 90+ days arrears continue to climb especially among Regionals. It is worth reflecting that any upturn in the property market, to the extent it emerges, will have precisely NO effect on existing cash-strapped households, as the flat incomes, rising costs pincer movements continue to grip.

This was predictable, given the rising mortgage stress we have been detecting for some time. Of course the question becomes, will this lead to higher bank losses down the track?