Employment conditions may be improving across the country but it seems many Australian lenders are still on shaky ground after recent data reported a rise in home loan arrears rose in January.

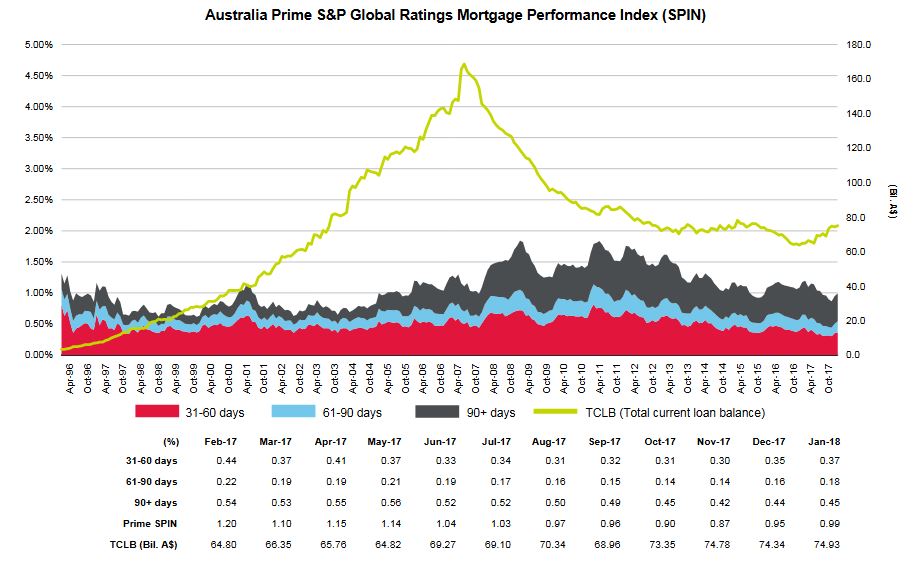

The Standard & Poor’s Performance Index (SPIN) for Australian prime mortgages increased to 1.30% from 1.07% in December 2017, according to a report by S&P Global Ratings.

While the level of mortgage defaults remains relatively low, the report – titled ‘RMBS Arrears Statistics: Australia’ – found that many borrows are sensitive to interest-rate movements and changes in their economic circumstances due to a high level of household debt.

Of course, it’s not uncommon to see a rise in the number of home loan arrears in January with Christmas spending and summer holidays often blamed for the imbalance. However, this year, the magnitude of the month-on-month increase in January was higher than previous movements.

“We believe the impact of incremental increases in interest rates during 2017 could be a contributing factor to the rise in mortgage arrears in January,” read a release from S&P Global Ratings.

“We believe overall arrears could moderate in the coming months,” it continued. “However, it will only become evident during the next few months whether some of the loans in early arrears categories cure or migrate into more severe arrears categories due to stretched affordability constraints.”

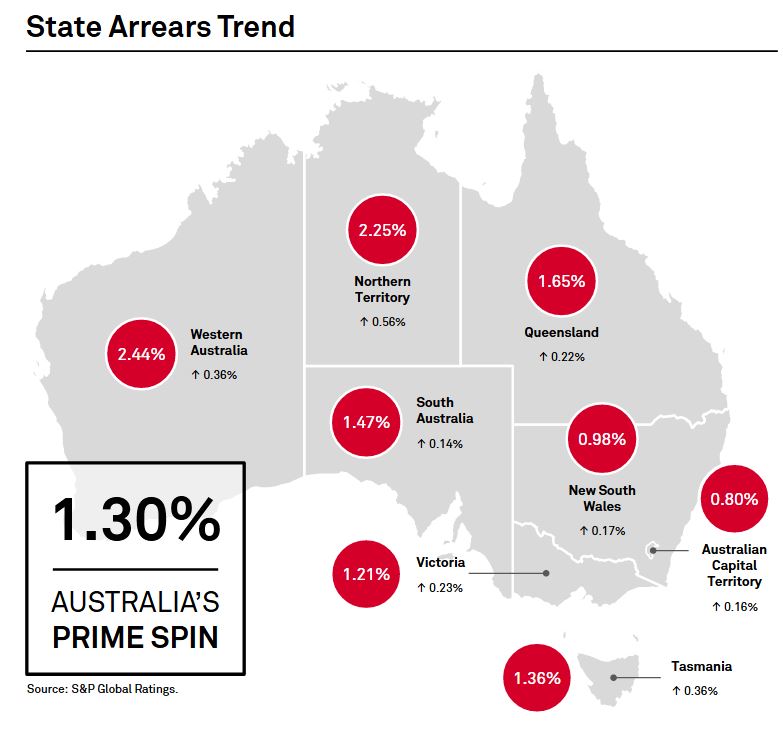

The report also found that no area was exempt from the increase with loans in arrears by more than 30 days increasing in January in every state and territory.

Western Australia remains the home of the nation’s highest arrears, where loans in arrears more than 30 days rose to 2.44% in January from 2.08% in December, reaching a new record high.

Conversely, New South Wales continues to have the lowest arrears among the more populous states at 0.98% in January.

“Improving employment conditions will help keep defaults low, but rate rises will have an impact on borrowers,” said S&P Global Ratings.

“The prudence of loan underwriting standards, particularly debt-serviceability calculations, is fundamental to how well borrowers absorb these higher costs.”

The financial services firm also offered insight into which loans it identified as being most susceptible to higher levels of arrears:

Interest-only loans that are approaching their interest-only expiry date

As lending standards for interest-only loans were less stringent before 2015, interest-only loans underwritten before then could be more susceptible to repayment shock when the loans roll into an amortizing repayment structure.High loan-to-value ratio loans

Apart from the obvious risk of having less equity built up in the home, which increases the risk of loss in the event of borrower default, borrowers with high LTV loans are also more likely to find it harder to refinance their home loan with another lender – a common way for borrowers to manage their way out of financial stress.High debt relative to income loans

Borrowers with less of a buffer to service their mortgages are more likely to experience financial stress when interest rates rise or their economic circumstances change. The integrity of debt-serviceability standards is important in ensuring that debt-to-income serviceability assessments reflect each borrower’s actual income and expenditure patterns.