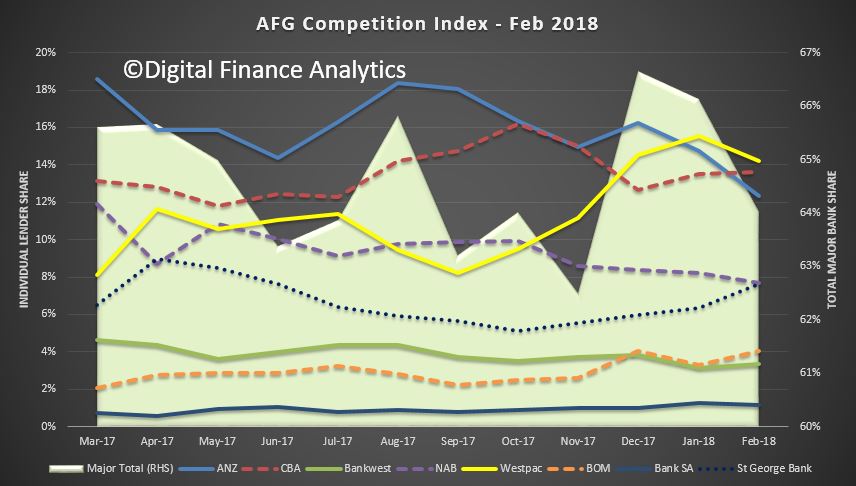

AFG has released their latest Competition index, based on flows through their systems. Myopic it may be, but it does give us another reference point on the market. Major bank share of new loans drifted lower, but also with significant shifts between lenders. The non-majors’ market share is now at 35.97%

AFG General Manager Broker & Residential, Mark Hewitt explained the results: “The gap between the first placed major lender, Westpac at 14.21% of the market and third placed ANZ at 12.32%, is the closest it has been for some time.

“As AFG has stated many times, a consumer dealing directly with a lender has limited negotiating power or knowledge of the interest rates and lending criteria offered by competitors. This has been further validated by the findings of the interim ACCC Residential Mortgage Price Inquiry. The presence of the mortgage broking channel is one of the few drivers of competitive tension in the Australian lending market.

“Whilst the majors’ market share lifted a couple of percentage points across the quarter, rising from 62.51% in November 2017 to 64.03% at the end of February, three of the four majors went backwards.

“ANZ dropped from 14.93% in November 2017 to 12.32% at the close of the last quarter. CBA’s share of the market dropped from 14.99% to 13.63%, and their subsidiary Bankwest dropped from 3.74% to 3.35%. NAB also recorded a drop, from 8.57% in November 2017 to finish the last quarter at 7.67% of the market.

“Only the Westpac group of brands, Westpac, St George, Bank of Melbourne and BankSA grew, with their market share lifting from 20.28% in November 2017 to 27.05% at the close of the last quarter,” he said.

“Interestingly, the Westpac group’s major gain came in the area of fixed rate loans with their share of that product type increasing from 23.63% to 44.24% of the market.

In a sign the majors are again open for business for investors, their share of that segment of the market has lifted from 64.82% in November 2017 to finish February at 66.78%.

The non-majors’ market share is now at 35.97%. “Amongst the non-majors AMP recorded an increase in market share and lifted from 2.27% to 4.62% and Homeloans recorded an increase from 0.14% to 0.33%.