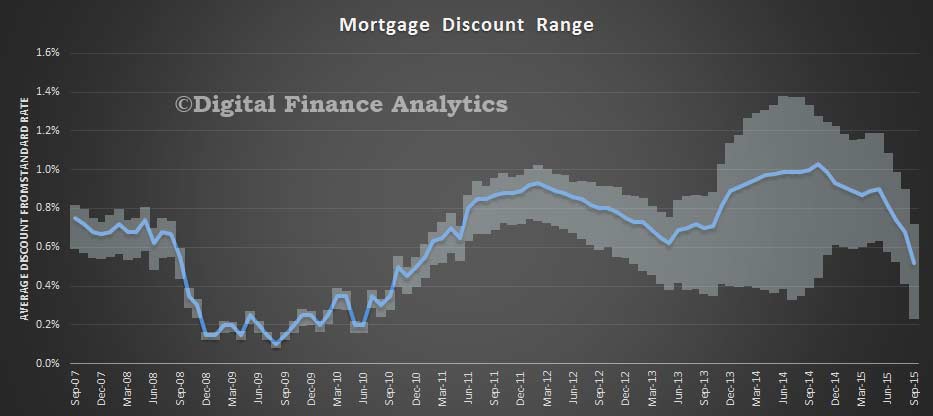

Latest data from the DFA surveys which is going into the forthcoming edition of the Property Imperative, shows that the era of very large mortgage discounts is passing. The average discount has now fallen from above 100 basis points to around 60 basis points and it will continue to fall further. This means a windfall for lenders who can pocket the extra margin, or use it to attract owner occupied new business.

![]() The range of discounts between the upper and lower bounds is reducing, with the lowest bounds around 20 basis points.

The range of discounts between the upper and lower bounds is reducing, with the lowest bounds around 20 basis points.

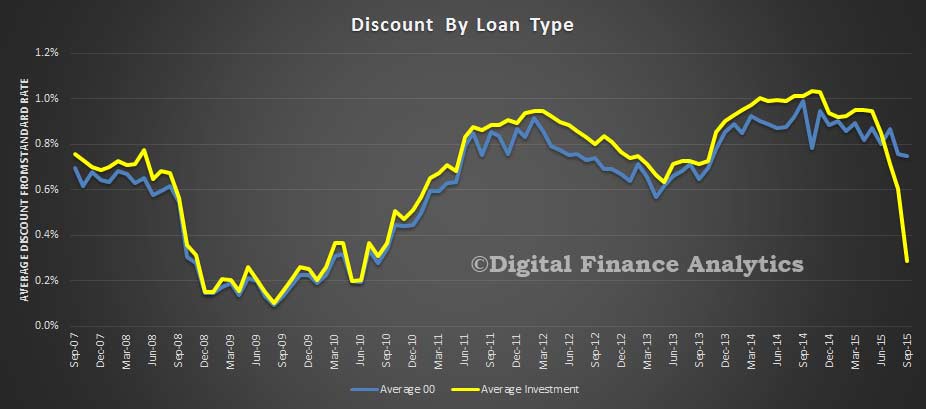

The most insightful data is the split by loan type. Loans for investment loans (both new and refinanced) are much reduced, with the average a little above 20 basis points – some lenders offer no discount at all now. On the other hand, owner occupied borrowers with new or refinanced loans can obtain a larger cut in rates. This reflects the new competitive landscape, where lenders are seeking to swing business away from the investment sector to owner occupied lending.

The most insightful data is the split by loan type. Loans for investment loans (both new and refinanced) are much reduced, with the average a little above 20 basis points – some lenders offer no discount at all now. On the other hand, owner occupied borrowers with new or refinanced loans can obtain a larger cut in rates. This reflects the new competitive landscape, where lenders are seeking to swing business away from the investment sector to owner occupied lending.

You can read our earlier analysis on discounts here.

You can read our earlier analysis on discounts here.