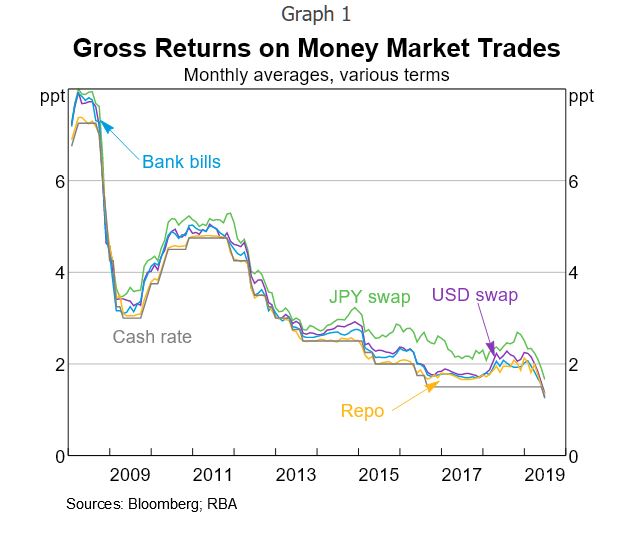

The recent RBA Bulletin included an article “Bank Balance Sheet Constraints and Money Market Divergence“, which in summary shows that money market trades have generally not been profitable for the four major banks since the financial crisis.

This is partly because debt funding costs have fallen by less than money market returns. In addition, equity funding, which is more expensive than debt, has increased. Consequently, the incentive for banks to arbitrage between money market interest rates has fallen.

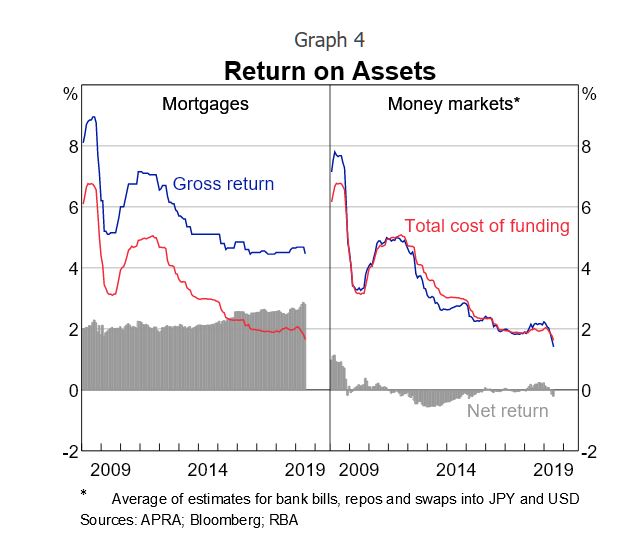

They show that residential mortgages are always significantly more profitable than money market trades over the sample period (Graph 4). This suggests that there has been a substantial opportunity cost associated with diverting equity funding away from mortgages and towards lower-margin activities such as money market trading. This is consistent with the balance sheets of the major banks being weighted towards mortgages and away from trading investments.

According to the latest property exposure statistics from the Australian Prudential Regulation Authority (APRA), the ADI’s sector exposure to residential mortgages increased by 3.6 per cent when comparing the June quarter 2019 to the previous corresponding period.

Thus banks tend to prefer more profitable lines of business, such as lending for residential housing, over the narrow margins implied by money market arbitrage. In other words, bank profitability is strongly connected with mortgage growth.

We know that APRA has reduced the rules on minimum lending standards for mortgages in July, and since then, banks have dropped their minimum rate requirements, opening the taps for more loans. As Australian Broker reported recently:

Westpac will decrease its floor rate from 5.75% to 5.35%, effective 30 September.

The same change will go into effect at its subsidiaries: St. George, BankSA and Bank of Melbourne.

After the initial round of floor reductions across lenders of all sizes, Westpac matched CBA with the higher floor rate of the big four banks at 5.75%, while ANZ and NAB each amended theirs to 5.50%.

Smaller lenders followed suit, the majority also updating their rates to either the 5.50% or 5.75% figure.

While some went even lower, ME Bank amending its rate down to 5.25% and Macquarie to 5.30%, Westpac has taken a step away from the other majors with its newest update.

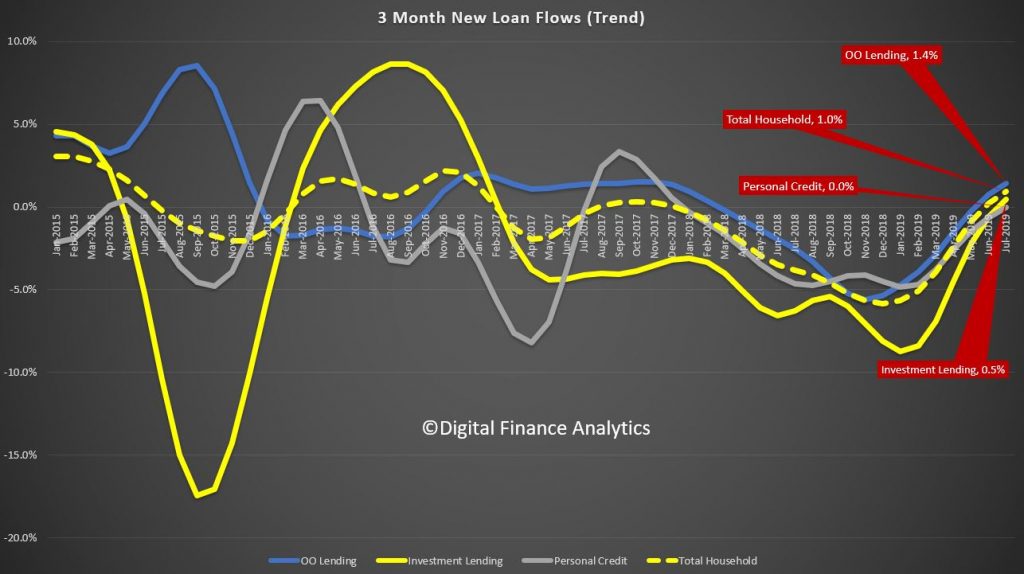

With July marking the strongest demand for new mortgages in five years and further RBA rate cuts expected in the near future, the floor reduction seems well timed to capitalise on the strong market activity forecasted to continue into the coming

Now of course there are still tighter guidelines on income and cost analysis for mortgage applications than a couple of years ago, but have no doubt standards are lowering again, and mortgage lending momentum appears to be on the turn, judging by the most recent data.

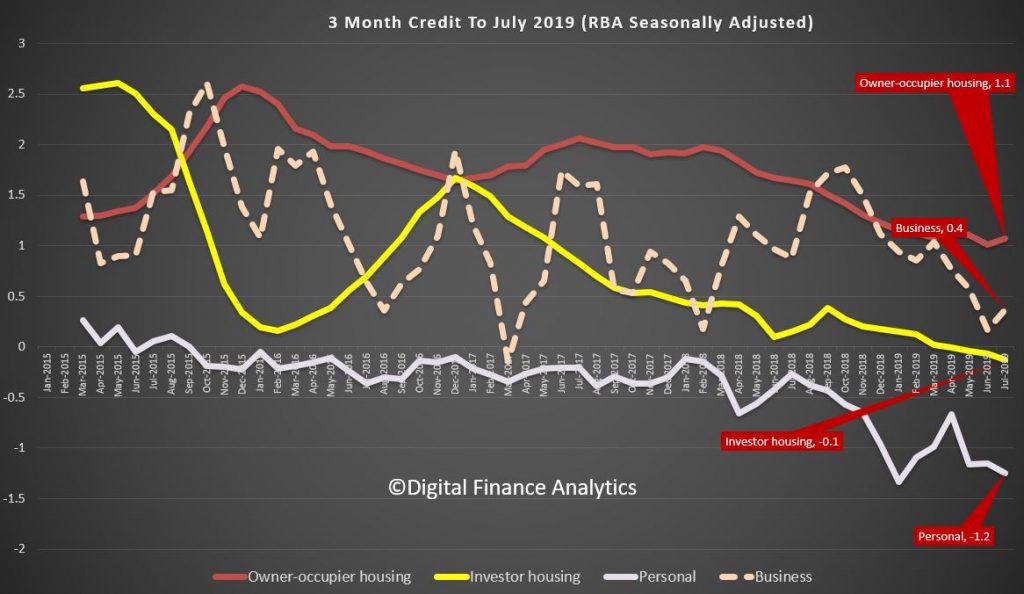

And the RBA stock data showed a small rise in to total value of owner occupied loans outstanding, though investor loans are still sliding on a 3 month seasonally adjusted rolling basis.

We expect a further rise in the results to be released at the end of September, to end August 2019

In addition, as reported in the AFR, they are being encouraged to lend.

Scott Morrison says Australia’s banks must not shy away from lending after the Hayne commission as he pushes back against what he calls an “instinctiveness” in society towards responsible lending standards that are too onerous.

Speaking to the Australian American Association in New York, the Prime Minister said that while it was important to implement the findings of the royal commission, as well as other reforms such as the Banking Executive Accountability Regime, “we need our banks to keep lending”.

“We can’t be scared of our own shadows in our economy, the animal spirits in our economy and the role of the banking and financial system in extending credit.

And lenders are responding with a tranche of mortgage rate cuts to attract new borrowers or new refinances (rather than passing cheaper funding costs through to existing borrowers).

For example, the Commonwealth Bank of Australia changed its New Wealth Package fixed rates for owner-occupied and investment home loans, for both new and existing customers switching to a fixed rate home/investment home loan as of Tuesday, 24 September.

The largest rate drop is for owner-occupiers with interest-only home loans on a five-year fixed rate, who will see rates drop by 90 basis points to 3.99 per cent, as will investors with an interest-only home loans on a four-year fixed rate.

Owner-occupiers with IO mortgages on one-year and four-year fixed rates will see rates drop by 65 basis points (to 3.89 and 3.99 per cent, respectively), while those with a three-year fixed rate will see their new rate start from 3.79 per cent (10 basis points lower than previous).

Other sizeable rate drops include investors with a four-year fixed rate on P&I repayments, who will see their interest rates fall by 75 basis points to 3.64 per cent.

Investors with P&I repayments on other fixed rate terms will see rates drop from between 5 and 50 basis points.

Owner-occupiers with a P&I home loan that is on a one-year fixed rate term will see a range change of 60 basis points, dropping the new rate to 3.29 per cent. Those with a four-year fixed rate will also see their rates drop by the same amount, bringing the new rate to 3.49 per cent.

And ME Bank announced reductions of up to 49 basis points across its variable home loan products for investors.

The rate reduction announcement comes a week following ME bank’s 2019 financial year results, which saw its home loan portfolio grow by 7.3 per cent, from $24.5 billion to $26.3 billion (or 2.5 times system growth).

The bank has cut rates for investors on both principal and interest (P&I) and interest-only (IO) loans with a loan-to-value ratio of less than, or equal to, 80 per cent.

The changes have been applied to the “flexible home loan member package” for investors, as well as the “basic home loan” investor product, with all changes effective as of Tuesday, 24 September 2019.

The largest rate reduction (49 basis points) was applied to the bank’s basic home loan product, for investors making principal and interest repayments.

For investors on the bank’s basic home loan product, the new rates are as follows:

- P&I repayments, any loan amount – 49 basis point reduction to 3.68 per cent p.a. (3.70 per cent comparison rate)

- IO repayments, any loan amount – 45 basis point reduction to 3.89 per cent p.a. (3.79 per cent comparison rate)

Investors currently on the flexible home loan package (which requires an annual fee of $395) will see the following changes:

- P&I repayments on a loan amount above $700,000 – 14 basis point reduction to 3.63 per cent p.a. (4.06 per cent comparison rate)

- IO repayments on a loan amount between $400,000-$700,000 – 23 basis point reduction to 3.89 per cent p.a. (4.19 per cent comparison rate)

So to Philip Lowe’s recent speech “An Economic Update” where he said that…

…the global economy is that while it is still growing reasonably well, the risks are increasingly tilted to the downside. The main source of these downside risks are geopolitical developments in many parts of the world. These developments are creating considerable uncertainty and this uncertainty is causing businesses to reconsider their spending plans. This is making the international environment more challenging for us.

On the Australian economy, he said after having been through a soft patch, a gentle turning point has been reached. While we are not expecting a return to strong economic growth in the near term, we are expecting growth to pick up. Against this backdrop, the main source of domestic uncertainty continues to be the strength of household spending.

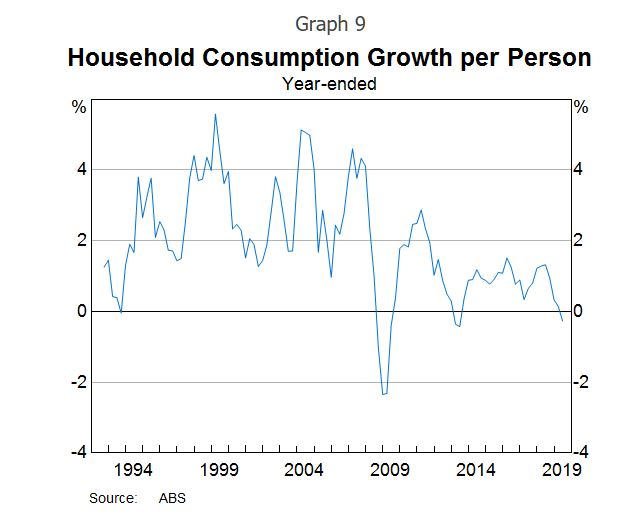

He went on to say over the past year, there has been no growth at all in consumption per person, which is an unusual outcome at a time when employment is growing strongly (Graph 9). An important part of the explanation here is that household disposable income has been increasing only slowly for an extended period, reflecting both subdued wage increases and strong growth in taxes paid.

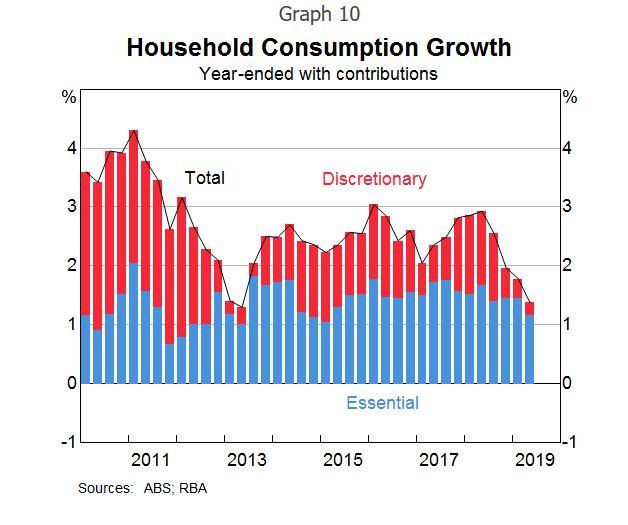

The persistence of slow growth in household income has led many people to reassess how fast their incomes will increase in the future. As they have done this, they have also reassessed their spending, particularly on discretionary items, which has been quite weak over recent times (Graph 10). Not surprisingly, spending on household essentials has been much less affected.

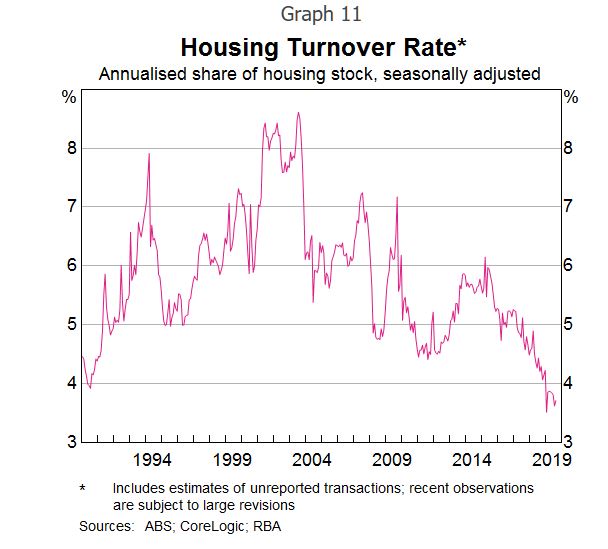

Another part of the explanation for weak growth in household spending is the adjustment in the housing market. As housing prices have fallen, there has been a marked decline in housing turnover, with the turnover rate having declined to the lowest level in more than 20 years (Graph 11). With fewer of us moving homes, spending on new furniture and household appliances has been quite soft. So too has expenditure on moving costs and real estate fees. More broadly, the correction in the housing market has also affected the economy through its impact on residential construction activity.

Thus, we can join the dots, if banks lend more and stoke the housing market, this may reverse the weak consumer spending and drive the economy harder. This is of course why the Government and regulators are doing all they can to pull prices higher (though volumes remain very low, and the number of new listings have hardly moved).

And according to the ABC, more building firms are failing.

Statistics, provided by ASIC, show 169 NSW-based construction companies went into administration, receivership or a court-ordered shutdown in the June quarter — the highest number since the September quarter in 2015.

Over the whole 2018-19 financial year, 556 construction companies went under — 101 more than the previous financial year.

Experts say it is a reflection of the state’s slowing apartment and housing market, with about 50,000 less apartments being constructed compared to the same time two years ago, and a marked slowdown in housing construction.

An increasing number of half-finished apartment projects are doting the Sydney landscape, with property development giant Ralan Group — which collapsed in July owing $500 million to creditors — the most high-profile example.

Yet, despite all this in a Q&A the Governor was asked if he was concerned about the recent developments in the housing market. Lowe said the RBA was not worried about the recent lift in dwelling prices and he does not expect credit growth to materially lift due to lower interest rates – meaning that the recent acceleration in the housing market will not be an impediment to a near term rate cut.

In fact the only point of resistance against looser lending and more credit is ASIC’s appeal against the recent ruling relating to HEM (Household Expenditure Measures) that found knowing a customer’s current living expenses was immaterial to deciding whether they could afford repayments on a loan.

In the most famous line of his judgment, Justice Perram found that

“Knowing the amount I actually expend on food tells one nothing about what that conceptual minimum [of how much one can spend without going into “substantial hardship”] is. But it is that conceptual minimum which drives the question of whether I can afford to make the repayments on the loan.”

ASIC commissioner Sean Hughes said the regulator felt compelled to appeal after Justice Perram ruled that a lender “may do what it wants in the assessment process”.

“The Credit Act imposes a number of legal obligations on credit providers, including the need to make reasonable inquiries about a borrower’s financial circumstances, verifying information obtained from borrowers and making an assessment of whether a loan is unsuitable for the borrower,” he said in a statement.

“ASIC considers that the Federal Court’s decision creates uncertainty as to what is required for a lender to comply with its assessment obligation, nor does ASIC regard the decision as consistent with the legislative intention of the responsible lending regime.

“For those reasons, ASIC will appeal to the Full Court of the Federal Court.”

If ASIC loses then the final drag on future credit growth will be blown away.

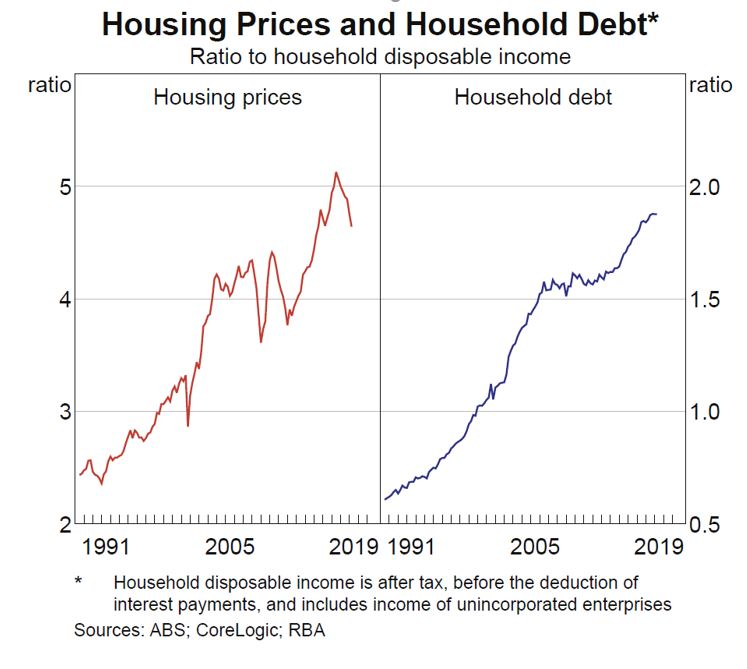

I have to say, I find this whole narrative very unconvincing. Remember home prices relative to income remain very stretched, the debt burden has never been higher, and yet people are being encouraged to borrow big, and help resurrect the housing market (and the economy), at any cost.

If rates are cut again, the flow of credit will rise (thanks to the APRA changes and heightened competition among lenders). And of course the main driver of this is that banks need lending growth to drive future profitability. But my own modelling suggests that as we approach the zero bounds, profitability will actually be squeezed some more. That said, we can see why it is that Mortgage Growth is The Only Game In Town. From Polys, to Regulators, to Lenders, they all want it. Household though will bear the consequences.