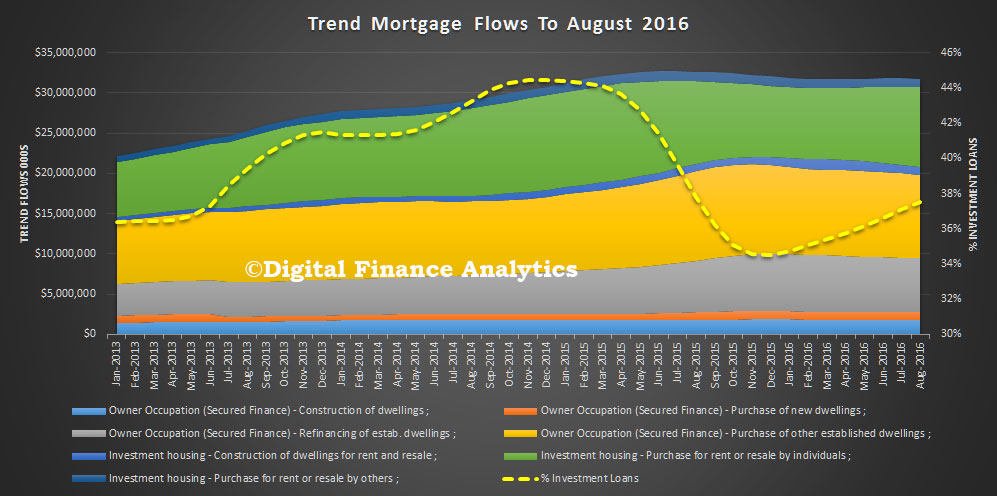

The latest home finance data from the ABS to August 2016 shows that overall housing lending fell slightly, down 0.22% to $31.7bn, in trend terms. But you need segmented analysis to understand what is going on.

Lending for investment purposes rose by 1% to 11.9bn, 37.5% of all lending, up from 37.1% last month, whilst in owner occupied property land, total volumes fell from 55,301 to 54,600 (down 1.27%) and the total value of new loans was $19.8 billion, down from $20 billion (down 0.93%) the previous month.

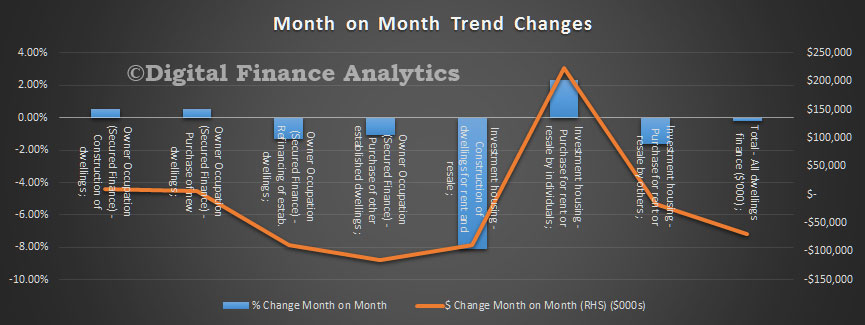

Looking at all trend home lending flows, investment lending borrowing for an existing property rose by individuals 2.3% to $9.8bn, and there were small rises in loans for OO construction and new dwellings.

Looking at all trend home lending flows, investment lending borrowing for an existing property rose by individuals 2.3% to $9.8bn, and there were small rises in loans for OO construction and new dwellings.

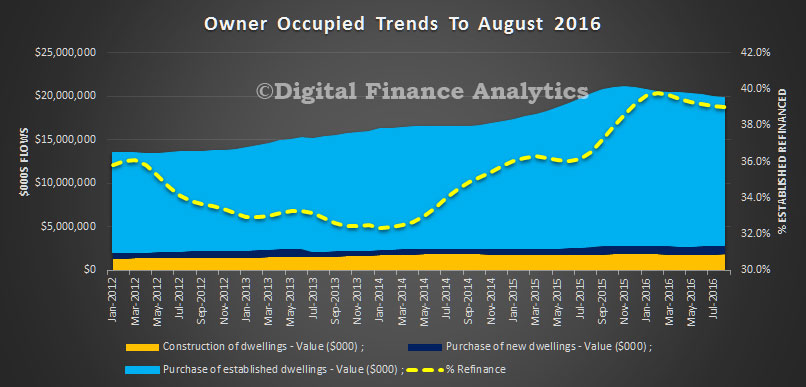

Owner occupied refinance still remains high, at 39% of existing OO loans, though the volumes are down a little this month to $6.6bn. This is more than 20% of all loan transactions (OO and INV), and up from 17% in 2013.

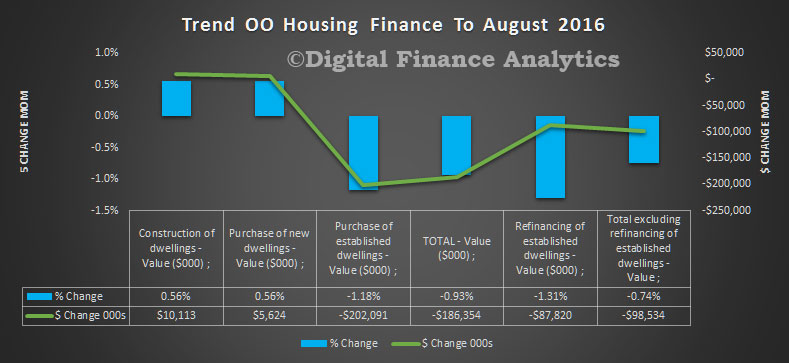

Looking at the OO month on month movements, construction ($1.8bn) and purchase of new dwellings ($1bn) were both up, by 0.56%, showing that demand for, and lending for new property is still being met. However, the value of purchase of established dwellings fell 1.18% to $16.9 bn. Refinanced loans also fell, by 1.31% to $6.6 bn.

Looking at the OO month on month movements, construction ($1.8bn) and purchase of new dwellings ($1bn) were both up, by 0.56%, showing that demand for, and lending for new property is still being met. However, the value of purchase of established dwellings fell 1.18% to $16.9 bn. Refinanced loans also fell, by 1.31% to $6.6 bn.

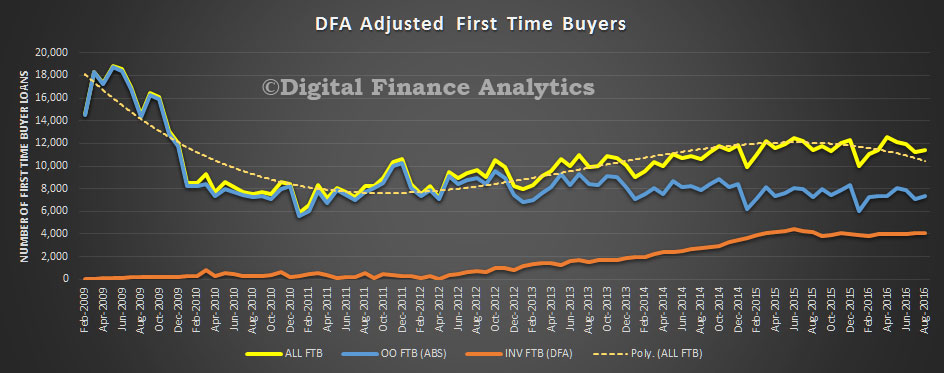

First time buyers are impacted by ABS revisions, but overall we see a lift in the number of FTB OO buyers, up 3.5% to 7,372. They also made a larger share of all buyers, at 13.4%, but still way below their peak in 2009.

First time buyers are impacted by ABS revisions, but overall we see a lift in the number of FTB OO buyers, up 3.5% to 7,372. They also made a larger share of all buyers, at 13.4%, but still way below their peak in 2009.

We track FTB investors, who are not caught in the ABS statistics, and last month another estimated 4,061 when straight to the investment property sector, a rise of 3.4%. So overall the FTB sector in total was 11,434, up 3.5% on the previous month. You can read more about the FTB changes to the ABS data here.

The overall trend trajectory however is lower, despite record low interest rates.

Loans for investment purchases, refinance, and loans for new property are still supporting the market, whilst momentum in the large existing market sector, refinance apart, is slowing.

Loans for investment purchases, refinance, and loans for new property are still supporting the market, whilst momentum in the large existing market sector, refinance apart, is slowing.