APRA released their banking statistics to end February 2020 today, as it is the last day of the month. They are of course using the new Economic and Financial Statistics (EFS) data collection, which modernised the collection of data submitted by ADIs and Registered Financial Corporations (RFCs).

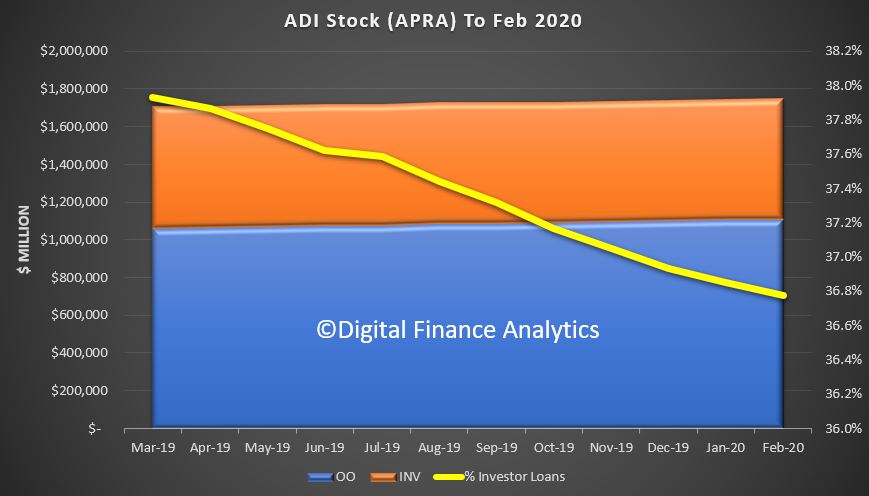

In the halcyon days of February (remember when the stock markets hit all time highs), total mortgage lending growth from the banks was already weak, with investment lending balances falling slightly, and owner occupied lending growing, on a net basis. Some of this was driven by households choosing to pay down loans thanks to their own financial uncertainty. This could have proved to be very smart. The share of investment mortgages in the portfolio dropped to 36.8%, with the total exposures up to $1.75 trillion dollars, with owner occupied loans at $1.10 trillion and investment loans $0.64 trillion.

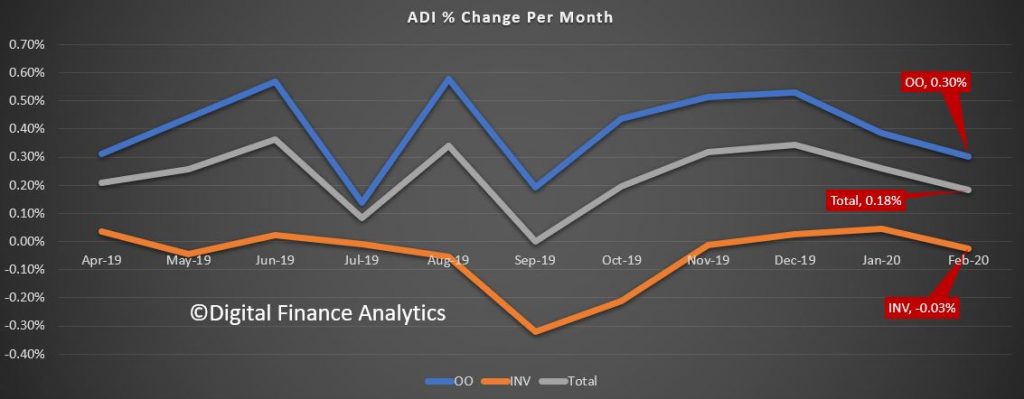

In percentage terms, investment balances fell by 0.03% or $170 million and owner occupied loans rose 0.3% or $3.3 billion, giving total loan growth of 0.18% or $3.17 billion. Ahead of course, interest will be rolled up into balances for the duration, but the number of new mortgages may slow. Hard to predict, as some seek to switch loans, or even sell quickly.

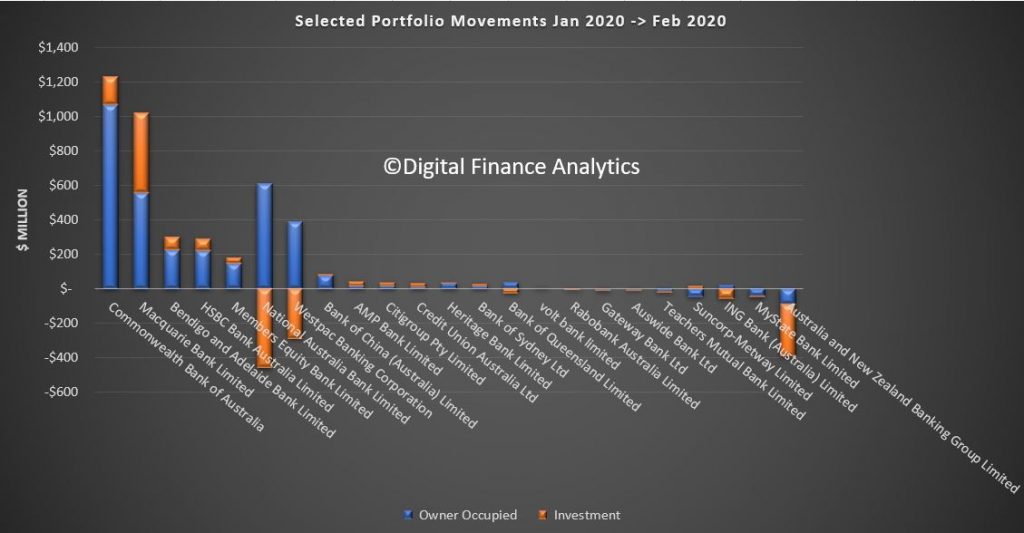

Portfolio movements within the banks, as reported by APRA, is subject to a range of potential input errors. but with that caveat it seems that CBA, Macquarie, Bendigo and HSBC were lending more freely, while NAB and Westpac saw their investor balances fall, whereas ANZ dropped both sets of balances. ING and Bank of Queensland dropped investor loans, while Suncorp dropped owner occupied balances while growing investor loan balances once again.

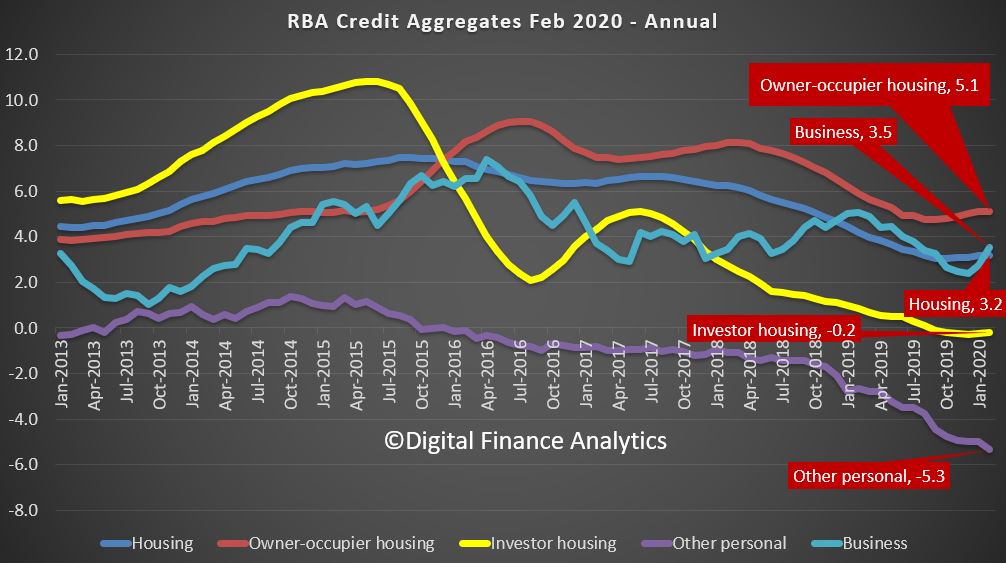

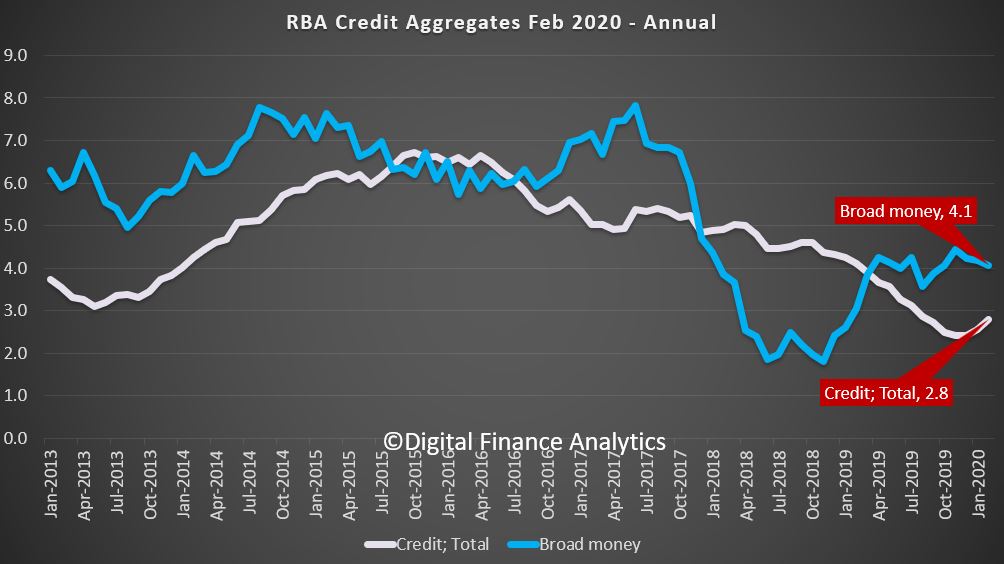

Meantime, the RBA aggregate figures are also out today. They reported total credit grew 0.4% in February, and 2.8% over the year, compared to 4.1% a year before. More signs of slowing.

Within that, lending for housing rose 0.3% in February to 3.2% over the year, compared with 4.2% a year ago. Business lending rose 0.9% in February to reach 3.5% over the year, compared with 5.1% a year back. And personal credit dropped 0.5% in February, and is down 5.3% over the year, compared with down 2.6% the previous year.

More granular analysis shows that lending for owner occupation is where the growth is, at 5.1% annualised, up from a low of 4.8% back in October last year, so hardly a stellar recovery. Investment lending is still falling slightly.

Broad money is falling, down to 4.1% annualised, despite the rise in credit. All signs of weakness before the current health crisis is freezing the economy.

All pretty academic now, but there is the data for the record!