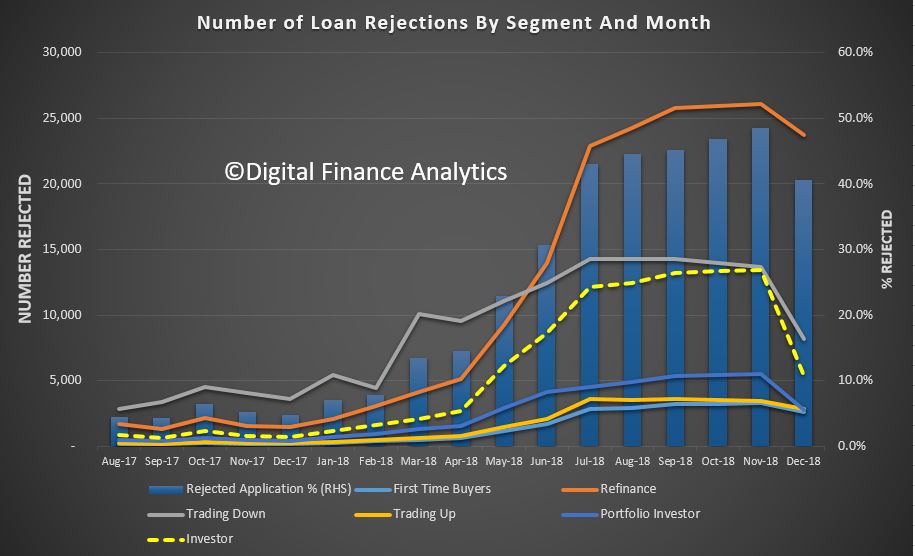

The latest data from our surveys indicates that around 40% of loan applications for mortgages were rejected in December 2018, compared with 8% a year prior, though on significantly lower absolute volumes. Households often made multiple applications when seeking a loan.

The volume of applications across all segments fell in the lead up to the holidays, and the proportion of rejections fell from 48% the prior month, which was a record.

The fall in investor applications is significant, as appetite for investment property eases. The relative volume of refinance applications remained quite high, as people are seeking to reduce their monthly repayments.

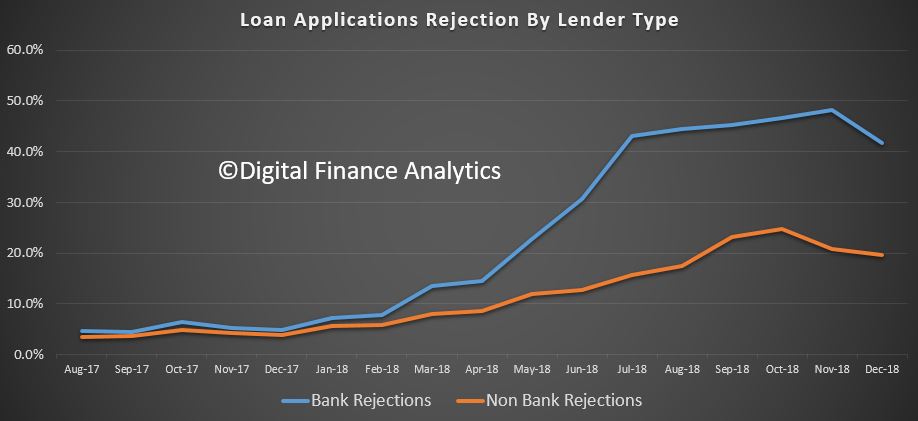

Non Bank rejections are running a much lower rates than bank rejections.

Curious as to how to explain loan settlements increase and a growing loan book based on the above, I can only see one explanation, aside from how the information is collected, and that is the average loan size must have increase, a lot.

Actually settlements are falling – in flow terms, but the stock is still growing – this is a weird contradiction, which I have not seen a satisfactory explanation of.