Australian Finance Group (AFG) has today released their Mortgage Index June Quarter 2017. Whilst myopic, as it is based of traffic within their business, it does provide a window on the market, and highlights some of the shifts in play.

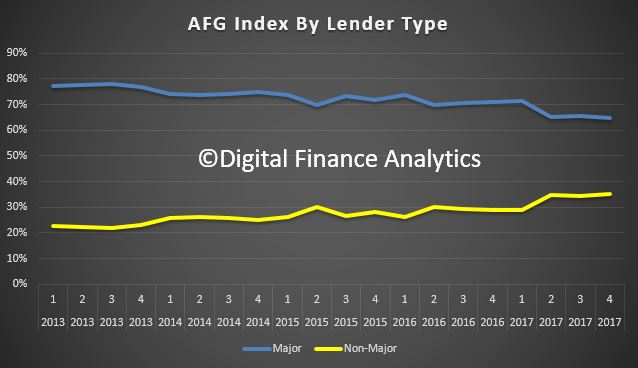

AFG CEO David Bailey welcomed the news that the non-major share of the market is now at 35%.

“Significant structural change to the lending market brought about by tighter lending rules has seen increased flows of business to the non-major lenders.”

“As the majors re-price their mortgages and change lending policies to meet regulatory caps, consumers are turning to mortgage brokers to get a full picture of the choices on offer in such a competitive market,” he said.

“The non-major lenders are helping fill the void left by some of the majors and consumers are benefiting from the fact that a mortgage broker can offer products from those lenders without a branch network.”

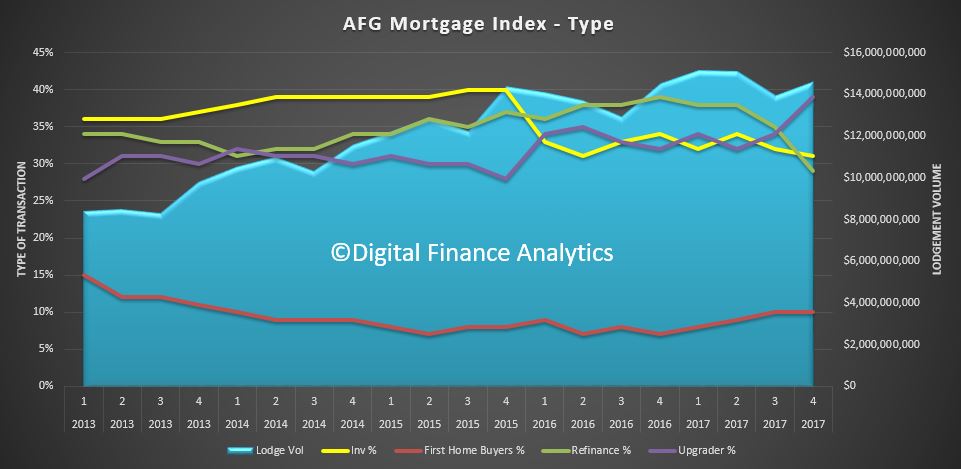

A series of rate rises and policy changes has also had an impact on the investment market. “In what will no doubt be welcome news for the regulator, investment lending has dropped to 31% of our total lending for the quarter as lenders continue to tighten their criteria,” said Mr Bailey.

Refinancing figures are also down from 35% to 29% as refinance options for borrowers with interest only or higher LVR investment loans decrease and others choose to stay put until the market settles. Lender policy restrictions have also seen the average loan size fall in every state apart from Queensland.

“The part of the market that has been virtually untouched by regulators and lenders is the principle and interest owner category. As a result, those opting to upgrade their homes have increased from 34% to 39% in response to some attractive lending offers,” he concluded.

In a sign that homeowners are picking the bottom of the market for interest rates, the number choosing to fix their rate has jumped significantly to finish the quarter at 23.7%.