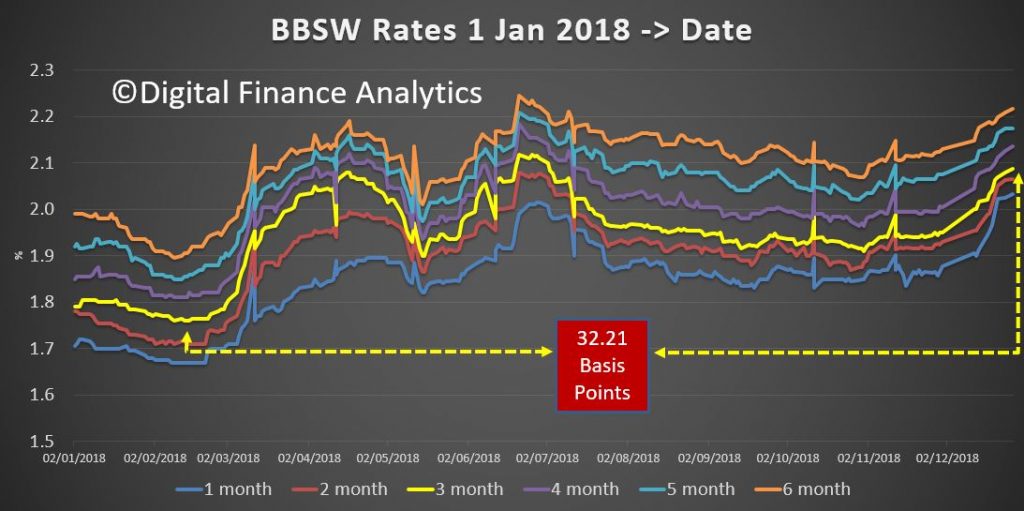

The Bank of Queensland has announced that they will lift mortgage rates for existing borrowers, thanks to higher funding costs, and pressures on bank deposits. The BBSW (interbank funding rate) has risen, and there are limits to how far deposit rates can be cut. We expect other banks to follow.

BOQ announced today that funding cost pressures and “intense” competition for term deposits were partly behind its decision to lift interest rates.

The rates of more than 20 of the bank’s home loan products will rise from Friday with most set to increase by 0.18 percentage points, including the standard variable rates for owner-occupiers and investors.

The standard variable rate for owner-occupiers paying principal and interest will rise from 5.70% to 5.88% ( comparison rate of 6.04%), while the standard variable investment housing rate will rise from 6.33% to 6.51% (comparison rate of 6.67%).

Six of its line of credit products, including the Clear Path Line of Credit Rate, will also rise by 0.18 percentage points.

The Economy Owner Occupier principal and interest home loan is the only one among the changes that will have a smaller hike of 0.11 percentage points to 3.99% (comparison rate of 4.15%).

As we highlighted yesterday, mortgage stress is on the rise with more than one million households under pressure, and these rate rises will created more pressure on household budgets.