DFA has released our latest results from our rolling 52,000 household surveys. As a result of the economic slowdown (which was already underway before COVID) and exacerbated by the COVID restrictions, more households are falling into financial stress.

We define stress in cash flow terms – money in and money out – for both rental and mortgage stress, with those in negative cash flow flagged as stressed. Investor stress is assessed by different means, including negative cash flow, extended vacancy rates, intention to sell and other factors. In the round while the various Government support schemes, and repayment holidays, plus rental freezes are assisting, the downward trajectory in finances is clear, and explains the rising stress.

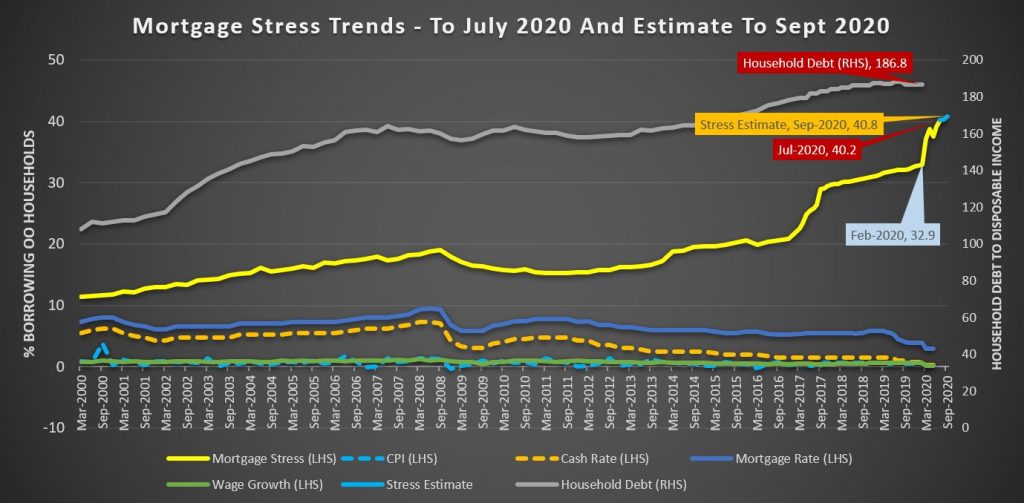

Mortgage stress rose to its highest level ever at 40.2 of households. We expect this to climb higher as support is moderated, and banks have hard conversations about recommencing repayments. Morgan Stanley commissioned a survey of mortgagors as part of some research on the impact of the coronavirus, and found that 55 per cent of them have received some form of income support. Household debt ratios continue to rise (thanks also to the capitalised interest and repayment holidays).

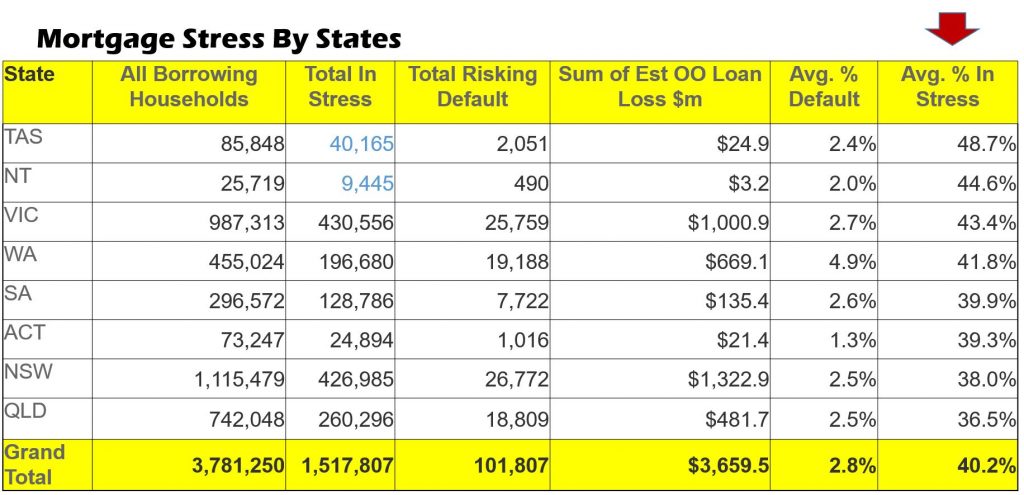

Two states saw a slight decline in the month, TAS and NT, as restrictions were somewhat eased,though both states have the highest stress percentages. But households in VIC rose by more than 15,000 from last month and NSW by more than 12,000. Overall more than 1.5 million households are impacted, up from 1.45 million last month.

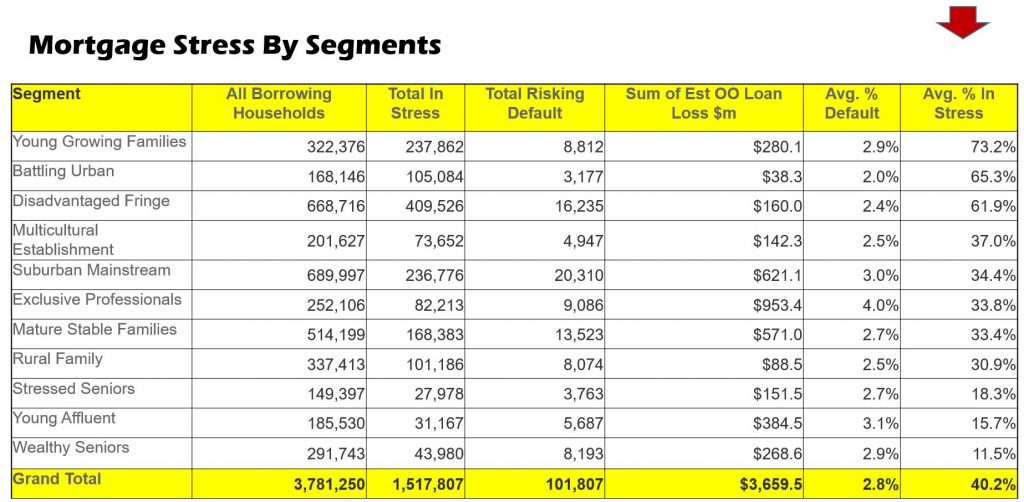

Across the segments, Young Growing Families are most exposed – this includes recent cohorts of first time buyers. Affluent households continue to be impacted, as unemployment is becoming structural. The RBA recently flagged an official rate of ~10% later in the year. The true rate is significantly higher.

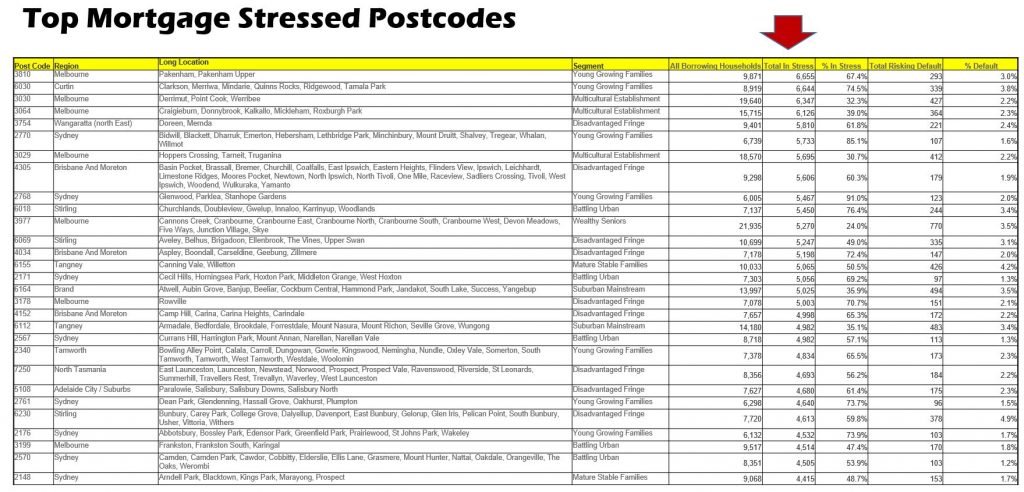

Looking in more detail at the post codes with the largest counts, many are fringe areas where there are many new estates, large houses on small lots driven by the construction boom. However a number of regional centres are also impacted. VIC is particularly exposed.

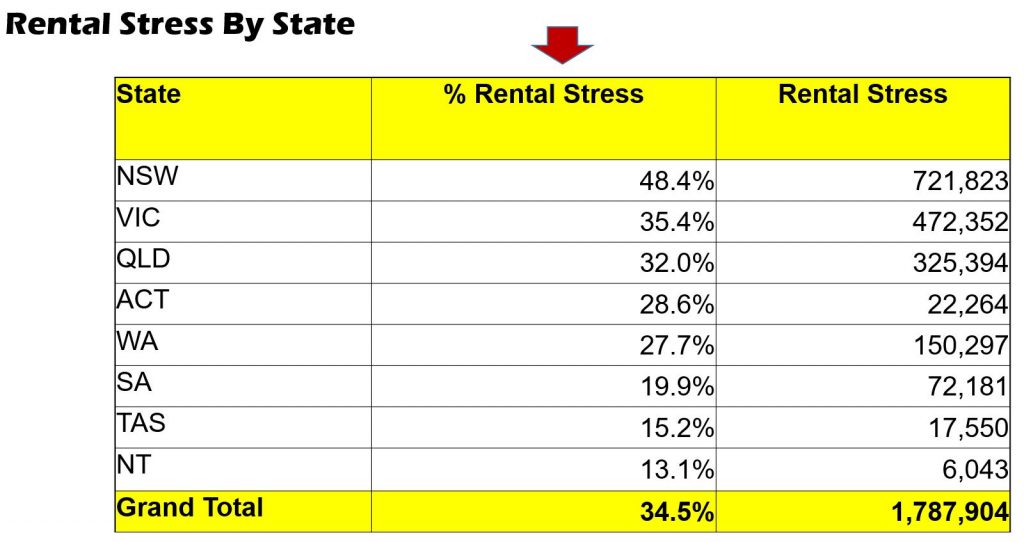

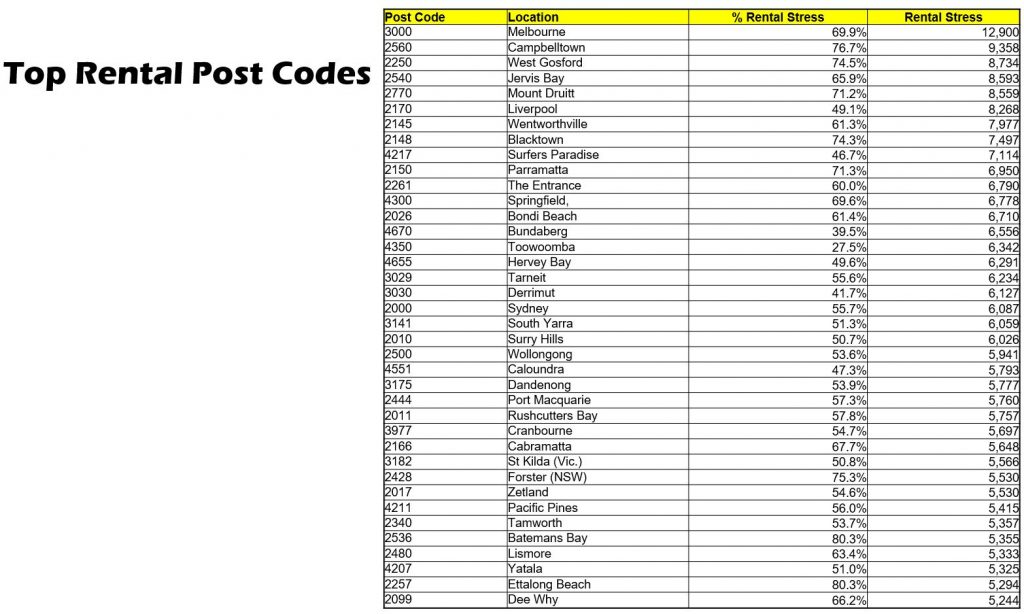

Turning to rental stress, we see a rise of tenants struggling with repayments. There is confusion for some as to whether their rents are on hold, or simply accruing. We are seeing more households planning to move back with family and friends. Stress is highest in NSW and VIC, with a significant spike in the largest states.

Across the segments, Young Affluent and Multicultural Groups are most exposed, linked with both students suddenly without part-time work, and the shrinking of the gig economy. However in terms of numbers of stressed renters more mainstream families are caught.

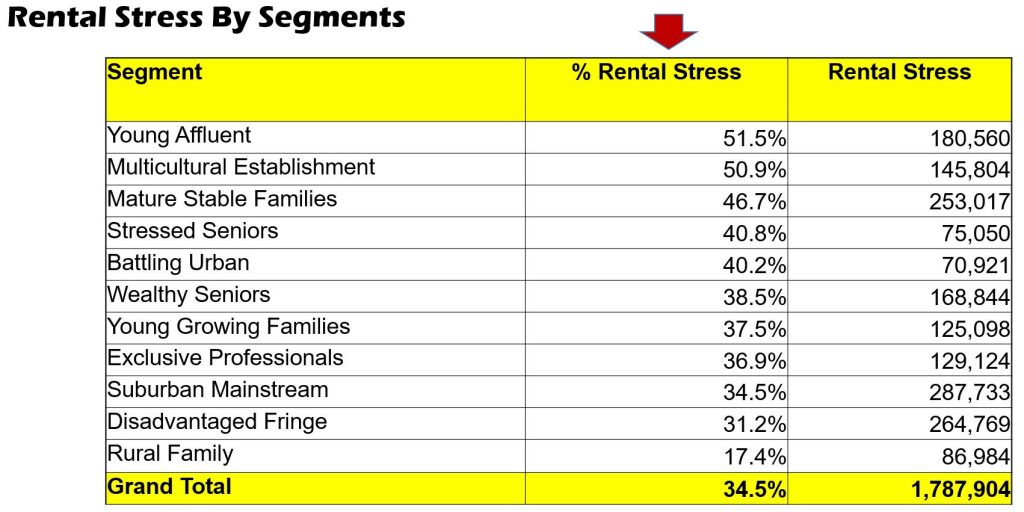

The post code distribution is illuminating, with Melbourne 3000 the standout high risk post code. Then comes both areas of Western Sydney and the Central Coast.

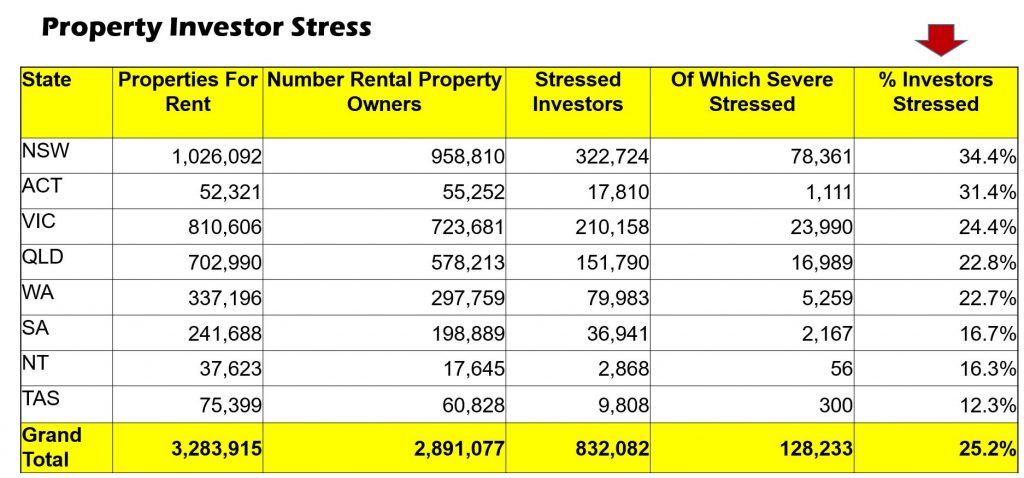

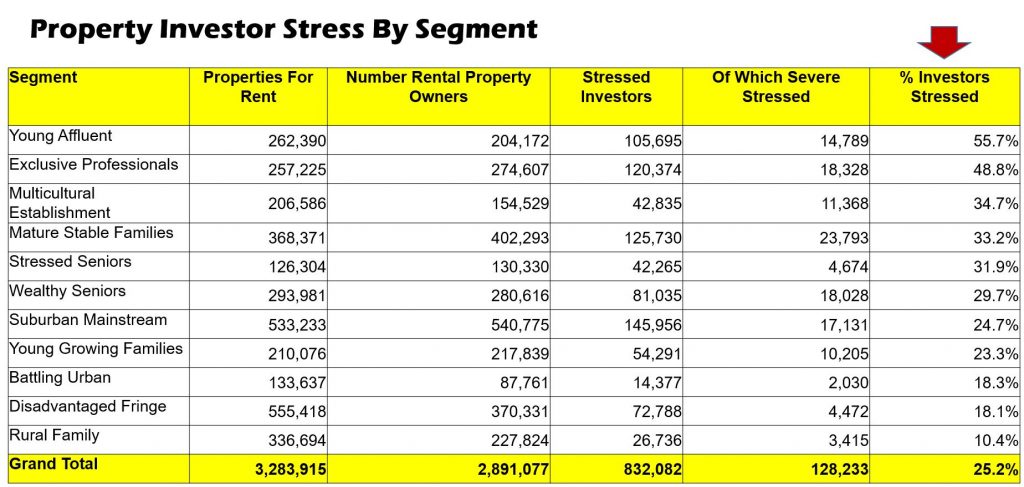

Finally turning to our latest analysis of Stressed Property Investors (based on their place of residence not where their properties are located), we see that 25% of investors are stressed, and overall 12% are actively considering selling. The highest rates of stress are in the NSW and ACT.

By segment, Young Affluent and Exclusive Professional Property Investors are the most stressed, not least because of the higher proportion of multiple investment property held. Many Young Affluents have multiple (cheaper) high-rise investments which are losing value.

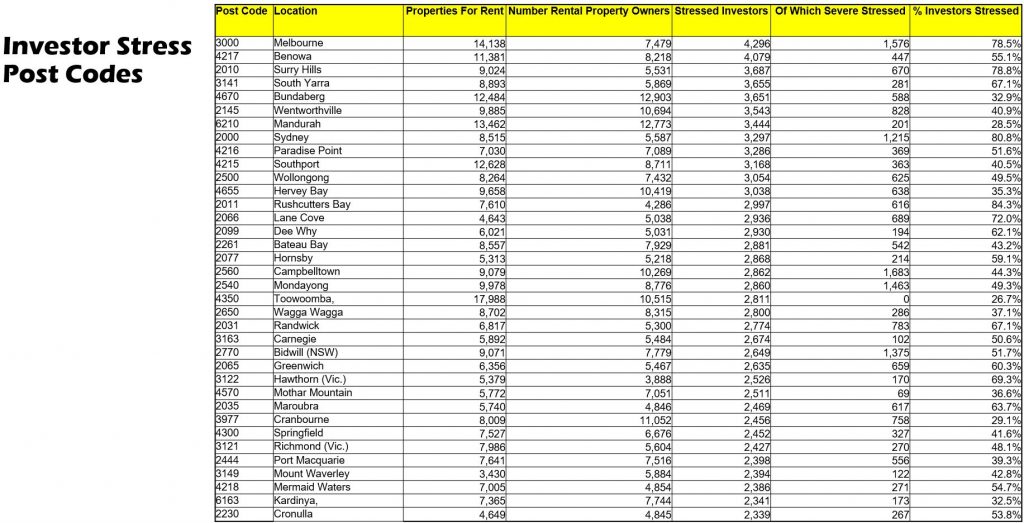

Melbourne 3000 holds the unenviable record for the highest count of stressed Investors (which may well correlate to the high rental stress). Mandurah, in WA, where prices have dropped 38% from peak appears near the top as many Investors have been in difficulty for years, and are unable to sell due to negative equity. Watch and learn….

We expect the banks to be tougher on property holders in these high risk areas, compared to others as the discussions about payment restarts after September.

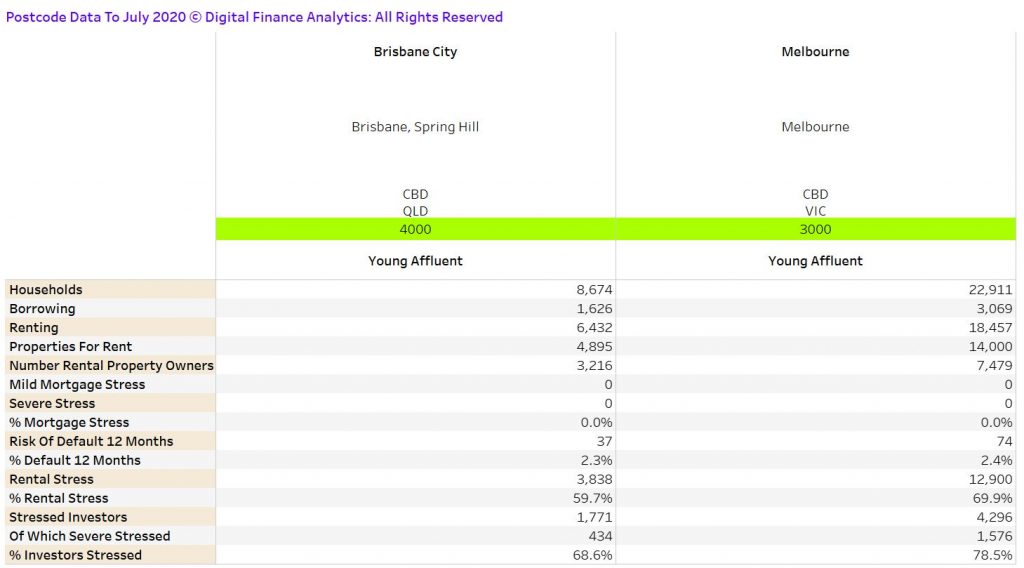

To make the point, here is the full data for 3000 and 4000. The pinch points here are clearly related to investment property.

We can provide post code level data for most locations across the country, or you can subscribe via Patreon to receive a full monthly update.

Finally, we discussed this analysis at length on our recent live stream:

– In the past (January 2017) you had a video interview with the ABC, in which you brought the news that the socalled “Young Affluent” in Australia also were experiencing “mortgage stress”.

– Did you perhaps recently give an interview to a(n) (australian) TV station on the topic “Affluent Mortgage Stress” ?? If so, is the video registration available to the general public (e.g. via YouTube) ?

– I came across an interesting article that shows that those who have high incomes also have “financial problems”. These households may have a high income but at the same time their expenses are also (very) high and as a result these households don’t save that much. And these expenses are NOT Always the result of (mortgage) debt related payments.

Title of the article: “They earn $200.000 and they say they are broke”.

https://ritholtz.com/2020/07/200000-and-broke/

– Perhaps you want to (re-)publish that article here on your blog / website ???