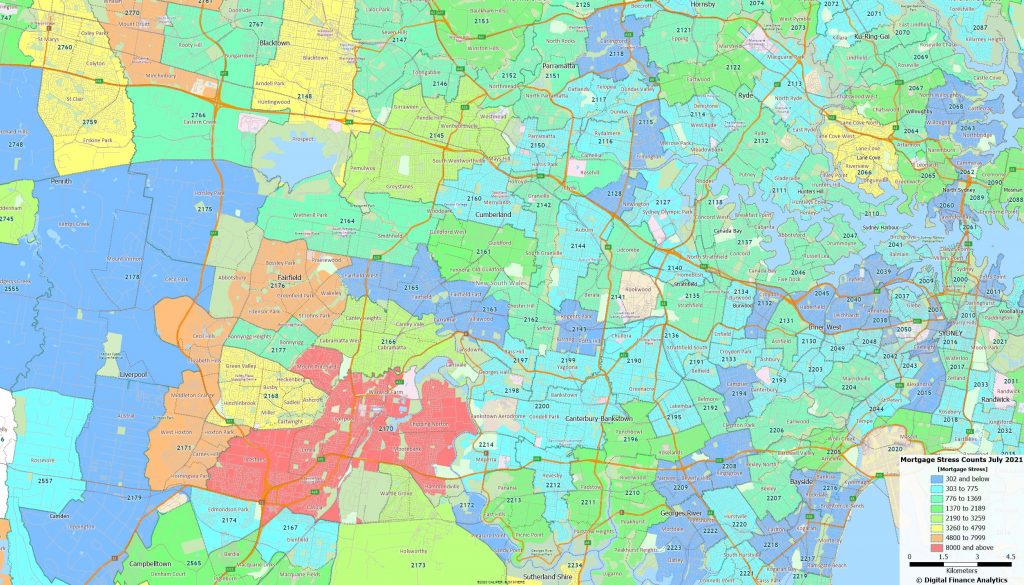

We have completed our mortgage stress analysis for July, and there is a significant correlation between mortgage stress hot spots and COVID hot spots. Here is an example based on South West Sydney, with geo-mapping which reveals the number of households in stress – defined in cash flow terms, not a specific proportion of income going on the mortgage.

Fairfield and South Western Sydney are the epicentre of COIVD, and mortgage stress. The reason is simple, more households there are in insecure work, often in multiple jobs with little fall-back, and massive spending pressures.

Analysis in other post codes across the country reveals the same findings.

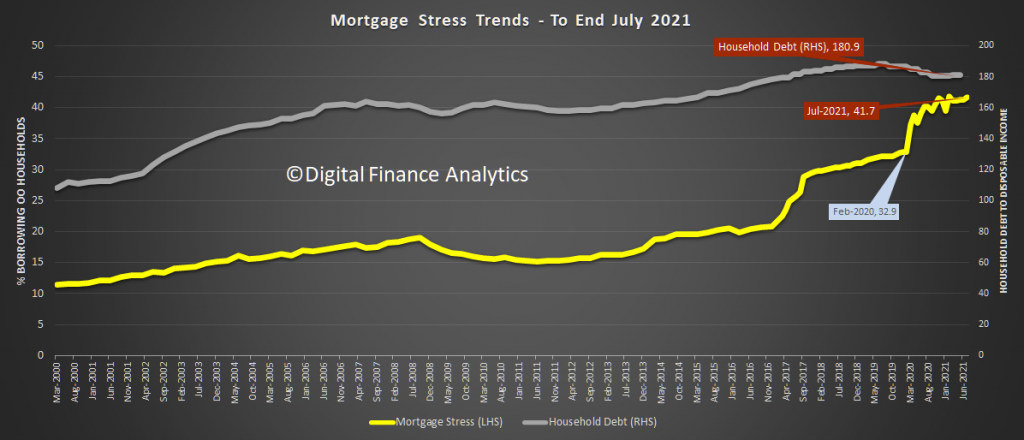

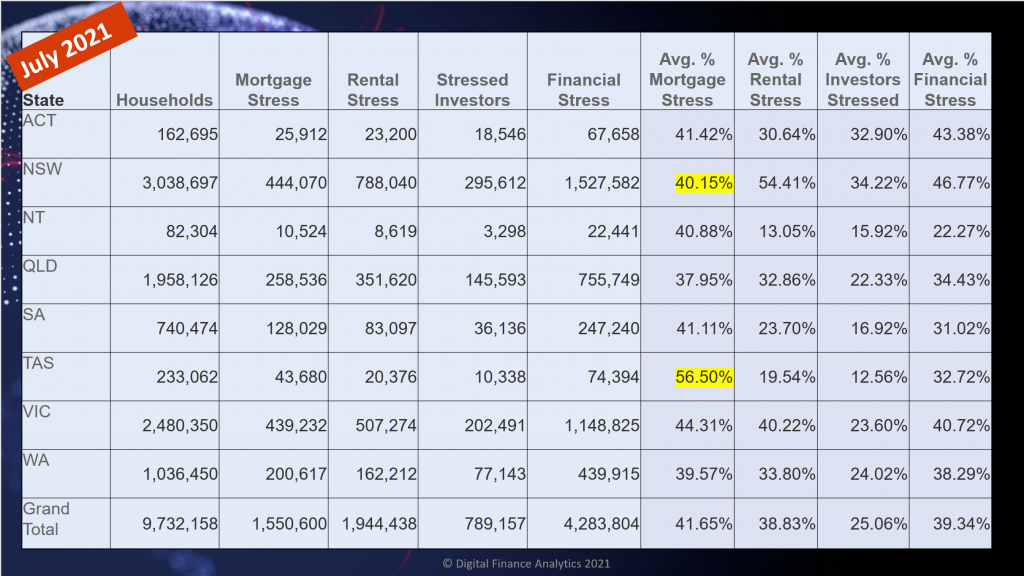

More generally, mortgage stress rose across the country in July, thanks to the lock-downs, and also more mortgages being written at high LVR and DTI ratios. Overall mortgage stress rose to 41.7%, while household debt ratios also rose.

There was significant spike in NSW – at 40.15%, compared with 38.62% a month earlier. Tasmania has the highest proportion of households in mortgage stress.

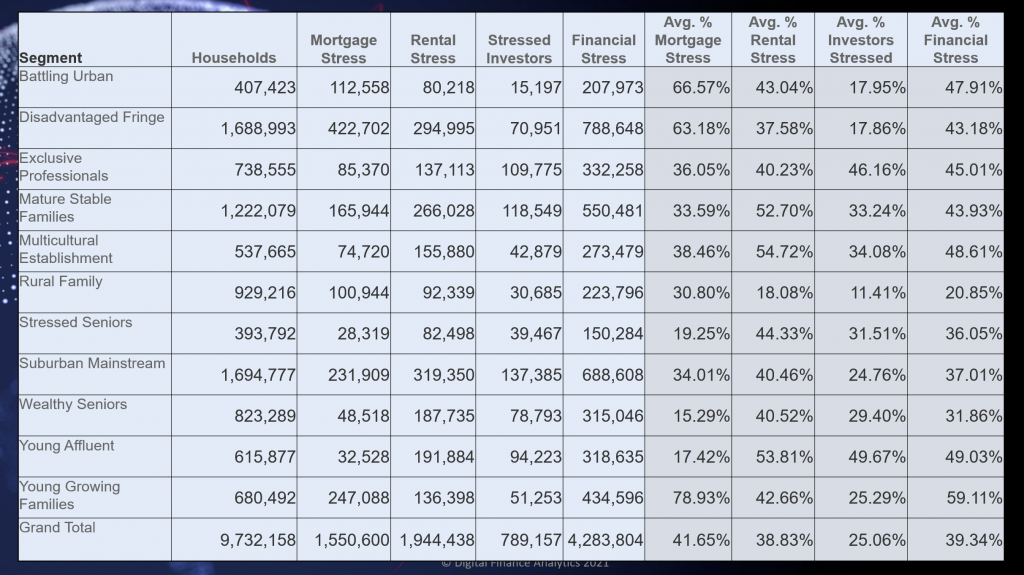

Whilst young growing families – containing many first time buyers has the highest concentration of mortgage stress, at more than 78%, our analysis shows that other households, including first generation migrants and more affluent households are also impacted. Indeed, this is also true of rental stress, and overall financial stress. Its is patchwork of pain.

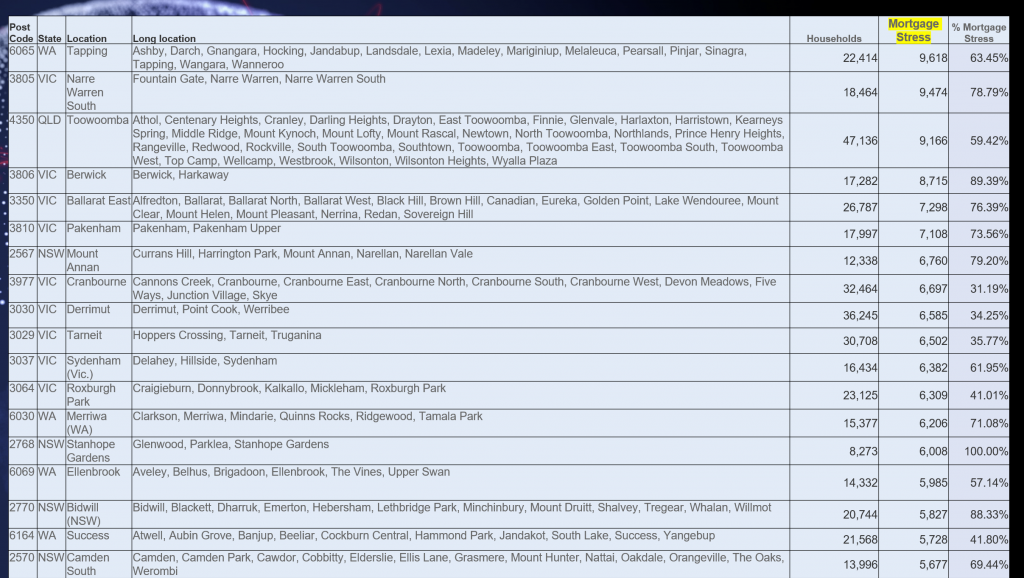

In terms of mortgage stress, the top post codes are contained within the high-growth corridors, across WA, VIC, QLD and NSW.

Rental stress – again measured in cash-flow terms is most predominant in 2540, 4217 and 2145, quite diverse areas, but with real issues in terms of income growth, against a backcloth of rising rents. We expect more pain ahead.

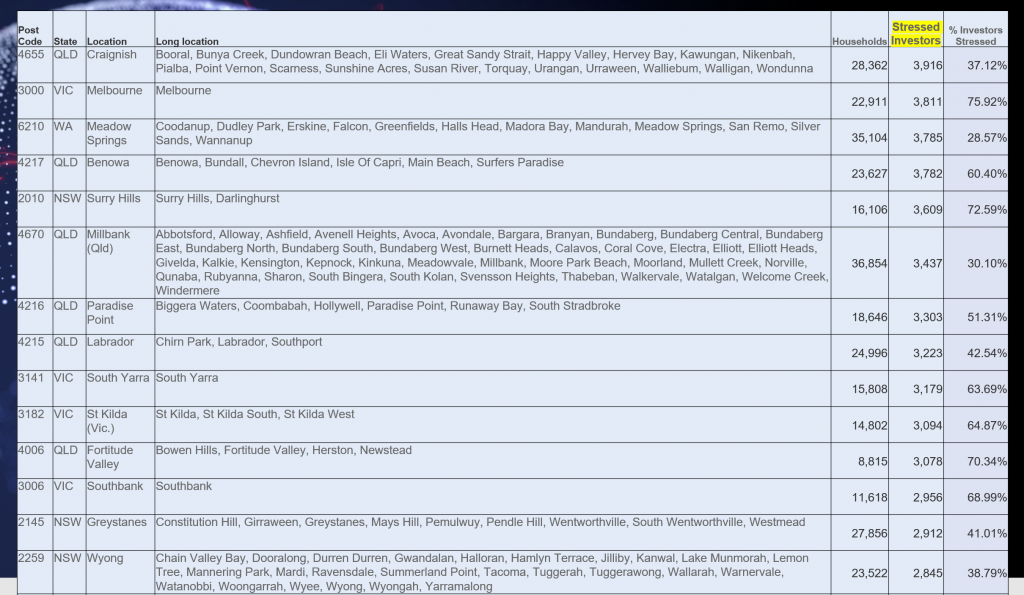

Investor stress is also widespread, with central city locations hit hard, by limited migration and lock-downs. Vacancy rates here are very high. Some more affluent areas are also impacted.

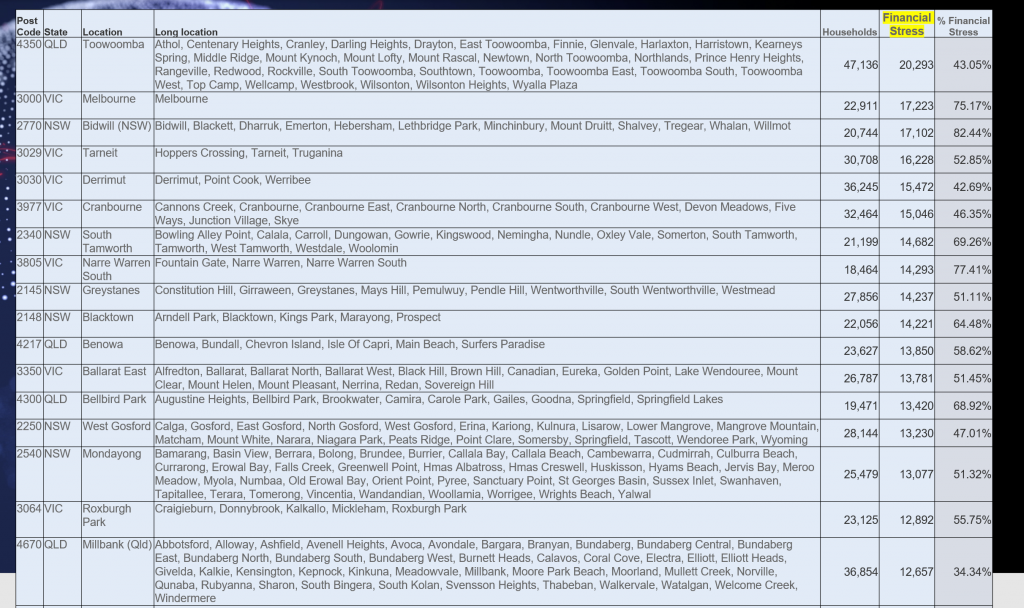

Turning to aggregate stress – the consolidation of the individual series, we see a consistent pattern of rising pressure.

Given the current trajectory of COVID and the ongoing lock-downs we expect stress to continue to grow – and as always we suggest people in difficulty should talk to their lender early, as there is no escape hatch in the current environment.